Federal Housing Credit Expansion: A Solution For Illinois' Affordable Housing Crisis?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Federal Housing Credit Expansion: A Solution for Illinois' Affordable Housing Crisis?

Illinois faces a critical affordable housing shortage, leaving countless families struggling to find safe, decent, and affordable places to live. The crisis impacts communities across the state, exacerbating existing inequalities and hindering economic growth. Could an expansion of the federal Low-Income Housing Tax Credit (LIHTC) program offer a significant solution? This article explores the potential benefits and challenges of such an expansion in Illinois.

The Scope of the Affordable Housing Crisis in Illinois

The lack of affordable housing in Illinois is a complex issue with far-reaching consequences. Rising rents, stagnant wages, and a dwindling supply of affordable units have created a perfect storm, pushing many families into housing insecurity. This crisis disproportionately affects low-income families, seniors, and individuals with disabilities. The consequences extend beyond individual hardship, impacting public health, education, and economic productivity. [Link to Illinois Housing Development Authority (IHDA) data on affordable housing shortage]

The Low-Income Housing Tax Credit (LIHTC) Program: A Key Tool

The LIHTC program is a cornerstone of the nation's affordable housing efforts. It provides tax credits to developers who build or rehabilitate affordable rental housing. These credits incentivize private investment in affordable housing, making projects financially viable that might otherwise be impossible. However, the demand for LIHTC funding far exceeds the available resources, creating a bottleneck that limits the program's impact.

Could Expansion Solve Illinois' Problems?

Advocates argue that a significant expansion of the LIHTC program in Illinois could dramatically increase the supply of affordable housing. Increased funding would allow for the development of more units, potentially easing the pressure on the current system. This would not only directly benefit those in need of affordable housing but also stimulate economic activity through job creation in the construction and related industries.

Challenges and Considerations

While expanding LIHTC offers a promising pathway, several challenges need to be addressed:

- Funding: Securing the necessary funding for a substantial expansion at both the state and federal level will require significant political will and advocacy.

- Project Development: Streamlining the application and approval process for LIHTC projects could help expedite the construction of new units.

- Land Availability: Finding suitable land for affordable housing development, particularly in desirable locations with access to jobs and services, remains a significant hurdle.

- Maintaining Affordability: Ensuring that the newly created units remain affordable over the long term requires careful oversight and mechanisms to prevent rent increases beyond the reach of targeted low-income households.

Other Potential Solutions in Combination with LIHTC Expansion

Expanding LIHTC shouldn't be considered in isolation. A comprehensive approach requires a multi-pronged strategy including:

- Increased funding for local housing authorities: Supporting local initiatives to address specific community needs.

- Strengthening renter protections: Implementing policies to prevent unfair evictions and excessive rent increases.

- Investing in infrastructure: Ensuring access to transportation, healthcare, and other essential services in affordable housing developments.

Conclusion: A Promising but Complex Path Forward

Expanding the federal Low-Income Housing Tax Credit in Illinois holds significant potential for alleviating the state's affordable housing crisis. However, realizing this potential requires a concerted effort from policymakers, developers, and community organizations to overcome the various challenges involved. A comprehensive strategy incorporating LIHTC expansion with complementary policies is crucial to create a lasting impact and provide safe, stable, and affordable housing for all Illinois residents. [Link to a relevant advocacy group working on affordable housing in Illinois]

Call to Action: Learn more about the LIHTC program and advocate for its expansion in your community. Contact your local representatives to express your support for increased funding for affordable housing initiatives in Illinois.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Federal Housing Credit Expansion: A Solution For Illinois' Affordable Housing Crisis?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

