Expanding Federal Housing Credits: A Solution For Illinois's Rental Crisis?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Expanding Federal Housing Credits: A Solution for Illinois's Rental Crisis?

Illinois is grappling with a severe rental crisis, leaving countless residents struggling to find affordable housing. Skyrocketing rents and a shortage of available units have pushed many families to the brink, forcing difficult choices between housing and other essential needs. Could expanding federal housing credits offer a viable solution to this escalating problem? This article explores the potential benefits and challenges of such a policy in the context of Illinois's unique housing market.

The Depth of Illinois's Rental Crisis

The rental market in Illinois, particularly in major cities like Chicago, is experiencing unprecedented pressure. Vacancy rates are at historic lows, driving up rents significantly. This isn't just affecting low-income families; middle-class individuals and families are also finding it increasingly difficult to secure affordable housing. Factors contributing to this crisis include:

- Limited Housing Supply: A lack of new construction and insufficient investment in affordable housing units have exacerbated the existing shortage.

- Increased Demand: Population growth and migration to urban centers have increased the demand for rental properties.

- Economic Factors: Inflation and rising interest rates have made both renting and homeownership more expensive.

The Potential of Expanded Federal Housing Credits

One potential avenue for addressing this crisis lies in expanding existing federal housing credits, such as the Low-Income Housing Tax Credit (LIHTC). Expanding these credits could incentivize developers to build more affordable rental units, increasing the overall supply and potentially lowering rents. This approach could:

- Stimulate Development: Increased tax credits could make affordable housing projects financially viable, encouraging developers to invest in areas with high demand.

- Target Specific Needs: The credits could be targeted towards specific areas or demographics facing the most significant housing challenges, ensuring resources are allocated effectively.

- Create Jobs: Construction and management of new affordable housing units would create jobs, boosting local economies.

However, expanding federal housing credits is not without its challenges. These include:

- Funding Limitations: Securing sufficient funding to significantly expand the credits would require substantial political will and resources.

- Administrative Hurdles: The process of applying for and receiving LIHTC can be complex and time-consuming, potentially delaying projects.

- Potential for Inefficiency: Without careful planning and oversight, the expansion could lead to inefficient allocation of resources or unintended consequences.

Other Solutions and the Need for a Multi-Pronged Approach

While expanding federal housing credits offers a promising approach, it's crucial to understand that it's not a silver bullet. A comprehensive strategy to address Illinois's rental crisis requires a multi-pronged approach, including:

- Increased Zoning Reforms: Relaxing restrictive zoning regulations can allow for the construction of more housing units, including multi-family dwellings.

- Investment in Public Transportation: Improved public transportation can make areas outside of expensive city centers more accessible and affordable.

- Strengthening Tenant Protections: Implementing stronger tenant protection laws can prevent displacement and ensure fair housing practices.

Conclusion: A Necessary Step, but Not the Only One

Expanding federal housing credits could play a significant role in alleviating Illinois's rental crisis. However, its success hinges on careful planning, sufficient funding, and a commitment to addressing other contributing factors. A coordinated effort involving federal, state, and local governments, along with private sector investment, is essential to achieve lasting solutions and provide affordable housing for all Illinois residents. The future of housing in Illinois depends on a comprehensive strategy that tackles this challenge head-on. Learn more about the LIHTC program . What are your thoughts on this pressing issue? Share your opinion in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Expanding Federal Housing Credits: A Solution For Illinois's Rental Crisis?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

