Fed Rate Concerns And Iran Situation Weigh On Stocks: S&P 500, Nasdaq Losses

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fed Rate Concerns and Iran Situation Weigh on Stocks: S&P 500, Nasdaq Suffer Losses

Market volatility continues as investors grapple with rising interest rates and escalating geopolitical tensions in the Middle East. The S&P 500 and Nasdaq experienced significant losses today, mirroring a global trend of uncertainty fueled by the Federal Reserve's monetary policy and the increasingly complex situation in Iran.

The ongoing conflict in Iran has sent shockwaves through global markets, impacting oil prices and investor confidence. Concerns over potential escalation and disruptions to oil supplies are driving risk aversion, leading many investors to pull back from equities. This uncertainty, coupled with the persistent threat of further interest rate hikes by the Federal Reserve, created a perfect storm for today's market downturn.

<br>

Rising Interest Rates: A Persistent Headwind

The Federal Reserve's commitment to combating inflation through interest rate hikes remains a major factor influencing market sentiment. While the recent pause in rate increases offered a brief respite, the expectation of further tightening in the coming months continues to weigh heavily on investor confidence. Higher interest rates increase borrowing costs for businesses, potentially slowing economic growth and impacting corporate earnings – a significant concern for stock valuations. This uncertainty is prompting investors to reassess their portfolios and potentially reduce their exposure to riskier assets. Analysts predict continued volatility until there's greater clarity on the Fed's future monetary policy. For detailed analysis on the Fed's next moves, you can consult the latest reports from the Federal Reserve Bank of [insert relevant Federal Reserve Bank link here].

<br>

Iran Situation Adds to Market Jitters

The escalating tensions in Iran have added another layer of complexity to the already challenging market environment. The potential for further conflict and its impact on global oil supplies is a primary concern for investors. Oil prices have shown significant sensitivity to developments in the region, and any significant disruption could trigger a broader market sell-off. This geopolitical risk is exacerbating existing concerns about inflation and economic growth, leading to a more cautious approach among investors. For in-depth coverage of the situation in Iran, please refer to reputable news sources such as [insert link to a reputable news source covering the Iran situation].

<br>

S&P 500 and Nasdaq Bear the Brunt

The S&P 500 and Nasdaq, often considered bellwethers of the US stock market, bore the brunt of today's sell-off. Both indices experienced significant percentage declines, reflecting the widespread negative sentiment among investors. This downturn highlights the interconnectedness of global markets and the sensitivity of equity valuations to both macroeconomic factors and geopolitical events. The current market volatility underscores the need for investors to maintain a diversified portfolio and carefully consider their risk tolerance.

<br>

What to Expect Next?

The coming days and weeks are likely to remain volatile as investors digest the implications of both the Federal Reserve's monetary policy and the evolving situation in Iran. Close monitoring of economic indicators, geopolitical developments, and Federal Reserve communications will be crucial for navigating this uncertain market environment. Investors should consult with financial advisors to assess their risk tolerance and develop appropriate investment strategies.

<br>

Keywords: S&P 500, Nasdaq, stock market, Fed rate, interest rates, inflation, Iran, geopolitical risk, market volatility, investment strategy, economic growth, oil prices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fed Rate Concerns And Iran Situation Weigh On Stocks: S&P 500, Nasdaq Losses. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

