Evaluating The Risks And Rewards Of Investing In Hims & Hers (HIMS) Stock.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

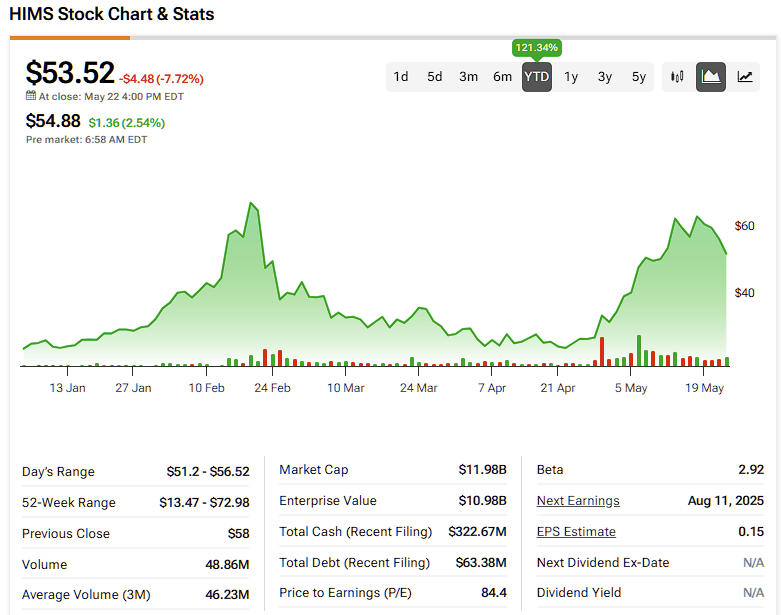

Evaluating the Risks and Rewards of Investing in Hims & Hers (HIMS) Stock

Hims & Hers Health (HIMS) has disrupted the telehealth space, offering convenient access to healthcare services for men and women. But is investing in HIMS stock a smart move? This article delves into the potential rewards and significant risks associated with this relatively young company, helping you make an informed investment decision.

The Allure of Hims & Hers: A Convenient Healthcare Model

Hims & Hers has carved a niche by providing convenient, at-home access to treatments for common health concerns, including hair loss, sexual health issues, and skincare. This direct-to-consumer (DTC) model, coupled with a strong digital presence, has attracted significant attention and a growing customer base. The company's success hinges on several factors:

- Accessibility: Eliminating the barriers of traditional healthcare appointments appeals to a broad demographic.

- Discreet Service: Addressing sensitive health topics privately resonates with many consumers.

- Expanding Product Line: Hims & Hers continually expands its product offerings, broadening its market reach.

These elements have contributed to impressive growth, making HIMS stock attractive to some investors. However, it's crucial to acknowledge the inherent risks.

Navigating the Risks: Challenges Facing HIMS

While the potential rewards are undeniable, several key risks must be considered before investing in HIMS stock:

- Competition: The telehealth market is increasingly competitive, with established players and new entrants vying for market share. This intense competition puts pressure on pricing and profitability.

- Regulatory Hurdles: The healthcare industry is heavily regulated, and changes in regulations could significantly impact HIMS's operations and profitability. Keeping up with evolving legal landscapes is a constant challenge.

- Dependence on Marketing: HIMS relies heavily on marketing and advertising to acquire new customers. Reduced marketing effectiveness or increased advertising costs could negatively affect growth.

- Profitability Concerns: While revenue is growing, HIMS is not yet consistently profitable. Investors should carefully analyze the company's financial statements and projections.

- Stock Volatility: As with any growth stock, HIMS experiences significant price fluctuations. Investing in HIMS requires a high tolerance for risk.

Analyzing the Financial Landscape: A Deep Dive into HIMS's Performance

Before making any investment decision, thorough due diligence is essential. Analyze HIMS's quarterly and annual financial reports to assess its revenue growth, profitability, and debt levels. Compare its performance to competitors and consider industry trends. Resources like the Securities and Exchange Commission (SEC) website () offer valuable financial data.

