Evaluating Hims & Hers Health (HIMS) Stock: A Prudent Investor's Guide.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Evaluating Hims & Hers Health (HIMS) Stock: A Prudent Investor's Guide

Hims & Hers Health (HIMS) has captured significant attention in the telehealth sector, offering convenient access to healthcare services. But is investing in HIMS stock a wise move? This in-depth guide provides a prudent investor's perspective, examining the company's strengths, weaknesses, and future prospects. We'll delve into the financial performance, competitive landscape, and potential risks to help you make an informed investment decision.

Hims & Hers Health: A Quick Overview

Hims & Hers Health is a leading telehealth platform providing convenient and affordable access to medical treatments for various conditions, primarily focused on men's and women's health. Their services range from hair loss treatment and skincare to sexual health and mental wellness. This direct-to-consumer (DTC) model, utilizing telemedicine consultations and at-home delivery, has resonated with a growing customer base seeking accessible and discreet healthcare options. The company's success hinges on several key factors, including brand recognition, technological infrastructure, and the expanding telehealth market.

Strengths of HIMS Stock:

- Strong Brand Recognition: Hims & Hers has cultivated a recognizable brand identity, associated with convenience, affordability, and discretion. This brand loyalty contributes significantly to customer acquisition and retention.

- Scalable Business Model: The DTC telehealth model offers inherent scalability. Expanding the service offerings and customer base can be achieved efficiently through online marketing and streamlined operations.

- Growing Telehealth Market: The telehealth sector is experiencing rapid growth, driven by increased consumer demand for convenient healthcare access. HIMS is well-positioned to capitalize on this expanding market.

- Diversified Product Offerings: Hims & Hers offers a diverse range of products and services, reducing reliance on any single offering and mitigating risk.

- Strategic Partnerships: Collaboration with healthcare providers and insurance companies can further expand their reach and enhance market penetration.

Weaknesses of HIMS Stock:

- Competition: The telehealth market is becoming increasingly competitive, with established players and new entrants vying for market share. This intensifies the pressure on pricing and profitability.

- Regulatory Scrutiny: The healthcare industry is subject to stringent regulations. Navigating these complexities and ensuring compliance can be challenging and costly.

- Dependence on Marketing: HIMS relies heavily on marketing and advertising to acquire new customers. A reduction in marketing effectiveness could impact growth.

- Profitability Concerns: While the company is experiencing revenue growth, achieving consistent profitability remains a challenge. Investors should carefully analyze the company's financial statements.

- Subscription Model Reliance: A significant portion of revenue comes from subscription-based services, making the business vulnerable to customer churn.

