Ethereum Sees $200M Investment Surge Following Pectra Upgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ethereum Sees $200M Investment Surge Following Shanghai Upgrade

Ethereum's price has experienced a significant boost following the successful completion of the Shanghai upgrade, attracting over $200 million in new investments. The upgrade, a landmark event for the Ethereum network, unlocked staked ETH, a move that has significantly impacted market sentiment and investor confidence. This surge highlights the growing institutional interest in Ethereum and its potential for future growth.

The Shanghai upgrade, also known as the "Shapella" upgrade, was a highly anticipated event within the cryptocurrency community. It marked a pivotal moment, allowing users to withdraw their staked ETH for the first time since the Beacon Chain launch in December 2020. This previously locked ETH, representing a substantial portion of the total Ethereum supply, was finally made available, significantly impacting liquidity and market dynamics.

<h3>Unlocking Staked ETH: A Catalyst for Growth</h3>

Prior to the Shanghai upgrade, the considerable amount of ETH locked in the staking contract represented a significant constraint on the overall supply. This constrained supply, coupled with growing demand, had contributed to Ethereum's price resilience. However, the ability to now withdraw staked ETH introduced a new level of flexibility for stakers, potentially influencing price movements in both directions.

The initial reaction to the upgrade has been overwhelmingly positive. Data from various cryptocurrency market trackers shows a considerable influx of investment capital into Ethereum, exceeding $200 million within the first few days following the upgrade's successful implementation. This influx suggests a growing confidence amongst investors in the long-term prospects of the Ethereum network.

<h3>Impact on Ethereum's Future</h3>

The successful execution of the Shanghai upgrade is a testament to Ethereum's technological advancements and its ability to adapt to evolving market demands. This milestone demonstrates the network's maturity and resilience, further solidifying its position as a leading blockchain platform. The unlock of staked ETH, rather than causing a price crash as some had predicted, appears to have fueled renewed investor interest.

This positive market reaction has significant implications for the future of Ethereum. The increased liquidity could stimulate further development and innovation within the Ethereum ecosystem, attracting even more developers and users. Moreover, the successful upgrade reinforces Ethereum's commitment to scalability and efficiency, key factors in its ongoing competition with other blockchain networks.

<h3>What Does This Mean for Investors?</h3>

While the immediate post-upgrade surge is encouraging, investors should remain cautious and conduct thorough research before making any investment decisions. The cryptocurrency market remains volatile, and factors beyond the Shanghai upgrade could still influence Ethereum's price.

It's crucial to remember that past performance is not indicative of future results. Diversification remains a key strategy for managing risk within any investment portfolio.

Further Reading:

- – For official information and updates on Ethereum.

- – For in-depth analysis and expert opinions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ethereum Sees $200M Investment Surge Following Pectra Upgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Exclusive Interview The Making Of Netflixs Fall Of Favre And Its Controversial Subject

May 20, 2025

Exclusive Interview The Making Of Netflixs Fall Of Favre And Its Controversial Subject

