Examining The Effects Of Trump's Tax And Spending Legislation On SNAP Eligibility

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Examining the Effects of Trump's Tax and Spending Legislation on SNAP Eligibility

The Trump administration's tax and spending policies, enacted between 2017 and 2020, significantly impacted various aspects of the American economy, including eligibility for the Supplemental Nutrition Assistance Program (SNAP), often known as food stamps. While the legislation aimed to stimulate economic growth through tax cuts, its effects on SNAP were complex and continue to be debated. This article delves into the key changes and their consequences on low-income families relying on this vital safety net.

The 2017 Tax Cuts and Jobs Act: An Indirect Impact

The centerpiece of Trump's economic agenda, the Tax Cuts and Jobs Act (TCJA), primarily focused on corporate and individual income tax reductions. While not directly targeting SNAP, the TCJA indirectly affected eligibility through several pathways. The act's provisions, including changes to the child tax credit and standard deduction, altered the financial landscape for many low-income families. These changes, while potentially beneficial in some cases, could have inadvertently pushed some families slightly above the income thresholds for SNAP eligibility.

Increased Employment and Its Impact

Proponents of the TCJA argued that the tax cuts would stimulate economic growth, leading to increased job creation and higher wages. While some sectors did experience growth, the overall impact on SNAP eligibility remains unclear. Increased employment could theoretically reduce SNAP enrollment, but this effect is often offset by factors like wage stagnation and the increasing cost of living. The actual effect on SNAP participation is a subject of ongoing economic analysis.

Changes in State-Level SNAP Programs

It’s crucial to remember that SNAP is a federally funded program, but states have some leeway in implementing it. Trump's administration's policies may have influenced state-level decisions regarding SNAP administration, work requirements, and eligibility criteria. Analyzing these state-by-state variations requires a nuanced approach, looking at specific policy changes and their corresponding impacts. Further research into individual state data is needed for a complete understanding.

Long-Term Effects and Uncertainties

Assessing the long-term effects of Trump's tax and spending policies on SNAP eligibility requires a comprehensive analysis, considering factors beyond immediate changes in income and employment. The COVID-19 pandemic, for example, significantly altered SNAP enrollment and eligibility, complicating efforts to isolate the impact of the TCJA. Researchers are still working to disentangle these complex factors and provide a definitive conclusion.

H2: Data Gaps and Future Research

A thorough evaluation of the TCJA's impact on SNAP requires access to comprehensive and reliable data. Unfortunately, there are significant data gaps and challenges in analyzing the complex interplay between tax policies, economic growth, and SNAP participation. Further research using advanced econometric techniques and longitudinal studies is vital for a more accurate and nuanced understanding.

H2: Conclusion: A Complex Interplay

The relationship between Trump's tax and spending legislation and SNAP eligibility is multifaceted and not easily summarized. While the TCJA did not directly target SNAP, its indirect effects on income, employment, and state-level program administration are significant and require further investigation. Researchers and policymakers need to continue analyzing this complex interplay to inform future policy decisions and ensure the effectiveness of the SNAP program in supporting low-income families. Further research is needed to definitively quantify the impact of these policies and inform future welfare legislation. Understanding this complex relationship is critical for creating effective and equitable social safety nets.

Keywords: Trump tax cuts, SNAP, food stamps, Supplemental Nutrition Assistance Program, TCJA, Tax Cuts and Jobs Act, eligibility, poverty, social safety net, economic impact, welfare, government assistance, low-income families, economic analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Examining The Effects Of Trump's Tax And Spending Legislation On SNAP Eligibility. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Check Your Pantry Fsis Announces Urgent Nationwide Bacon Recall

