Fed Rate Hikes And Iran Tensions: Impact On S&P 500 And Nasdaq Today

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed Rate Hikes and Iran Tensions: A Double Whammy for the S&P 500 and Nasdaq?

Market volatility is on the rise, driven by a potent cocktail of rising interest rates and escalating geopolitical tensions in the Middle East. Today's market performance of the S&P 500 and Nasdaq reflects this uncertainty, leaving investors wondering what the future holds. The Federal Reserve's continued commitment to tackling inflation through interest rate hikes is colliding head-on with concerns over the escalating conflict between Iran and its neighbors, creating a perfect storm for market anxiety.

The Fed's Tightening Grip: The Federal Reserve's recent interest rate increase, aimed at curbing inflation, has sent ripples through the financial markets. Higher interest rates generally increase borrowing costs for businesses, potentially slowing economic growth and impacting corporate profits. This directly affects stock valuations, particularly for growth-oriented companies heavily represented in the Nasdaq. Analysts are closely watching the impact of these hikes on key economic indicators like consumer spending and employment data, searching for signs of a potential slowdown or recession. [Link to relevant Federal Reserve data]

Iran Tensions Ignite Market Fears: The heightened tensions in the Middle East, particularly the escalating situation involving Iran, are adding another layer of complexity to the already challenging market landscape. Increased geopolitical uncertainty often leads to a flight to safety, as investors seek refuge in less volatile assets like government bonds. This outflow of capital from the stock market can contribute to declines in indices like the S&P 500 and Nasdaq. The impact on oil prices is also a key factor, as any disruption to oil supply can trigger inflation and further complicate the Fed's efforts to control prices. [Link to reputable news source on Iran tensions]

<h3>Analyzing the Impact on the S&P 500 and Nasdaq:</h3>

The combined effect of these two major factors is creating significant headwinds for the stock market. Here's a breakdown of the potential impacts:

-

S&P 500: The broad-based S&P 500, representing 500 large-cap US companies, is particularly vulnerable to economic slowdowns. Higher interest rates and geopolitical instability could dampen corporate earnings, leading to a decline in the index. Value stocks within the S&P 500 might be less affected than growth stocks, offering some degree of diversification.

-

Nasdaq: The Nasdaq Composite, heavily weighted with technology and growth stocks, is generally more sensitive to interest rate changes. Higher rates increase the cost of capital for these companies, often impacting their valuations more severely than those of established, more mature companies. The added uncertainty from Iran further exacerbates these concerns.

<h3>What Investors Should Do:</h3>

The current market conditions demand a cautious approach. Investors should:

- Diversify their portfolios: Spreading investments across different asset classes can mitigate risk.

- Re-evaluate risk tolerance: Consider adjusting investment strategies based on your individual risk appetite.

- Stay informed: Keep abreast of economic and geopolitical developments to make informed decisions.

- Consult a financial advisor: Seek professional advice tailored to your specific circumstances.

The outlook remains uncertain. The interplay between Fed policy and geopolitical developments will continue to shape the performance of the S&P 500 and Nasdaq in the coming weeks and months. Investors should carefully monitor these factors and adapt their strategies accordingly. While short-term predictions are difficult, long-term investors should consider this a period of volatility and potential opportunity, depending on their individual strategies and risk profiles. The key is to remain informed and make reasoned decisions based on a thorough understanding of the market dynamics at play.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fed Rate Hikes And Iran Tensions: Impact On S&P 500 And Nasdaq Today. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

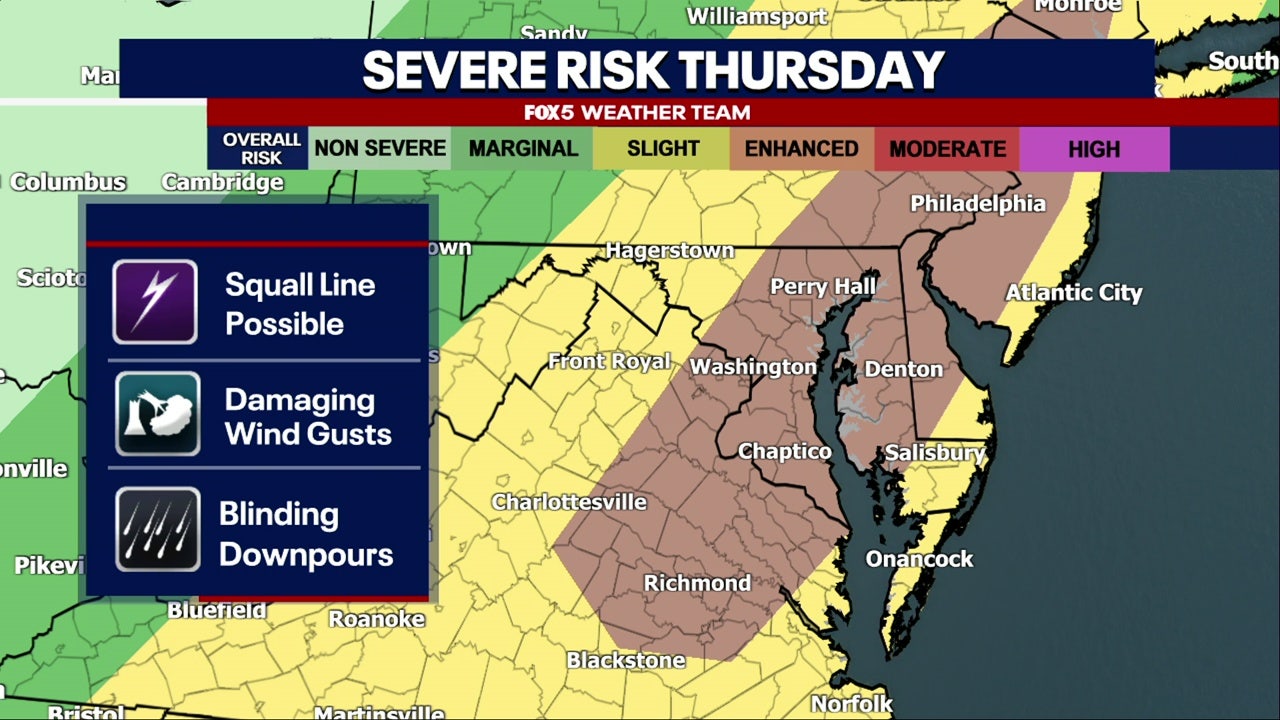

Washington D C Braces For Severe Thunderstorms Potential Tornadoes Thursday

Jun 20, 2025

Washington D C Braces For Severe Thunderstorms Potential Tornadoes Thursday

Jun 20, 2025 -

Nationals Beat Rockies On Woods Late Game Home Run

Jun 20, 2025

Nationals Beat Rockies On Woods Late Game Home Run

Jun 20, 2025 -

Climate Experts Under Fire Trumps Summer Offensive

Jun 20, 2025

Climate Experts Under Fire Trumps Summer Offensive

Jun 20, 2025 -

Hernandez Joins Detroit Tigers Bullpen Depth Concerns Eased

Jun 20, 2025

Hernandez Joins Detroit Tigers Bullpen Depth Concerns Eased

Jun 20, 2025 -

Hong Kong Democracy Suffers Amidst Us Distraction

Jun 20, 2025

Hong Kong Democracy Suffers Amidst Us Distraction

Jun 20, 2025