Ethereum's $18B Treasury Buy: Fueling A Potential $10,000 ETH Price Rally?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ethereum's $18 Billion Treasury Buy: Fueling a Potential $10,000 ETH Price Rally?

The cryptocurrency world is buzzing with excitement following news of Ethereum's staggering $18 billion treasury buyback. This monumental event has sent ripples through the market, sparking fervent speculation about a potential price surge for ETH, with some analysts even predicting a breathtaking rally to $10,000. But is this realistic, or is it just hype? Let's delve into the details and explore the potential implications.

What Does This Treasury Buyback Mean?

Ethereum, the world's second-largest cryptocurrency by market capitalization, has accumulated a substantial treasury over the years, primarily through transaction fees (gas fees) and network staking rewards. This $18 billion war chest isn't sitting idly by; it's being strategically deployed to bolster the network's future and potentially influence ETH's price. While the exact details of the buyback mechanism remain somewhat opaque, the sheer scale of the purchase is undeniably significant.

This strategic move differs greatly from typical corporate buybacks. Instead of directly purchasing ETH on open markets, it's more likely that this involves internal processes and possibly the burning of a significant portion of ETH, thereby reducing supply and potentially increasing its value.

The Bullish Arguments for a $10,000 ETH Price:

Proponents of a $10,000 ETH price point cite several factors fueled by this massive treasury buyback:

- Reduced Supply: The most significant factor is the potential reduction in the circulating supply of ETH. By removing a substantial number of coins from circulation, scarcity increases, driving up demand and potentially boosting the price.

- Increased Network Security: A larger treasury strengthens the Ethereum network, making it more secure and resilient against attacks. This enhanced security boosts investor confidence, further supporting price appreciation.

- Enhanced Development: The funds can be used to accelerate the development of Ethereum's infrastructure and ecosystem, attracting more developers and users, contributing to long-term price growth. This includes continued improvements to scalability, security, and user experience.

- Positive Market Sentiment: The sheer scale of the buyback has created considerable positive market sentiment, boosting investor confidence and driving further investment into ETH. This is a crucial psychological factor affecting price.

The Bearish Counterarguments:

While the potential for a price surge is undeniable, there are counterarguments to temper expectations of a rapid jump to $10,000:

- Market Volatility: The cryptocurrency market is notoriously volatile. External factors, such as regulatory uncertainty and macroeconomic conditions, can significantly impact ETH's price regardless of the treasury buyback.

- Gradual Price Increase: The price impact might be more gradual than some speculate. The buyback, while massive, is likely to be implemented over a considerable period to avoid market manipulation.

- Uncertain Implementation: The exact mechanics of the buyback and its impact on the circulating supply remain somewhat unclear, creating uncertainty.

Conclusion: A Cautious Optimism

Ethereum's $18 billion treasury buyback is a landmark event with potentially significant implications for the price of ETH. While a $10,000 price point may seem ambitious in the short term, the strategic move undoubtedly strengthens the Ethereum ecosystem and has the potential to drive long-term growth. Investors should approach this news with cautious optimism, considering the inherent volatility of the cryptocurrency market and the uncertainties surrounding the buyback's precise implementation. Further analysis and transparency regarding the execution of this plan are crucial for a clearer understanding of its overall impact. Stay tuned for further developments and remember to always conduct thorough research before making any investment decisions.