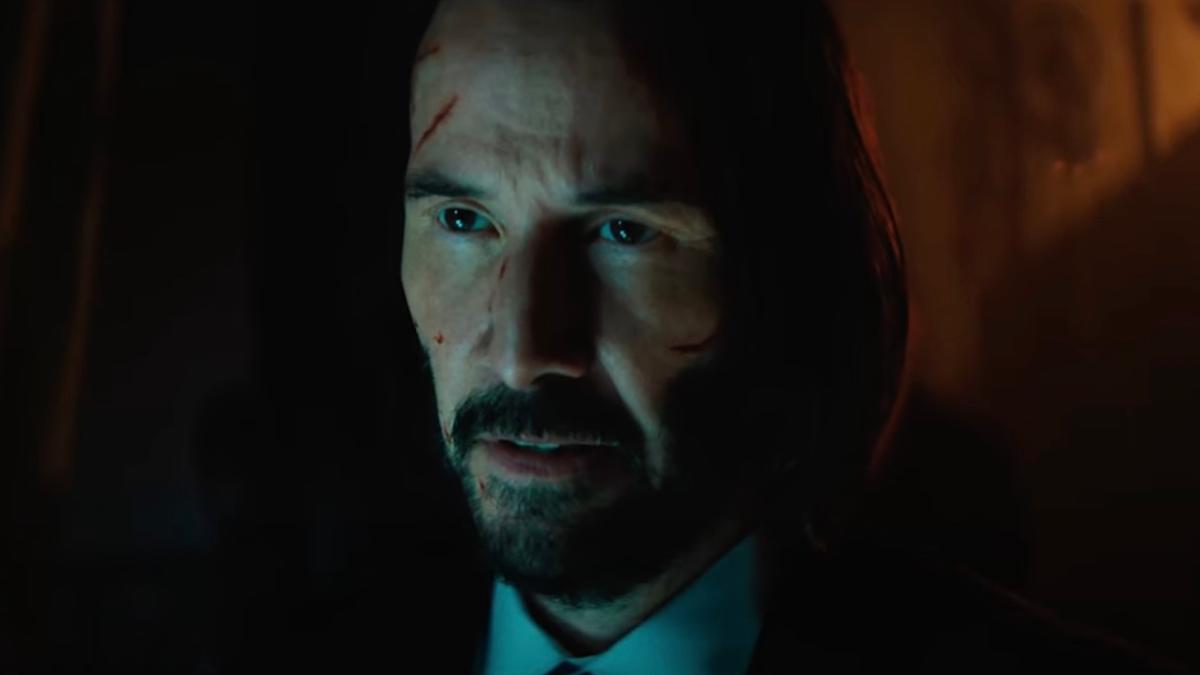

Could John Wick Continue Without Keanu Reeves Director Addresses Concerns

Jun 21, 2025

Could John Wick Continue Without Keanu Reeves Director Addresses Concerns

Jun 21, 2025 -

Cuban Spills The Beans Harris 2020 Vp Bid Included Him

Jun 21, 2025

Cuban Spills The Beans Harris 2020 Vp Bid Included Him

Jun 21, 2025 -

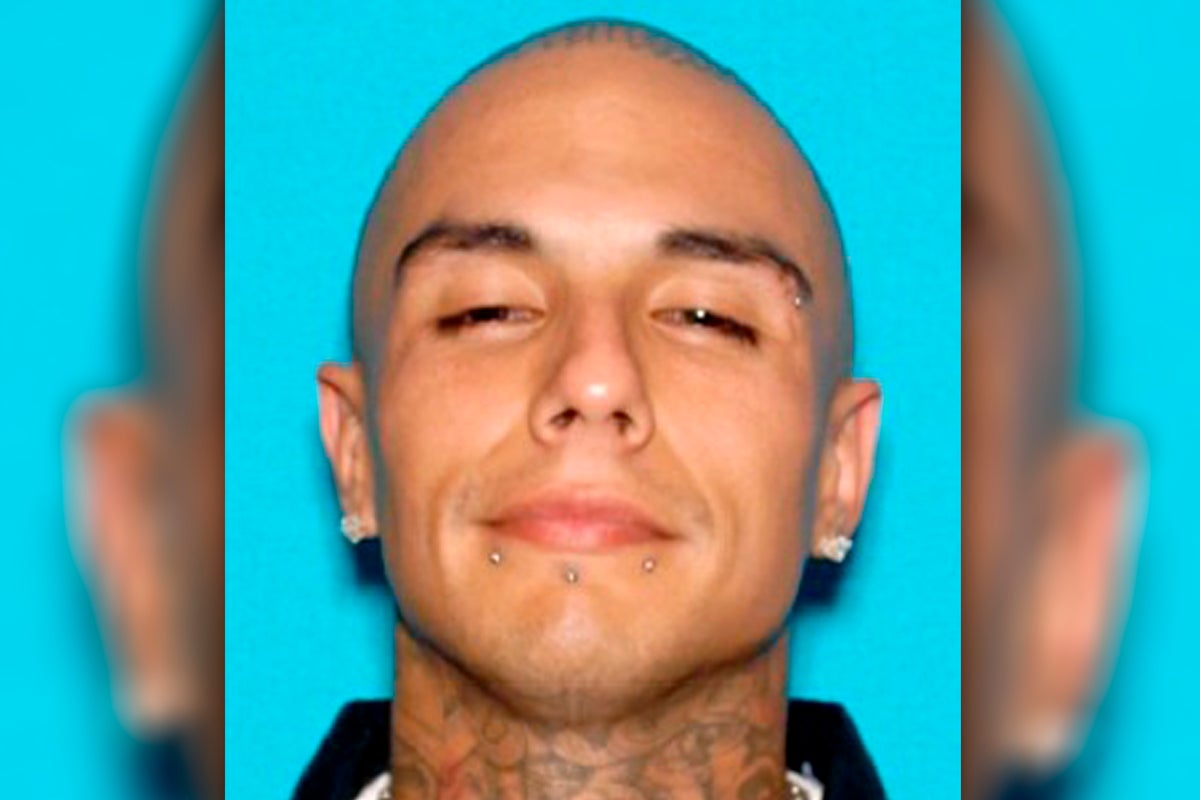

Alleged Mexican Mafia Hit On Rapper 19 Charged

