Expert Reveals AI's Role In Billion-Dollar Retirement Scam: FBI Investigates

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Expert Reveals AI's Role in Billion-Dollar Retirement Scam: FBI Investigates

A sophisticated retirement scam, potentially costing victims billions, is under FBI investigation, with a shocking twist: artificial intelligence is playing a central role. Experts warn this marks a dangerous escalation in financial crime, highlighting the increasingly blurred lines between technology and fraud.

The scam, uncovered by financial security expert Dr. Anya Sharma, targets retirees nearing or in retirement. It leverages sophisticated AI-powered tools to create highly personalized phishing campaigns, convincingly mimicking legitimate financial institutions and government agencies. “This isn’t your grandpa’s Nigerian prince email,” Dr. Sharma explains. “We’re talking hyper-realistic deepfakes, personalized voicemails, and AI-generated documents designed to bypass even the most cautious individuals.”

The FBI, confirming the ongoing investigation, declined to comment on specifics but acknowledged the growing threat posed by AI-driven financial crime. Sources close to the investigation indicate that the perpetrators are using AI to:

- Craft personalized phishing emails: AI analyzes publicly available data to tailor messages to individual victims, increasing the likelihood of success.

- Generate realistic deepfake videos: These videos feature seemingly legitimate financial advisors urging immediate action to avoid losing retirement savings.

- Create convincing voicemails: AI-powered voice cloning allows scammers to mimic the voices of trusted individuals, like family members or financial professionals.

- Automate the entire process: AI streamlines the scam's operation, allowing perpetrators to target thousands of victims simultaneously.

How AI Amplifies the Threat

The use of AI significantly amplifies the scale and sophistication of this retirement scam. Traditional scams relied on brute-force tactics, sending out mass emails with generic messages. This AI-driven approach, however, allows for targeted and personalized attacks, making them much more difficult to detect. The sheer volume of potential victims coupled with the individualized nature of the attacks makes this a particularly insidious form of fraud.

“The level of personalization is breathtaking,” adds Dr. Sharma. “The scammers are not just exploiting vulnerabilities; they’re creating them using AI to build trust and exploit emotional vulnerabilities.” This highlights the crucial need for increased awareness and improved cybersecurity measures amongst the elderly population, who are often the most vulnerable to such scams.

Protecting Yourself from AI-Powered Scams

Staying safe in the age of AI-driven fraud requires vigilance and proactive measures. Here are some crucial steps retirees can take:

- Verify all communications: Never act on unsolicited calls, emails, or texts regarding your finances. Always independently verify information through official channels.

- Be wary of personalized messages: While personalization may seem reassuring, it's a common tactic used by scammers.

- Educate yourself: Stay informed about the latest scams and techniques used by fraudsters. Resources like the Federal Trade Commission (FTC) website offer valuable information.

- Use strong passwords and multi-factor authentication: Protecting online accounts is paramount in preventing access to personal financial information.

- Report suspicious activity: If you suspect you've been a victim of a scam, report it immediately to the authorities and your financial institution.

This billion-dollar retirement scam underscores the urgent need for regulatory bodies and technology companies to collaborate and develop effective countermeasures against AI-driven financial crime. The future of financial security depends on staying ahead of these rapidly evolving threats. Learn more about protecting yourself from online scams by visiting the FTC website (link to FTC website).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Expert Reveals AI's Role In Billion-Dollar Retirement Scam: FBI Investigates. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Hollywood To Graduation Marlon Wayanss College Certificate Journey

Sep 01, 2025

From Hollywood To Graduation Marlon Wayanss College Certificate Journey

Sep 01, 2025 -

Streaming Charts Buzz Mel Gibsons 52 Rotten Tomatoes Film A Hit

Sep 01, 2025

Streaming Charts Buzz Mel Gibsons 52 Rotten Tomatoes Film A Hit

Sep 01, 2025 -

300 Million Spent On Water Unveiling Gta Vis Technological Marvel

Sep 01, 2025

300 Million Spent On Water Unveiling Gta Vis Technological Marvel

Sep 01, 2025 -

Marsha Blackburn Defends Trumps Rural Tennessee Policies

Sep 01, 2025

Marsha Blackburn Defends Trumps Rural Tennessee Policies

Sep 01, 2025 -

Navigating Medicares New Prior Authorization Pilot Implications For Participating States

Sep 01, 2025

Navigating Medicares New Prior Authorization Pilot Implications For Participating States

Sep 01, 2025

Latest Posts

-

From Braveheart To The Screen 10 Gritty Historical Shows

Sep 02, 2025

From Braveheart To The Screen 10 Gritty Historical Shows

Sep 02, 2025 -

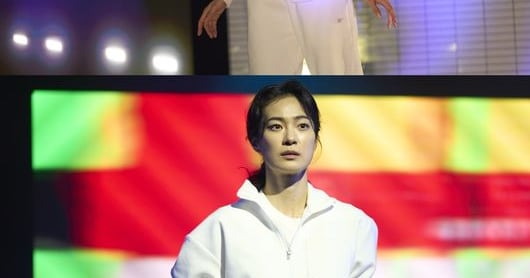

From The Effect And Beyond Ok Ja Yeon On Acting And Growth

Sep 02, 2025

From The Effect And Beyond Ok Ja Yeon On Acting And Growth

Sep 02, 2025 -

Trump Tariffs Deemed Illegal What Happens Next For Us Trade

Sep 02, 2025

Trump Tariffs Deemed Illegal What Happens Next For Us Trade

Sep 02, 2025 -

Love Triangle Turns Violent Ted Lasso Star In Shocking Soccer Scandal

Sep 02, 2025

Love Triangle Turns Violent Ted Lasso Star In Shocking Soccer Scandal

Sep 02, 2025 -

209 Million Historical Drama A Divisive Legacy After 30 Years

Sep 02, 2025

209 Million Historical Drama A Divisive Legacy After 30 Years

Sep 02, 2025