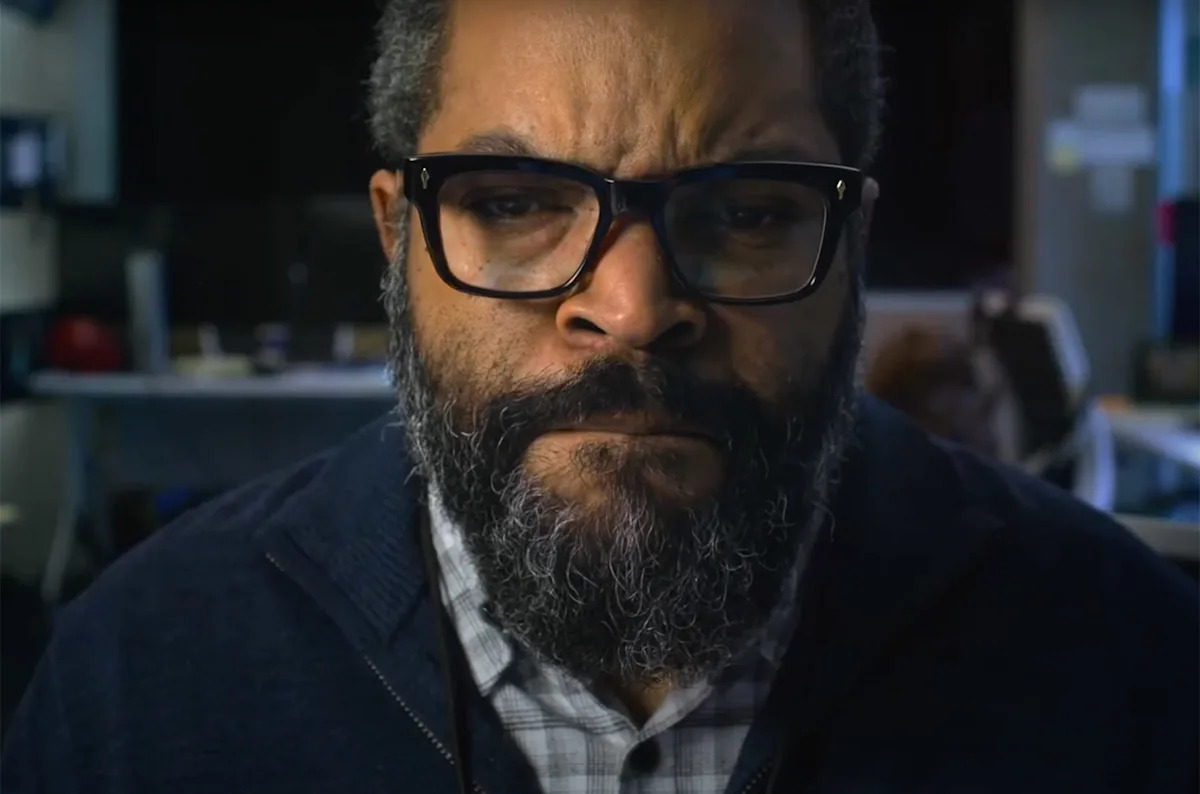

Senator Bookers Outburst Accusations Of Complacency In Democratic Party

Jul 31, 2025

Senator Bookers Outburst Accusations Of Complacency In Democratic Party

Jul 31, 2025 -

Ice Cube Leads War Of The Worlds Remake First Trailer Unveiled

Jul 31, 2025

Ice Cube Leads War Of The Worlds Remake First Trailer Unveiled

Jul 31, 2025 -

Liverpool Plays Friendly Unfazed By Tsunami Advisory

Jul 31, 2025

Liverpool Plays Friendly Unfazed By Tsunami Advisory

Jul 31, 2025 -

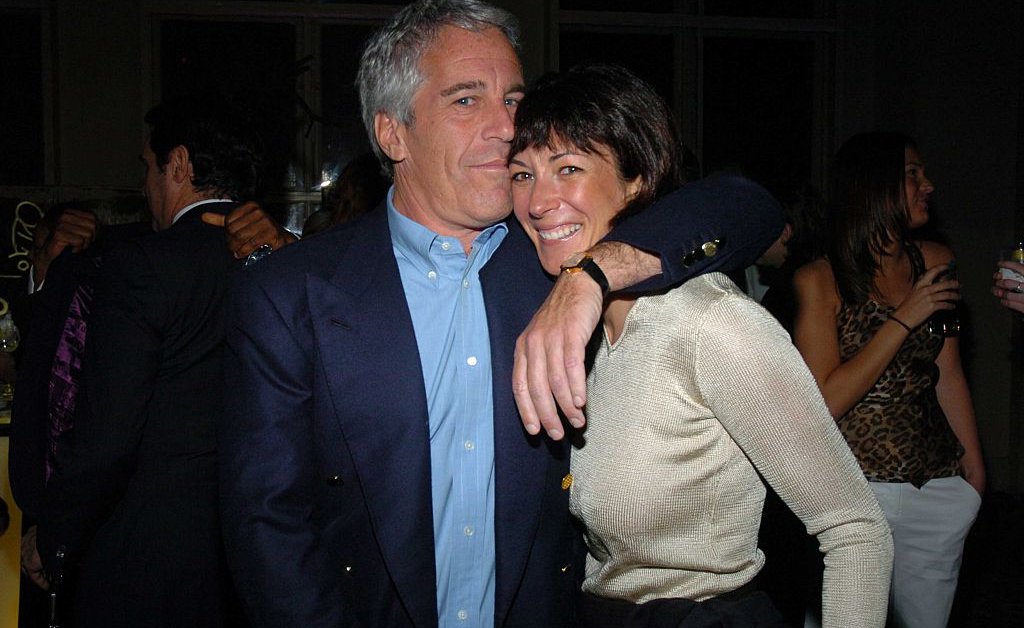

Jeffrey Epstein And Ghislaine Maxwell The Justice Department Investigation

Jul 31, 2025

Jeffrey Epstein And Ghislaine Maxwell The Justice Department Investigation

Jul 31, 2025 -

After Lengthy Process Senate Confirms Cdc Director

Jul 31, 2025

After Lengthy Process Senate Confirms Cdc Director

Jul 31, 2025

Latest Posts

-

Stromans Subpar Performance Leads To Rays Loss Against Yankees

Aug 02, 2025

Stromans Subpar Performance Leads To Rays Loss Against Yankees

Aug 02, 2025 -

Betting On Tauson Vs Starodubtseva Canadian Open 2025 Odds And Expert Picks

Aug 02, 2025

Betting On Tauson Vs Starodubtseva Canadian Open 2025 Odds And Expert Picks

Aug 02, 2025 -

Marcus Stroman Designated For Assignment By New York Yankees

Aug 02, 2025

Marcus Stroman Designated For Assignment By New York Yankees

Aug 02, 2025 -

Post Conflict Gaza The Urgent Need To Address Chronic Malnutrition

Aug 02, 2025

Post Conflict Gaza The Urgent Need To Address Chronic Malnutrition

Aug 02, 2025 -

Montreal Open Starodubtseva Rallies From Setback To Beat Wang Yafan

Aug 02, 2025

Montreal Open Starodubtseva Rallies From Setback To Beat Wang Yafan

Aug 02, 2025