Jun 21, 2025

Alleged Mexican Mafia Hit On Rapper 19 Charged

Jun 21, 2025 -

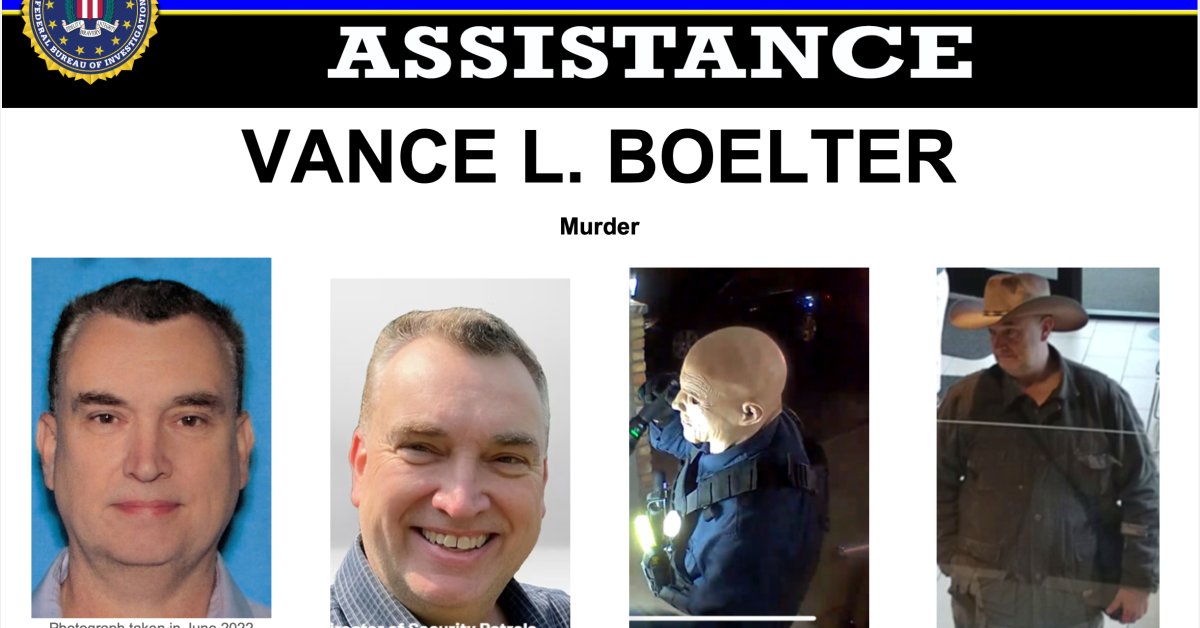

Minnesota Capitol Shooting Suspect Vance Boelters Background And Charges

Jun 21, 2025

Minnesota Capitol Shooting Suspect Vance Boelters Background And Charges

Jun 21, 2025 -

Barry Morphews Indictment Key Details In The Suzanne Morphew Case

Jun 21, 2025

Barry Morphews Indictment Key Details In The Suzanne Morphew Case

Jun 21, 2025