Should You Invest in HIMS? A Balanced Perspective

Investing in HIMS stock presents a classic high-risk, high-reward scenario. The company's innovative business model and expanding market offer significant upside potential. However, the competitive landscape, regulatory hurdles, and profitability concerns are substantial risks to consider.

Ultimately, the decision rests on your individual risk tolerance and investment goals. If you're a risk-averse investor, HIMS might not be the right choice. However, for investors with a higher risk tolerance and a long-term perspective, HIMS could potentially offer significant returns. It is crucial to diversify your portfolio and consult with a qualified financial advisor before making any investment decisions. Remember, this is not financial advice; conduct your own thorough research.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Evaluating The Risks And Rewards Of Investing In Hims & Hers (HIMS) Stock.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Breaking Murder Suspect Arrested In State Name

Jun 03, 2025

Breaking Murder Suspect Arrested In State Name

Jun 03, 2025 -

Abas Role Curtailed In Trump Judge Vetting Process Under Bondi

Jun 03, 2025

Abas Role Curtailed In Trump Judge Vetting Process Under Bondi

Jun 03, 2025 -

Trumps Criticism Of Scott Walker A Turning Point

Jun 03, 2025

Trumps Criticism Of Scott Walker A Turning Point

Jun 03, 2025 -

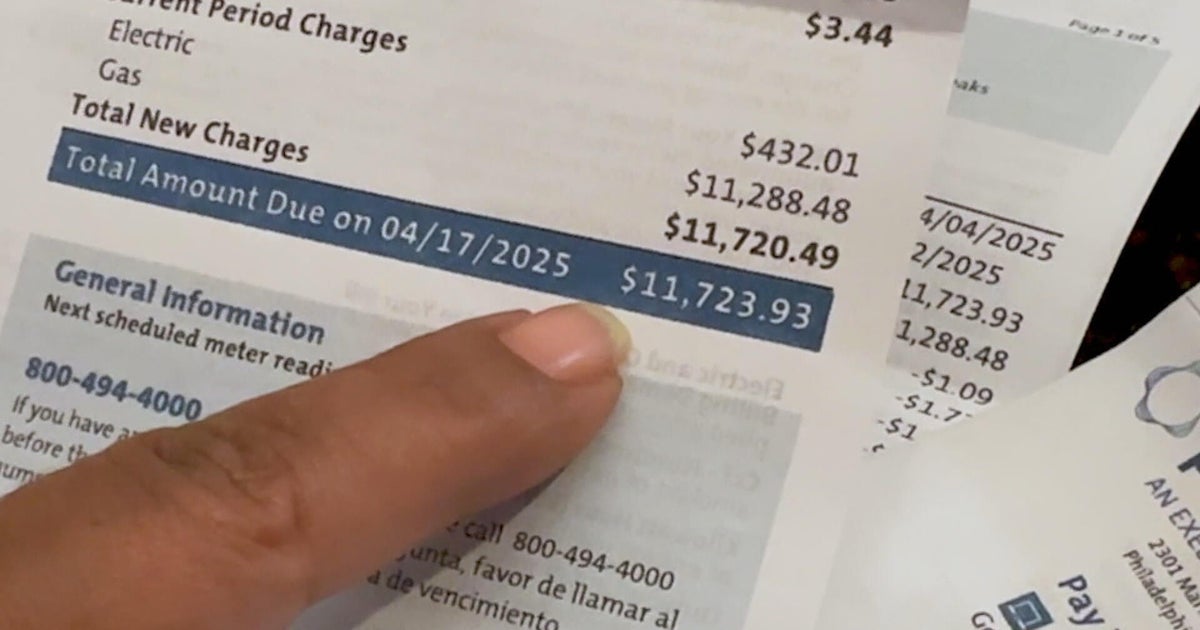

12 000 Peco Bill Stuns Customer Billing Issues Plague Others

Jun 03, 2025

12 000 Peco Bill Stuns Customer Billing Issues Plague Others

Jun 03, 2025 -

Real Life Tech Titans The Models For Jesse Armstrongs Mountainhead Characters

Jun 03, 2025

Real Life Tech Titans The Models For Jesse Armstrongs Mountainhead Characters

Jun 03, 2025