Evaluating Oklo Stock: A Guide To Sustainable Nuclear Power Investments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Evaluating Oklo Stock: A Guide to Sustainable Nuclear Power Investments

The energy sector is undergoing a dramatic transformation, with a growing emphasis on sustainable and environmentally friendly solutions. Nuclear power, often overlooked in the renewable energy conversation, is experiencing a resurgence, driven by advancements in reactor technology and a renewed focus on carbon reduction goals. Oklo, a company pioneering advanced nuclear fission technology, sits at the forefront of this revolution. But is investing in Oklo stock a smart move? This guide explores the factors to consider when evaluating this potentially groundbreaking, yet risky, opportunity in the sustainable energy sector.

Oklo: A Pioneer in Advanced Nuclear Fission

Oklo is developing small modular reactors (SMRs) designed to significantly reduce nuclear waste and improve safety. Their technology promises a more sustainable and efficient alternative to traditional nuclear power plants. This approach addresses many of the long-standing concerns surrounding nuclear energy, such as waste disposal and the risk of meltdowns. Key differentiators for Oklo include:

- Small Modular Reactors (SMRs): These smaller reactors offer greater flexibility and reduce the upfront capital costs associated with traditional large-scale nuclear plants. Learn more about the benefits of SMR technology [link to a reputable source on SMRs].

- Reduced Waste: Oklo's technology aims to drastically reduce the volume and toxicity of nuclear waste produced, addressing a major environmental concern.

- Enhanced Safety Features: The company employs advanced safety features designed to minimize the risk of accidents.

Factors to Consider Before Investing in Oklo Stock

While Oklo's technology holds immense promise, investing in its stock carries inherent risks. Before making any investment decisions, carefully weigh the following factors:

- Early-Stage Company: Oklo is still a relatively young company, meaning its technology is unproven at a commercial scale. This carries a higher degree of risk compared to established energy companies.

- Regulatory Hurdles: The nuclear industry is heavily regulated. Securing the necessary permits and approvals can be a lengthy and complex process, potentially delaying Oklo's progress.

- Market Competition: The advanced nuclear fission sector is becoming increasingly competitive, with other companies developing similar technologies.

- Financial Performance: Analyze Oklo's financial statements carefully, including revenue projections, expenses, and cash flow. Remember that early-stage companies often operate at a loss for an extended period.

- Technological Risks: While promising, the technology itself carries inherent risks. Unexpected technical challenges could significantly impact the company's timeline and financial performance.

Analyzing the Investment Potential: A Balanced Perspective

Investing in Oklo represents a high-risk, high-reward proposition. The potential for significant returns is undeniable, given the growing demand for clean energy and the innovative nature of Oklo's technology. However, the risks associated with an early-stage company in a heavily regulated industry should not be underestimated.

Due Diligence is Crucial: Thorough research is paramount. Consult with a qualified financial advisor before making any investment decisions. Understand your personal risk tolerance and investment goals before committing capital.

Where to Find More Information

For up-to-date information on Oklo, visit their official website [link to Oklo's website]. You can also consult reputable financial news sources and analyst reports to stay informed about the company's progress and market performance. Remember to always critically evaluate information from various sources.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in stocks involves risk, and you could lose money. Always conduct your own thorough research and consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Evaluating Oklo Stock: A Guide To Sustainable Nuclear Power Investments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2025 Nfl Season National Spotlight On Bengals Playoff Contention

May 28, 2025

2025 Nfl Season National Spotlight On Bengals Playoff Contention

May 28, 2025 -

Top 3 High Growth Ai Stocks To Watch Could They Be The Next Palantir

May 28, 2025

Top 3 High Growth Ai Stocks To Watch Could They Be The Next Palantir

May 28, 2025 -

Lauderhill Juneteenth 2025 Dionne Polite Announced As Featured Performer

May 28, 2025

Lauderhill Juneteenth 2025 Dionne Polite Announced As Featured Performer

May 28, 2025 -

Analysis The International Response To Trumps Golden Dome Proposal China North Korea Russia

May 28, 2025

Analysis The International Response To Trumps Golden Dome Proposal China North Korea Russia

May 28, 2025 -

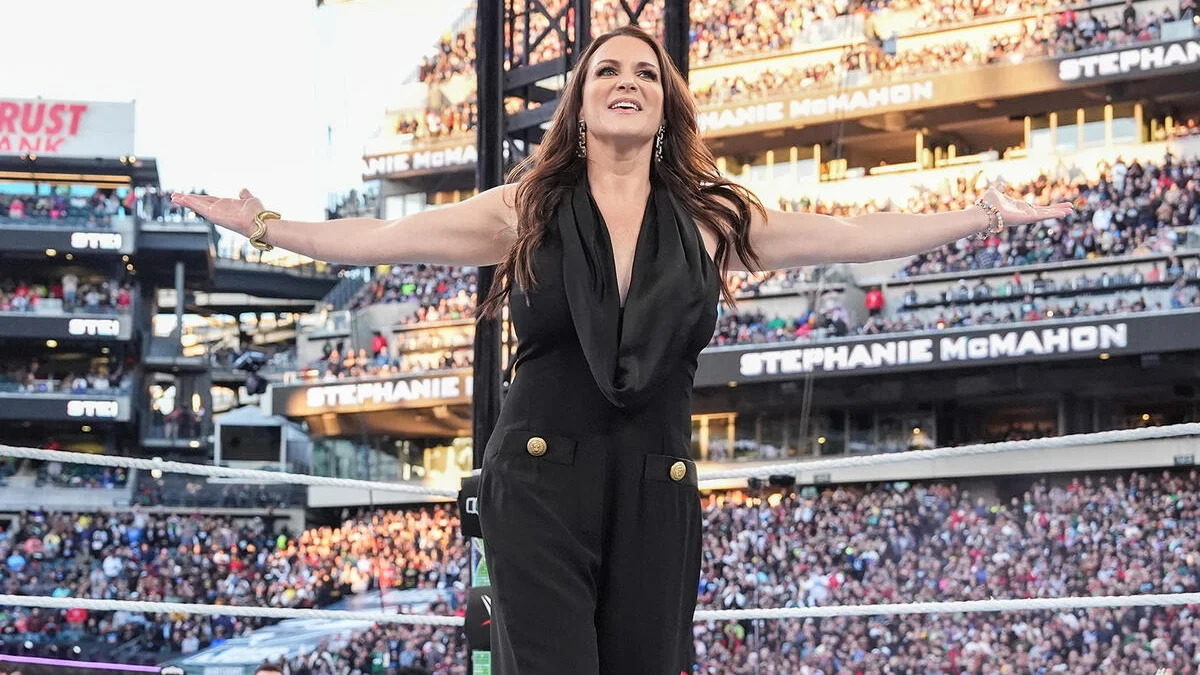

Wwes Stephanie Mc Mahon Shares Near Tattoo Regret The Story Behind It

May 28, 2025

Wwes Stephanie Mc Mahon Shares Near Tattoo Regret The Story Behind It

May 28, 2025