Evaluating The Investment Potential Of Hims & Hers Health (HIMS) Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Evaluating the Investment Potential of Hims & Hers Health (HIMS) Stock

Hims & Hers Health (HIMS) has emerged as a prominent player in the telehealth space, offering convenient and accessible healthcare services. But is this convenient model a sound investment? This article delves into the potential of HIMS stock, examining its strengths, weaknesses, and future prospects to help you make an informed investment decision.

The Allure of Telehealth: Hims & Hers' Business Model

Hims & Hers has capitalized on the growing demand for telehealth services, offering a streamlined approach to healthcare for conditions like hair loss, sexual health, and dermatological issues. Their direct-to-consumer model, leveraging a user-friendly app and online platform, bypasses traditional healthcare hurdles, making treatment more accessible and convenient. This business model is a key factor in their appeal to investors. However, the competitive landscape of telehealth is fierce, demanding a close look at their market position.

Hims & Hers' Strengths: A Closer Look

- Convenient and Accessible: The platform's ease of use and accessibility are significant advantages, attracting a broad customer base.

- Recurring Revenue Model: Subscriptions for ongoing treatments provide a predictable revenue stream, crucial for investor confidence.

- Expanding Product Offerings: Continual expansion into new areas of telehealth significantly broadens their market reach and potential.

- Strong Brand Recognition: Hims & Hers have successfully built a recognizable and trusted brand within the telehealth industry.

Weaknesses and Potential Risks to Consider:

- High Competition: The telehealth market is saturated, with established players and numerous startups vying for market share. This intense competition could impact profitability.

- Regulatory Uncertainty: The evolving regulatory landscape of telehealth poses potential challenges and uncertainties for the company's future operations.

- Dependence on Marketing: A significant portion of their revenue is dependent on marketing and advertising spend, which can be costly and unpredictable.

- Profitability Concerns: While revenue is growing, achieving consistent profitability remains a challenge for the company.

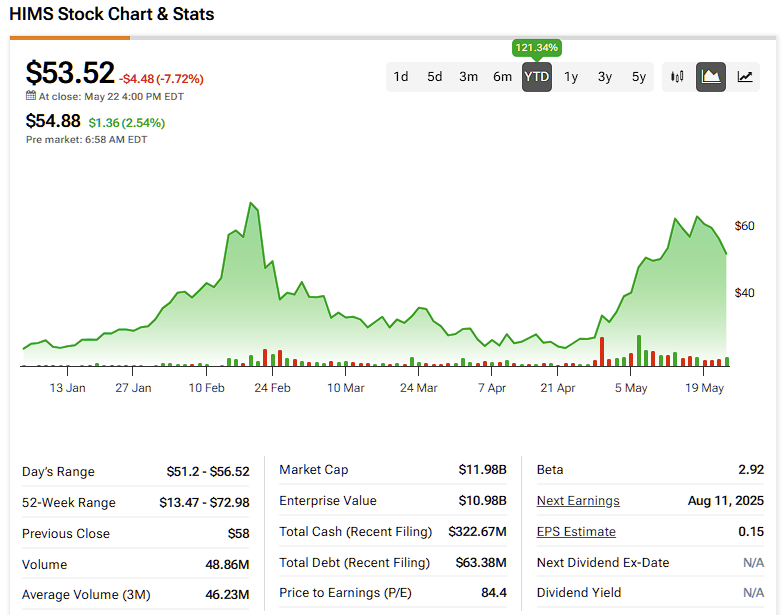

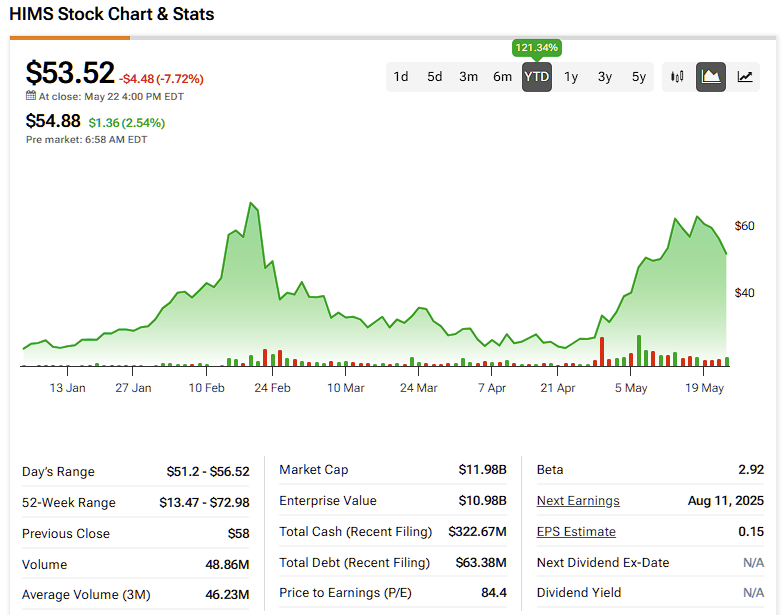

Financial Performance and Future Outlook:

Investors should carefully analyze HIMS's financial statements, focusing on key metrics like revenue growth, operating margins, and customer acquisition costs. Industry reports and analyst predictions can offer valuable insights into the company's future prospects. Consider comparing HIMS's performance to its competitors to understand its relative strength within the market. (Note: This article does not provide specific financial advice; consult with a financial advisor before making investment decisions).

Analyzing the Competition: Key Players in the Telehealth Market

The telehealth market is booming, with several key players competing for market share. Understanding the competitive landscape is crucial for evaluating HIMS's potential. Major competitors include Teladoc Health (TDOC), Amwell (AMWL), and others. Comparing HIMS's strengths and weaknesses against these competitors will help to assess its long-term viability.

Is HIMS Stock Right for You?

Investing in HIMS stock presents both opportunities and risks. The company's innovative business model and strong brand recognition are attractive features, but the intense competition and regulatory uncertainties pose significant challenges. Before investing, carefully consider your risk tolerance and investment goals. Conduct thorough due diligence, analyze the financial reports, and consult with a qualified financial advisor to make an informed investment decision.

Call to Action: Stay informed about HIMS's performance and the evolving telehealth landscape by regularly reviewing financial news and industry reports. This will help you make the best decisions for your investment portfolio. Remember to always consult a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Evaluating The Investment Potential Of Hims & Hers Health (HIMS) Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Saharan Dust Cloud Unprecedented Scale Impacts Caribbean And Us

Jun 04, 2025

Saharan Dust Cloud Unprecedented Scale Impacts Caribbean And Us

Jun 04, 2025 -

Controversy Erupts Beanie Bishops Actions Following Steelers Practice

Jun 04, 2025

Controversy Erupts Beanie Bishops Actions Following Steelers Practice

Jun 04, 2025 -

Billion Dollar Deal Subway Expands Its Food Empire With Chicken Chain Buyout

Jun 04, 2025

Billion Dollar Deal Subway Expands Its Food Empire With Chicken Chain Buyout

Jun 04, 2025 -

Massive Saharan Dust Cloud Blankets Caribbean Impacts Us Forecast

Jun 04, 2025

Massive Saharan Dust Cloud Blankets Caribbean Impacts Us Forecast

Jun 04, 2025 -

The Business Of Being Taylor Jenkins Reid Strategies For Authorial Success

Jun 04, 2025

The Business Of Being Taylor Jenkins Reid Strategies For Authorial Success

Jun 04, 2025