Evaluating The Volatility Of Hims & Hers Health (HIMS) Stock.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

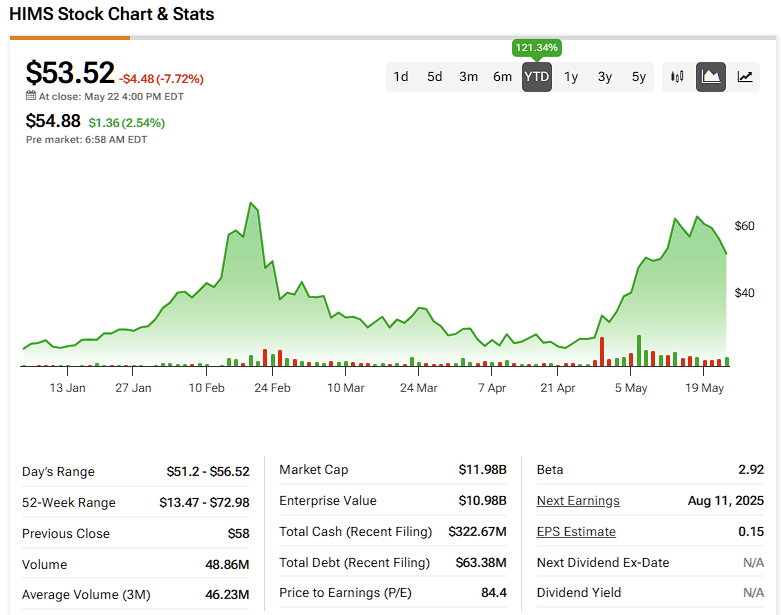

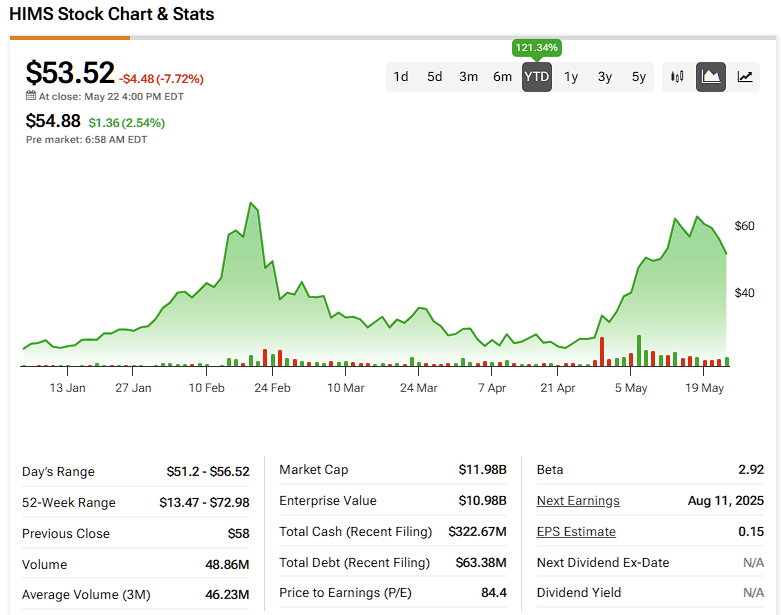

Evaluating the Volatility of Hims & Hers Health (HIMS) Stock: A Risky Ride or a Rewarding Investment?

Hims & Hers Health (HIMS) stock has been a rollercoaster ride for investors. Its fluctuating price presents both significant opportunities and substantial risks. This article delves into the factors contributing to HIMS's volatility, helping you assess whether this telehealth giant is a worthwhile addition to your portfolio.

Understanding HIMS's Business Model and Market Position:

Hims & Hers Health operates a telehealth platform offering personalized treatments for various health conditions, primarily focused on men's and women's health. This includes hair loss, sexual health, skincare, and mental wellness. The company's direct-to-consumer model, leveraging e-commerce and telemedicine, has disrupted traditional healthcare delivery. However, its dependence on this relatively new market segment also contributes to its volatility.

Factors Driving HIMS Stock Volatility:

Several factors contribute to the significant price swings experienced by HIMS investors:

-

Market Sentiment: The telehealth sector itself is subject to considerable market fluctuations. Investor confidence in the sector, influenced by broader economic conditions and regulatory changes, directly impacts HIMS's stock price. Positive news about telehealth adoption can drive the stock up, while negative news or regulatory uncertainty can lead to sharp declines.

-

Competition: HIMS faces increasing competition from both established healthcare providers expanding into telehealth and new entrants in the digital health space. Aggressive competitive pricing strategies and the emergence of innovative competitors can significantly influence HIMS's market share and profitability, impacting its stock performance.

-

Financial Performance: Quarterly earnings reports play a crucial role in shaping investor perceptions. Missing revenue targets, disappointing growth rates, or unexpected losses can trigger immediate sell-offs. Conversely, exceeding expectations often leads to significant price increases. Analyzing HIMS's financial statements – including revenue growth, operating margins, and cash flow – is essential for understanding its underlying performance and predicting future stock movements.

-

Regulatory Landscape: The telehealth industry is subject to evolving regulations at both the state and federal levels. Changes in reimbursement policies, data privacy laws, or licensing requirements can significantly impact HIMS's operational efficiency and profitability, causing stock price fluctuations.

-

Expansion Strategies: HIMS's strategic decisions regarding market expansion, product development, and acquisitions also influence investor sentiment. Successful expansion into new markets or the launch of successful new products can boost investor confidence, while setbacks can lead to price drops.

Analyzing the Risk-Reward Profile:

Investing in HIMS stock involves a substantial degree of risk. The company operates in a dynamic and competitive market, making its future performance uncertain. However, the potential rewards can be significant for investors who believe in HIMS's long-term growth potential. Analyzing the company's financial health, competitive landscape, and regulatory environment is crucial for evaluating the risk-reward profile.

Should You Invest in HIMS Stock?

The decision to invest in HIMS stock depends on your risk tolerance and investment goals. If you're a risk-averse investor, HIMS may not be suitable for your portfolio. However, if you're comfortable with higher volatility and believe in the long-term growth potential of the telehealth sector, HIMS could be a worthwhile consideration. It's crucial to conduct thorough due diligence and consult with a financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Evaluating The Volatility Of Hims & Hers Health (HIMS) Stock.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Henry County Tornado Victims The Wire Actor Details Familys Ordeal

Jun 03, 2025

Henry County Tornado Victims The Wire Actor Details Familys Ordeal

Jun 03, 2025 -

Actress Sydney Sweeney Sells Used Bathwater Is This A Trend

Jun 03, 2025

Actress Sydney Sweeney Sells Used Bathwater Is This A Trend

Jun 03, 2025 -

Roseanne Barr Recovers Embraces Texas Dream Despite Injury

Jun 03, 2025

Roseanne Barr Recovers Embraces Texas Dream Despite Injury

Jun 03, 2025 -

Al Rokers 20 Year Weight Loss Journey Maintaining A 100 Pound Success

Jun 03, 2025

Al Rokers 20 Year Weight Loss Journey Maintaining A 100 Pound Success

Jun 03, 2025 -

Miley And Billy Cyrus A Relationship Update From An Inside Source

Jun 03, 2025

Miley And Billy Cyrus A Relationship Update From An Inside Source

Jun 03, 2025