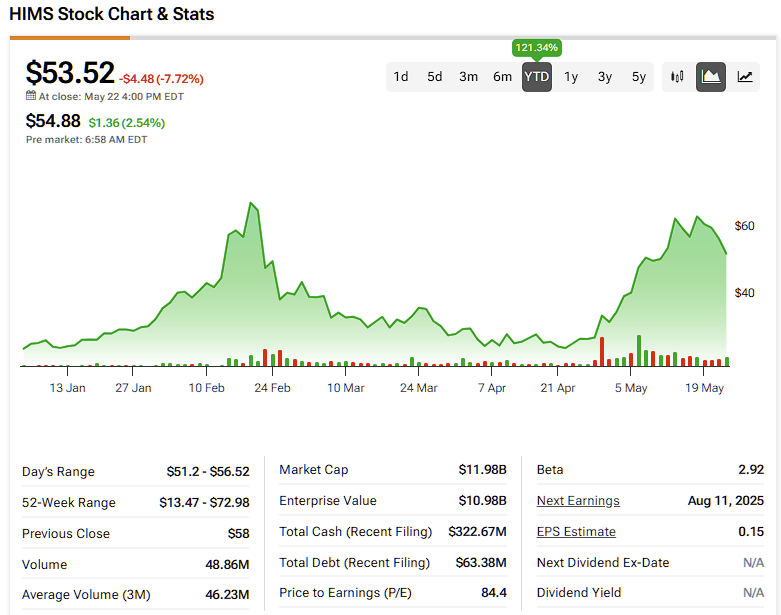

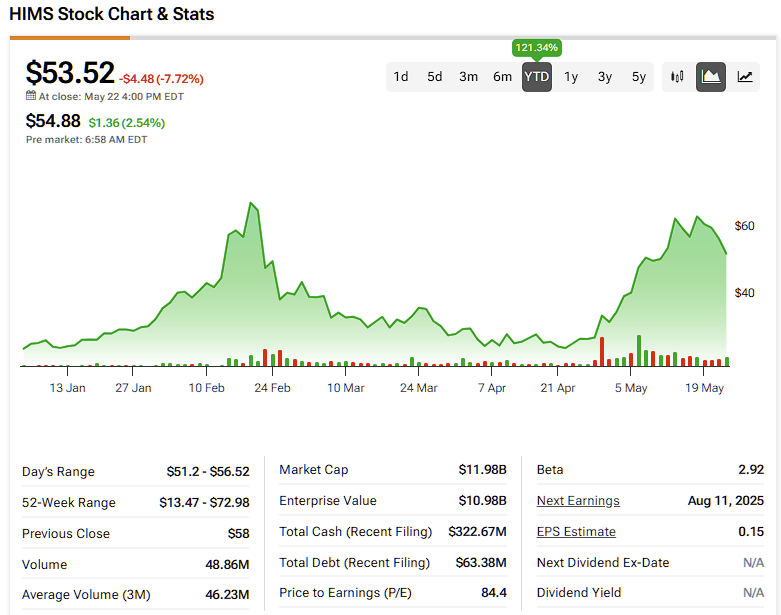

Financial Performance Analysis: (This section would require incorporating the most recent financial data available from official HIMS reports and reputable financial news sources. Include key metrics like revenue growth, profitability margins, and debt levels. Analyze trends and compare them to competitors.)

Competitive Landscape: A detailed analysis of HIMS's competitors is crucial. This includes companies offering similar telehealth services, as well as traditional healthcare providers expanding their online presence. This comparison should consider pricing strategies, service offerings, and market share.

Future Outlook and Potential Risks:

The future of HIMS depends heavily on its ability to navigate the competitive landscape, maintain its brand strength, and achieve sustained profitability. Potential risks include increased competition, regulatory changes, and fluctuations in customer demand. Investors should assess these risks carefully before making any investment decisions.

Conclusion:

Investing in HIMS stock presents both opportunities and risks. A thorough understanding of the company's strengths and weaknesses, combined with a careful analysis of its financial performance and the competitive landscape, is essential for making an informed investment choice. Consider seeking advice from a qualified financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own research and consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Evaluating Hims & Hers Health (HIMS) Stock: A Prudent Investor's Guide.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

2 C Scenario Planning A Timely Guide For Corporate Sustainability

Jun 04, 2025

2 C Scenario Planning A Timely Guide For Corporate Sustainability

Jun 04, 2025 -

Brazils Finance Sector Eyes Climate Change As Engine For Economic Development

Jun 04, 2025

Brazils Finance Sector Eyes Climate Change As Engine For Economic Development

Jun 04, 2025 -

Suhail Ahmad Bhat From Ball Boy In Kashmir To Indian Football Team

Jun 04, 2025

Suhail Ahmad Bhat From Ball Boy In Kashmir To Indian Football Team

Jun 04, 2025 -

Lu Pone Apologizes The Broadway Stars Controversial Remarks And Subsequent Retraction

Jun 04, 2025

Lu Pone Apologizes The Broadway Stars Controversial Remarks And Subsequent Retraction

Jun 04, 2025 -

Eurozone Expansion Bulgarias Path To Membership And Challenges Ahead

Jun 04, 2025

Eurozone Expansion Bulgarias Path To Membership And Challenges Ahead

Jun 04, 2025