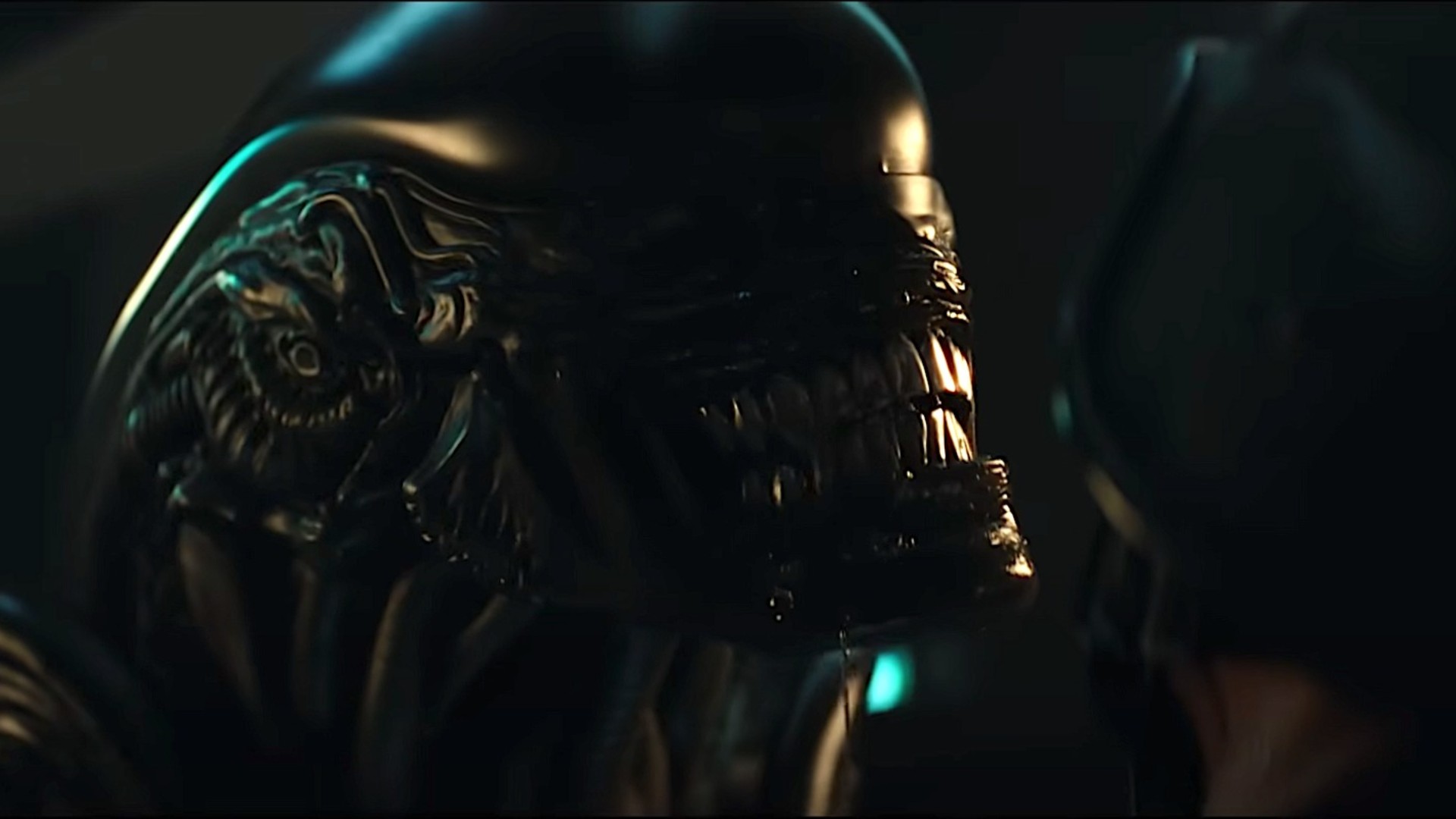

Gruesome Aliens And Crawling Eyeballs The Making Of Hulus Alien Earth Video

Jul 30, 2025

Gruesome Aliens And Crawling Eyeballs The Making Of Hulus Alien Earth Video

Jul 30, 2025 -

I Phone 17 Anticipated Release Date Pre Order Start And Launch Day

Jul 30, 2025

I Phone 17 Anticipated Release Date Pre Order Start And Launch Day

Jul 30, 2025 -

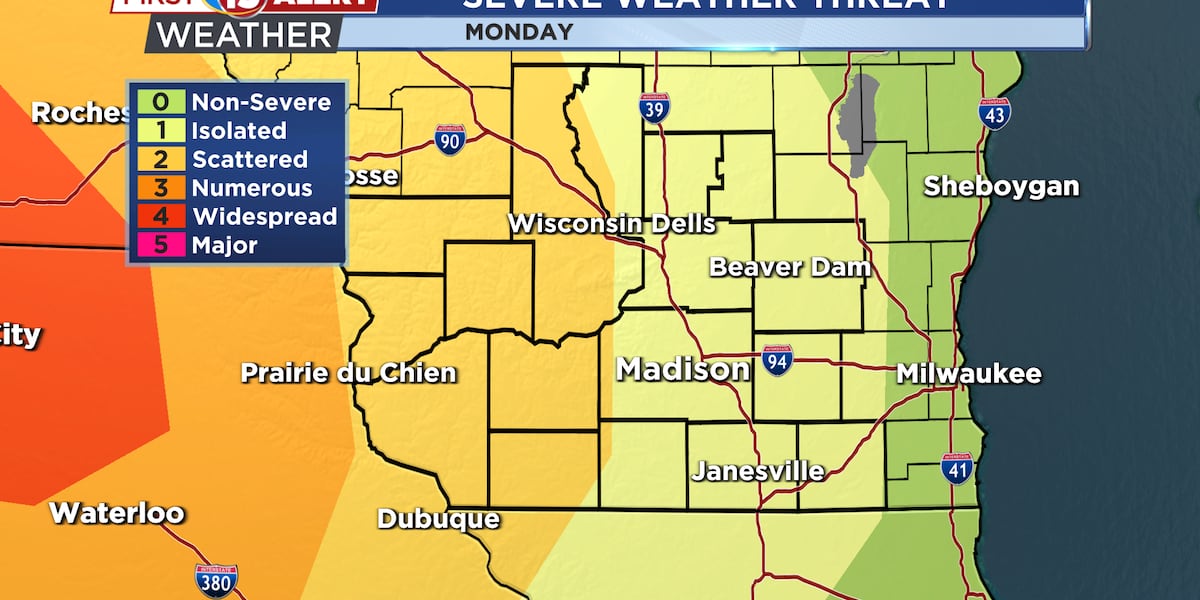

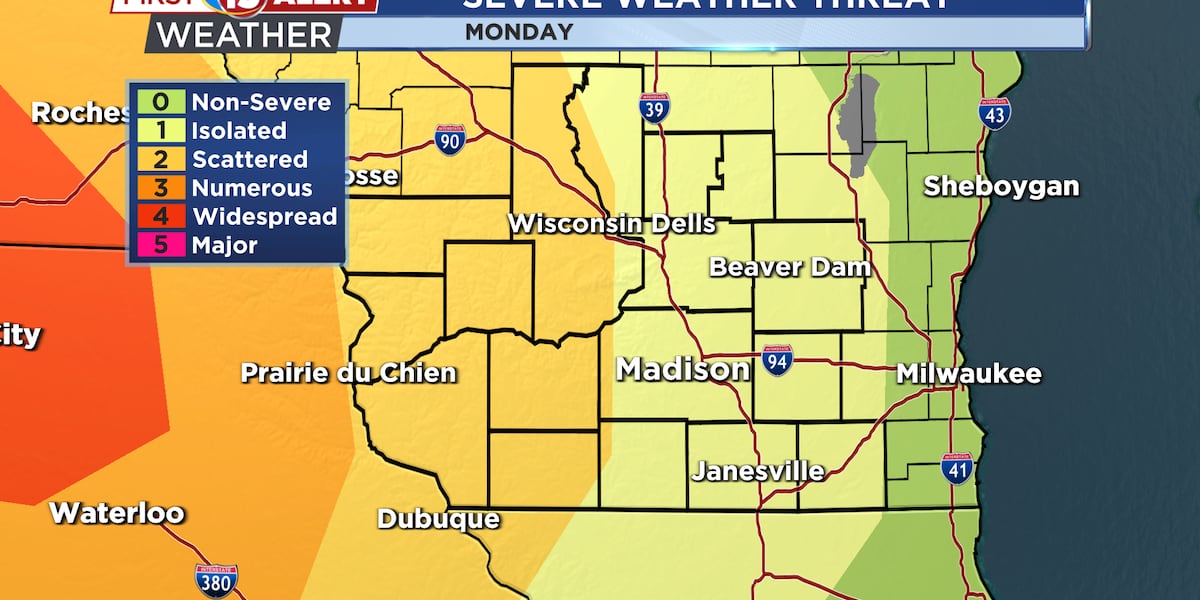

Sudden Storm Surge Heat Gives Way To Powerful Overnight Weather

Jul 30, 2025

Sudden Storm Surge Heat Gives Way To Powerful Overnight Weather

Jul 30, 2025 -

Fatal Pedestrian Accident In Yuba County One Dead One Injured

Jul 30, 2025

Fatal Pedestrian Accident In Yuba County One Dead One Injured

Jul 30, 2025 -

Sudden Storm Surge After Heatwave Overnight Weather Alert

Jul 30, 2025

Sudden Storm Surge After Heatwave Overnight Weather Alert

Jul 30, 2025