Ethereum Price Plunges: ETH Flash Crash Nears $4K

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ethereum Price Plunges: ETH Flash Crash Nears $4K

The cryptocurrency market experienced a significant shockwave today as the price of Ethereum (ETH) plummeted, briefly nearing the $4,000 mark in a dramatic flash crash. This unexpected downturn sent ripples through the crypto community, leaving investors reeling and prompting urgent questions about the future of the second-largest cryptocurrency by market capitalization.

The sudden price drop, which saw ETH lose a substantial percentage of its value in a short period, is currently attributed to a confluence of factors. While pinpointing the exact cause remains challenging, several contributing elements are under intense scrutiny.

What Caused the Ethereum Flash Crash?

Several theories are circulating regarding the causes of this sharp decline. These include:

-

Liquidation cascades: A large number of leveraged positions on exchanges may have been liquidated simultaneously, triggering a chain reaction that amplified the sell-off. This is a common phenomenon in volatile markets and can lead to rapid price drops. Learn more about .

-

Broader market sentiment: The overall bearish sentiment in the cryptocurrency market, coupled with concerns about macroeconomic conditions, could have contributed to the sell-off. Recent regulatory uncertainty and negative news around other cryptocurrencies might have also exacerbated the situation.

-

Technical glitches: Although less likely, the possibility of technical glitches on exchanges cannot be entirely ruled out. While major exchanges have robust systems, unexpected issues can sometimes impact order execution and price discovery.

-

Whale activity: The actions of large investors ("whales") manipulating the market by placing large sell orders can significantly impact prices. While difficult to prove, this remains a recurring concern within the crypto space.

The speed and severity of the crash underscore the inherent volatility of the cryptocurrency market. While Ethereum has shown remarkable resilience in the past, this incident highlights the risks associated with investing in digital assets.

What Happens Next?

The immediate aftermath of the flash crash saw a period of intense uncertainty. Many investors are closely monitoring the market for signs of recovery, while others are bracing for further volatility. The price of ETH has shown some signs of recovery, but the path ahead remains unclear.

Several key factors will determine the future trajectory of Ethereum's price:

-

Market sentiment: A shift towards a more bullish sentiment could trigger a price rebound. However, sustained bearishness could lead to further declines.

-

Regulatory developments: Clarity regarding regulatory frameworks for cryptocurrencies could influence investor confidence and price stability.

-

Technological advancements: Continued progress in Ethereum's development, such as the successful implementation of , could positively impact its long-term value.

Investing in Ethereum: A Cautious Approach

The recent flash crash serves as a stark reminder of the risks involved in cryptocurrency investments. Before investing in Ethereum or any other cryptocurrency, it's crucial to:

- Do your research: Understand the technology, market dynamics, and potential risks associated with ETH.

- Diversify your portfolio: Don't put all your eggs in one basket. Diversification can help mitigate losses.

- Only invest what you can afford to lose: Cryptocurrencies are highly volatile, and losses are possible.

The future of Ethereum remains a topic of much debate and speculation. While this recent flash crash caused considerable concern, the long-term potential of the platform continues to attract significant interest from developers and investors alike. However, navigating this volatile market requires careful consideration and a well-informed approach. Stay tuned for further updates as the situation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ethereum Price Plunges: ETH Flash Crash Nears $4K. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

We Dont Have Defenders Maresca On Squad Depth Concerns

Sep 23, 2025

We Dont Have Defenders Maresca On Squad Depth Concerns

Sep 23, 2025 -

Fort Mc Murray Gains New Air Canada Route Non Stop Service From Vancouver International Airport Yvr

Sep 23, 2025

Fort Mc Murray Gains New Air Canada Route Non Stop Service From Vancouver International Airport Yvr

Sep 23, 2025 -

From Tony Soprano To Today Tracing The Impact Of The Sopranos On Modern Drama

Sep 23, 2025

From Tony Soprano To Today Tracing The Impact Of The Sopranos On Modern Drama

Sep 23, 2025 -

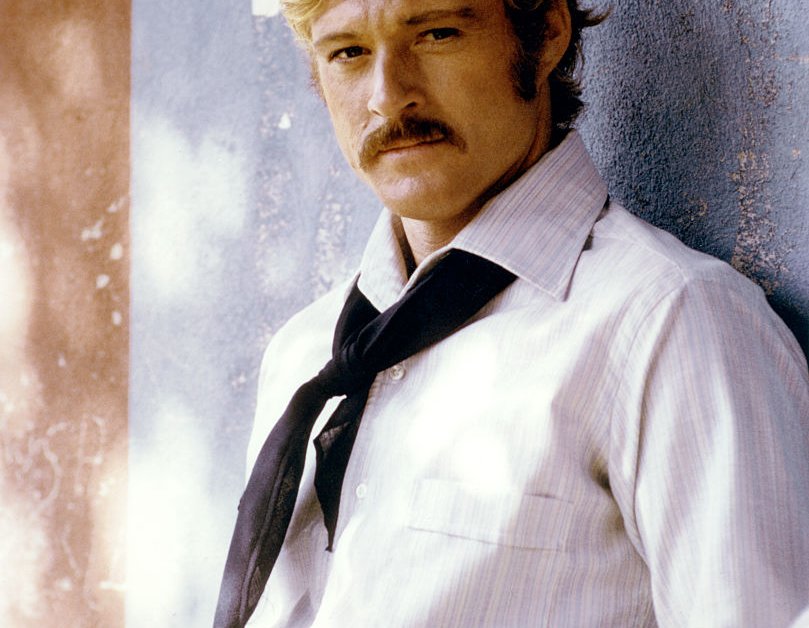

Deciphering The Honesty In Robert Redfords Expression

Sep 23, 2025

Deciphering The Honesty In Robert Redfords Expression

Sep 23, 2025 -

Pacific League Update Ryo Ota Delivers For Orix Securing Third Straight Lead

Sep 23, 2025

Pacific League Update Ryo Ota Delivers For Orix Securing Third Straight Lead

Sep 23, 2025