Ethereum's Sharp Decline: Will Bulls Save The Day?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ethereum's Sharp Decline: Will Bulls Save the Day?

Ethereum (ETH), the world's second-largest cryptocurrency by market capitalization, has experienced a significant price drop in recent weeks, leaving investors wondering if the bulls can stage a comeback. The decline, which has seen ETH fall [insert percentage]% from its recent high of $[insert price], has sparked concerns about the future of the Ethereum network and the broader cryptocurrency market. But is this a temporary setback or the beginning of a more prolonged downturn? Let's delve into the potential factors driving this decline and explore the possibility of a bullish reversal.

Understanding the Recent Drop:

Several factors could be contributing to Ethereum's recent price slump. These include:

- The broader cryptocurrency market downturn: The entire crypto market has seen a period of volatility, with Bitcoin (BTC), the largest cryptocurrency, also experiencing a price correction. This overall negative sentiment often spills over into altcoins like Ethereum.

- Regulatory uncertainty: Increasing regulatory scrutiny of the cryptocurrency industry worldwide continues to create uncertainty and potentially impact investor confidence. News regarding stricter regulations or enforcement actions can trigger sell-offs.

- Macroeconomic factors: Global inflation, rising interest rates, and fears of a recession are impacting various asset classes, including cryptocurrencies. Investors may be shifting their funds to more traditional, perceived "safe-haven" assets.

- Technical factors: Certain technical indicators, such as moving averages and relative strength index (RSI), may suggest an overbought condition preceding the drop. These indicators, while not definitive, can influence trader sentiment and trigger selling pressure. Learn more about technical analysis [link to reputable resource on technical analysis].

- The Merge's Aftermath: While the successful Ethereum Merge was a significant milestone, some analysts suggest that the anticipated price surge following the event hasn't fully materialized, potentially contributing to the current sell-off. Read more about the Ethereum Merge [link to a relevant article on the Merge].

Will the Bulls Return? Analyzing the Potential for a Rebound:

Despite the current bearish sentiment, several factors could potentially trigger a bullish reversal for Ethereum:

- Technological advancements: Ethereum's ongoing development, including scaling solutions like sharding and Layer-2 protocols, continue to enhance the network's capabilities and attract developers. These improvements could drive long-term growth and attract new investors.

- Deflationary nature of ETH: The Ethereum Merge transitioned the network to a proof-of-stake consensus mechanism, leading to a reduction in ETH supply. This deflationary aspect could support price appreciation in the long term.

- Growing DeFi ecosystem: Ethereum remains the dominant platform for decentralized finance (DeFi) applications. The continued growth and innovation within the DeFi ecosystem could boost demand for ETH.

- Institutional adoption: Increasing institutional investment in the cryptocurrency market could provide significant support to Ethereum's price. Major financial institutions are increasingly exploring ways to integrate crypto assets into their portfolios.

Conclusion: Navigating the Volatility

The recent decline in Ethereum's price presents both challenges and opportunities. While the current market conditions are uncertain, the underlying fundamentals of Ethereum remain strong. The potential for future growth fueled by technological advancements and increasing adoption makes it crucial for investors to carefully assess their risk tolerance and long-term investment strategy. Remember that cryptocurrency investments are inherently volatile, and it’s vital to conduct thorough research and consider consulting a financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves significant risks, and you could lose your entire investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ethereum's Sharp Decline: Will Bulls Save The Day?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Sun Also Rises Examining The Growth Of Sol Investments

Sep 23, 2025

The Sun Also Rises Examining The Growth Of Sol Investments

Sep 23, 2025 -

Despite Setbacks Bill Gates Holds Optimistic Stance On Global Health

Sep 23, 2025

Despite Setbacks Bill Gates Holds Optimistic Stance On Global Health

Sep 23, 2025 -

Vicky Kaushal And Katrina Kaif First Pregnancy Photo Revealed

Sep 23, 2025

Vicky Kaushal And Katrina Kaif First Pregnancy Photo Revealed

Sep 23, 2025 -

Egypts Alaa Abd El Fattah From Prison Cell To Freedom After Presidential Pardon

Sep 23, 2025

Egypts Alaa Abd El Fattah From Prison Cell To Freedom After Presidential Pardon

Sep 23, 2025 -

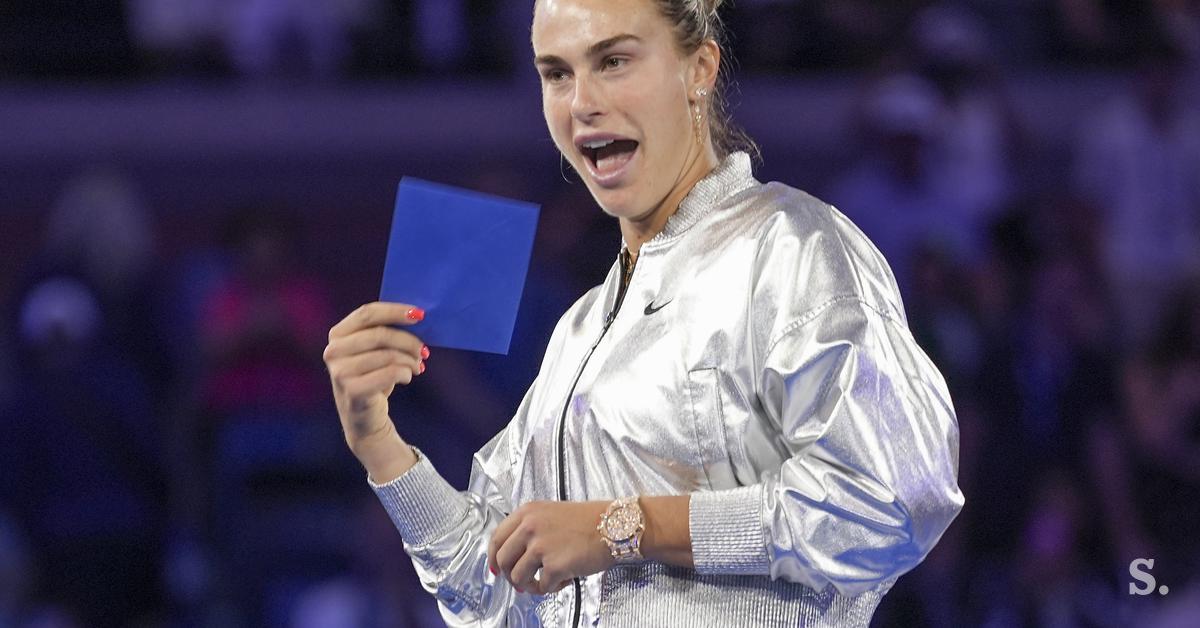

Teniski Svet Pretresel Preobrat Sabalenka Na Vrhu Lestvice Erjavec Ponos Slovenije

Sep 23, 2025

Teniski Svet Pretresel Preobrat Sabalenka Na Vrhu Lestvice Erjavec Ponos Slovenije

Sep 23, 2025