Related Articles:

- [Link to an article about Ethereum's scalability solutions]

- [Link to an article discussing cryptocurrency market volatility]

- [Link to an article about the future of decentralized finance (DeFi)]

Keywords: Ethereum, ETH, Ethereum price, $10000 ETH, cryptocurrency, treasury buyback, blockchain, DeFi, cryptocurrency market, crypto news, investment, price prediction, market analysis, crypto trading.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ethereum's $18B Treasury Buy: Fueling A Potential $10,000 ETH Price Rally?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ethereum Eth Reaches 4 530 Xrp And Shib Price Analysis And Predictions

Sep 23, 2025

Ethereum Eth Reaches 4 530 Xrp And Shib Price Analysis And Predictions

Sep 23, 2025 -

Silence Or Support How Late Night Tv Handled Kimmels Suspension

Sep 23, 2025

Silence Or Support How Late Night Tv Handled Kimmels Suspension

Sep 23, 2025 -

Lincoln City Vs Chelsea Live Team News Prediction And Streaming Details

Sep 23, 2025

Lincoln City Vs Chelsea Live Team News Prediction And Streaming Details

Sep 23, 2025 -

Otsus Stellar Six Pacific League Pitcher Silences Opponents

Sep 23, 2025

Otsus Stellar Six Pacific League Pitcher Silences Opponents

Sep 23, 2025 -

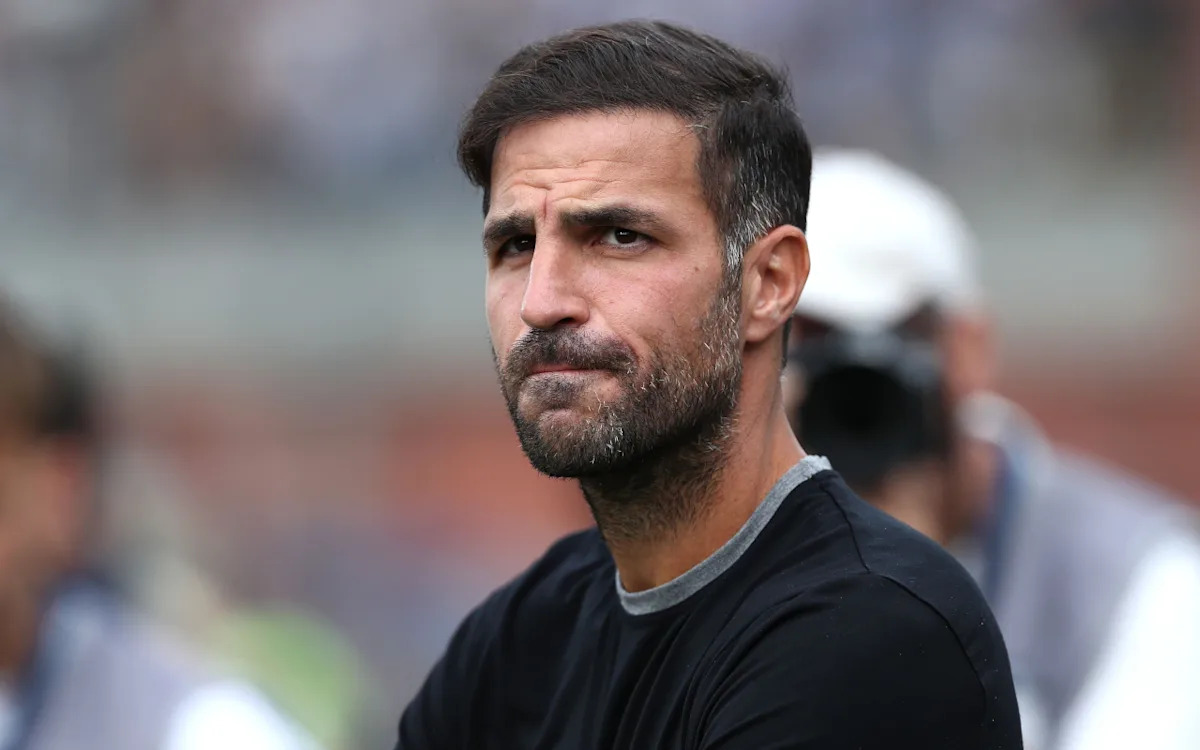

Financial Support Pledged By Fabregas And Como Following Devastating Floods

Sep 23, 2025

Financial Support Pledged By Fabregas And Como Following Devastating Floods

Sep 23, 2025