May 20, 2025 -

Unexpected Comedy Gold The Sex Scene In Overcompensating You Wont Forget

May 20, 2025

Unexpected Comedy Gold The Sex Scene In Overcompensating You Wont Forget

May 20, 2025 -

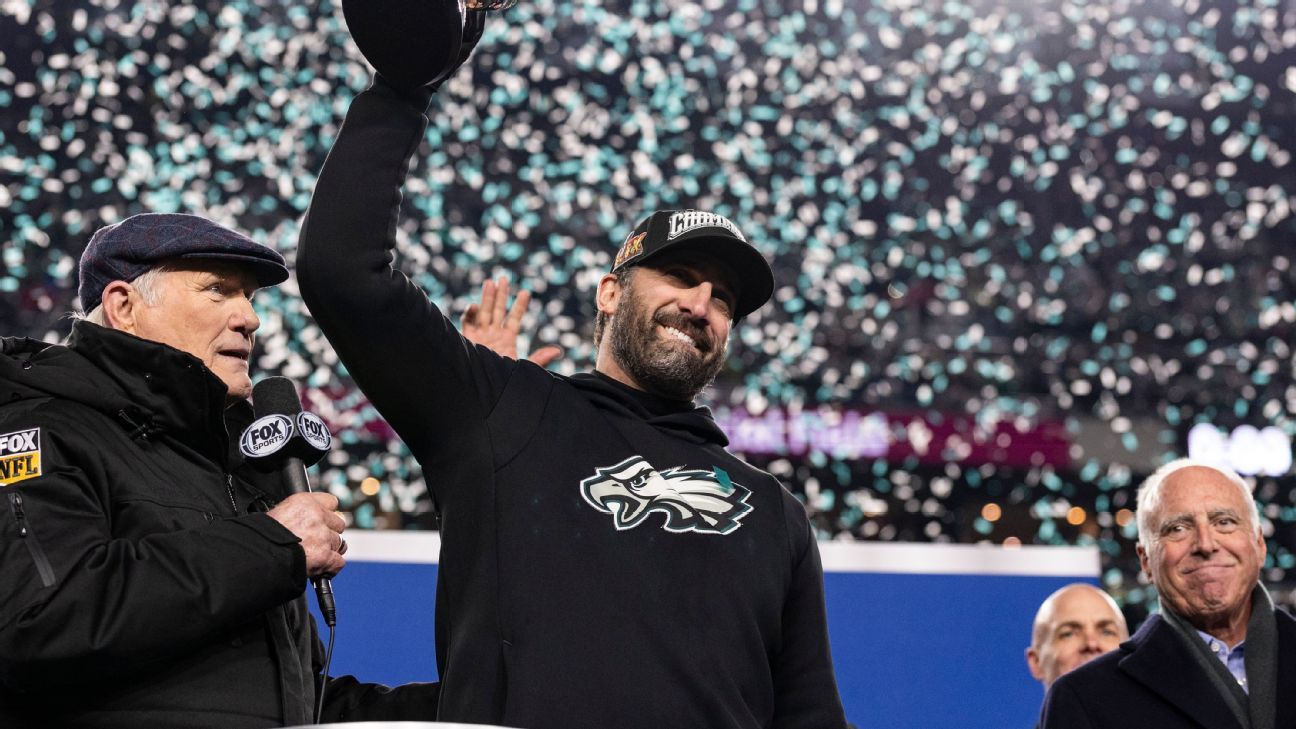

Eagles Lock Up Sirianni With Long Term Contract Deal

May 20, 2025

Eagles Lock Up Sirianni With Long Term Contract Deal

May 20, 2025 -

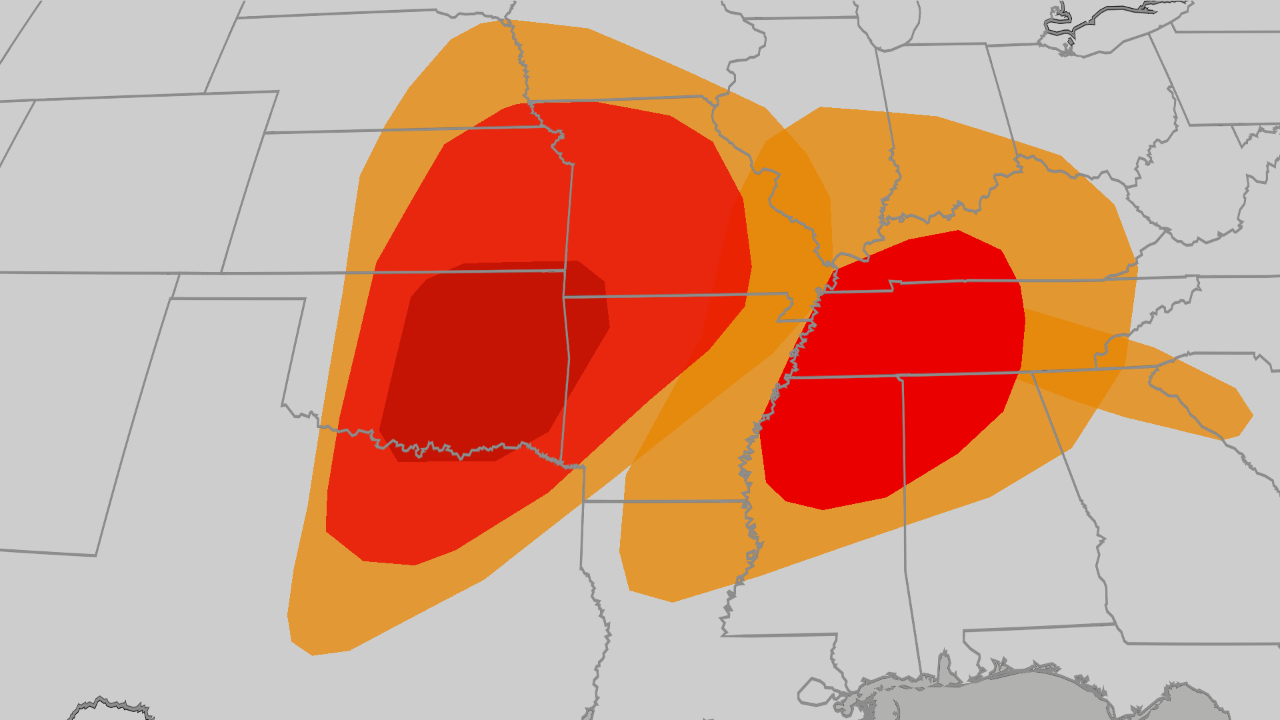

Plains Midwest And South Brace For Severe Weather Tornado Outbreak Possible

May 20, 2025

Plains Midwest And South Brace For Severe Weather Tornado Outbreak Possible

May 20, 2025 -

Get Ready For Helldivers 2s Master Of Ceremony Warbond Drop On May 15th

May 20, 2025

Get Ready For Helldivers 2s Master Of Ceremony Warbond Drop On May 15th

May 20, 2025