Falling Mortgage Rates: Reaching October 2024's Record Lows

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Falling Mortgage Rates: Reaching October 2024's Record Lows – A Sign of Relief for Homebuyers?

The housing market is buzzing with excitement as mortgage rates plummet, reaching levels not seen since October 2024. This significant drop offers a much-needed breath of fresh air for potential homebuyers who have been sidelined by persistently high interest rates over the past year. But what's driving this sudden shift, and what does it mean for the future of the housing market?

The Factors Fueling the Fall:

Several economic factors are contributing to this decline in mortgage rates. Firstly, the recent slowdown in inflation has given the Federal Reserve more room to maneuver. With inflation easing, the pressure to aggressively raise interest rates—which directly impacts mortgage rates—has lessened. This more cautious approach by the Fed is translating into lower borrowing costs for consumers.

Secondly, concerns about potential banking instability have also played a role. While the banking sector has shown resilience, the uncertainty has prompted investors to seek safer havens, pushing down long-term bond yields, which are closely tied to mortgage rates. This flight to safety indirectly benefits homebuyers looking for mortgages.

Finally, a decrease in demand for mortgages has also contributed to the falling rates. With higher rates previously deterring many potential buyers, lenders are now more competitive, offering lower rates to attract borrowers.

What Does This Mean for Homebuyers?

For those hoping to buy a home, the falling mortgage rates represent a significant opportunity. Lower rates mean lower monthly payments, making homeownership more affordable and accessible. This could inject renewed energy into the housing market, potentially leading to increased buyer activity and a more balanced market.

Is This a Temporary Dip or a Sustainable Trend?

While the current drop in mortgage rates is undeniably positive news, it's crucial to avoid premature assumptions. Economic conditions remain fluid, and several factors could influence future rate movements. Inflationary pressures, future Federal Reserve decisions, and overall economic growth all play a crucial role.

Experts are divided on whether this trend will continue. Some analysts predict further rate decreases in the coming months, while others caution that this could be a temporary reprieve before rates stabilize or even rise again.

Navigating the Market:

Potential homebuyers should carefully weigh their options and consult with financial advisors before making any major decisions. Understanding your personal financial situation, researching current market conditions, and securing pre-approval for a mortgage are crucial steps. Remember to compare offers from multiple lenders to secure the best possible rate.

Key Takeaways:

- Mortgage rates are at their lowest since October 2024. This presents a significant opportunity for prospective homebuyers.

- Several economic factors contribute to this decline, including easing inflation and concerns about banking stability.

- The impact on the housing market remains to be seen, with experts offering varying predictions for the future.

- Careful planning and consultation with financial professionals are essential for navigating the current market.

Looking Ahead: The coming months will be crucial in determining the long-term trajectory of mortgage rates. Stay informed about economic news and consult with financial experts to make informed decisions about your homeownership journey. For further insights into the housing market, check out resources like [link to a relevant reputable financial news source] and [link to another relevant resource].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Falling Mortgage Rates: Reaching October 2024's Record Lows. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ex Nfl Star Jj Watt Unveils New Do For Broadcasting Career

Sep 09, 2025

Ex Nfl Star Jj Watt Unveils New Do For Broadcasting Career

Sep 09, 2025 -

Us Military Buildup In Venezuela Trump Addresses Regime Change Speculation

Sep 09, 2025

Us Military Buildup In Venezuela Trump Addresses Regime Change Speculation

Sep 09, 2025 -

Wall Street Rallies S And P 500 Nasdaq And Dow Futures Rise Ahead Of Inflation Data

Sep 09, 2025

Wall Street Rallies S And P 500 Nasdaq And Dow Futures Rise Ahead Of Inflation Data

Sep 09, 2025 -

Schaefer Center And Boone Saloon Billy Strings September 11 12 Performances

Sep 09, 2025

Schaefer Center And Boone Saloon Billy Strings September 11 12 Performances

Sep 09, 2025 -

Giorgio Armanis Enduring Style Iconic Looks And Lasting Impact

Sep 09, 2025

Giorgio Armanis Enduring Style Iconic Looks And Lasting Impact

Sep 09, 2025

Latest Posts

-

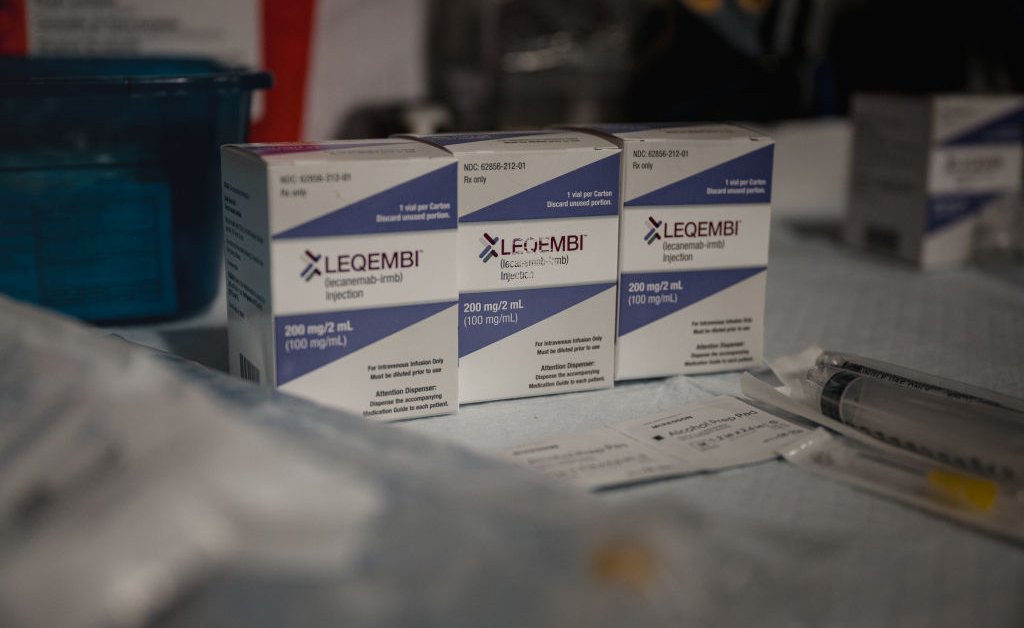

Home Administration Of Alzheimers Medication A New Era Of Treatment

Sep 09, 2025

Home Administration Of Alzheimers Medication A New Era Of Treatment

Sep 09, 2025 -

From Gridiron To Green Screen J J Watts Transition To Cbs And The Lessons From Romo

Sep 09, 2025

From Gridiron To Green Screen J J Watts Transition To Cbs And The Lessons From Romo

Sep 09, 2025 -

Sherrone Moore Suspended Biff Poggi Takes The Helm For Michigan

Sep 09, 2025

Sherrone Moore Suspended Biff Poggi Takes The Helm For Michigan

Sep 09, 2025 -

Wall Street Rallies S And P 500 Nasdaq And Dow Higher Ahead Of Inflation Data

Sep 09, 2025

Wall Street Rallies S And P 500 Nasdaq And Dow Higher Ahead Of Inflation Data

Sep 09, 2025 -

Supreme Court Upholds Trump Era Immigration Raids Live Updates

Sep 09, 2025

Supreme Court Upholds Trump Era Immigration Raids Live Updates

Sep 09, 2025