Jul 04, 2025

Check Your Pantry Fsis Announces Urgent Nationwide Bacon Recall

Jul 04, 2025 -

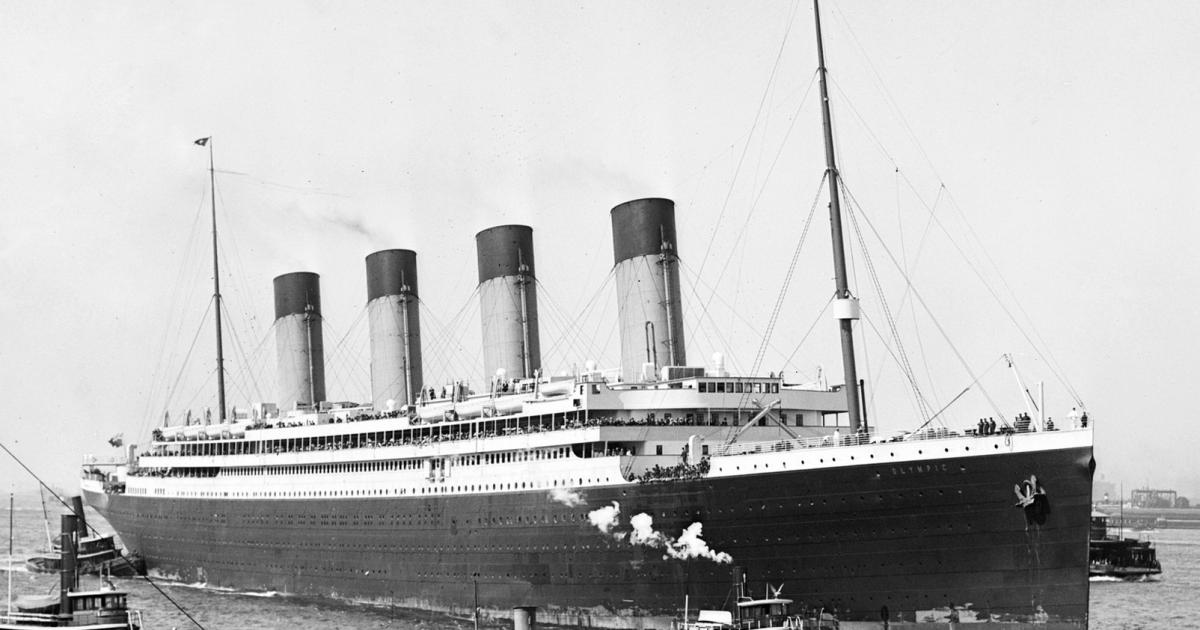

Exploring The Bournemouth Titanic Story Untold Tales

Jul 04, 2025

Exploring The Bournemouth Titanic Story Untold Tales

Jul 04, 2025 -

Genco Injury Attorneys Increased Access To Legal Help In Colorado Springs

Jul 04, 2025

Genco Injury Attorneys Increased Access To Legal Help In Colorado Springs

Jul 04, 2025 -

Urgent Search For Missing Passengers After Ferry Capsizes Off Bali Coast

Jul 04, 2025

Urgent Search For Missing Passengers After Ferry Capsizes Off Bali Coast

Jul 04, 2025 -

Usda Issues Nationwide Recall Of Oscar Mayer Turkey Bacon Due To Listeria

Jul 04, 2025

Usda Issues Nationwide Recall Of Oscar Mayer Turkey Bacon Due To Listeria

Jul 04, 2025

Latest Posts

-

El Arte Del Entrenador Equilibrio Entre El Juego Y La Audiencia

Sep 10, 2025

El Arte Del Entrenador Equilibrio Entre El Juego Y La Audiencia

Sep 10, 2025 -

Unexpected Health Benefits Of Becoming A Grandparent

Sep 10, 2025

Unexpected Health Benefits Of Becoming A Grandparent

Sep 10, 2025 -

Live Stream Details France Vs Iceland World Cup Qualifier Match Today

Sep 10, 2025

Live Stream Details France Vs Iceland World Cup Qualifier Match Today

Sep 10, 2025 -

France Vs Iceland 2026 World Cup Qualifying Live Stream And Tv Guide

Sep 10, 2025

France Vs Iceland 2026 World Cup Qualifying Live Stream And Tv Guide

Sep 10, 2025 -

Portugals World Cup Dream Can They Win It All

Sep 10, 2025

Portugals World Cup Dream Can They Win It All

Sep 10, 2025