Ethereum Investment Surge: $200 Million Inflows After Shanghai Upgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ethereum Investment Surge: $200 Million Inflows After Shanghai Upgrade

The Ethereum network has witnessed a significant influx of investment following the highly anticipated Shanghai upgrade, with over $200 million flowing into the market in just the first few days. This substantial increase signals a renewed confidence in the second-largest cryptocurrency and its future prospects. The upgrade, which unlocked staked ETH, was a major milestone for the network and appears to have triggered a wave of positive market sentiment.

The Shanghai Upgrade: A Catalyst for Investment

The Shanghai upgrade, implemented on April 12th, 2023, marked a pivotal moment for Ethereum. For the first time, it allowed users to withdraw their staked Ether (ETH) along with accumulated staking rewards. This long-awaited feature addressed a key concern for many investors who had previously been hesitant to stake their ETH due to the lack of liquidity. This unlocking of staked ETH is widely considered a key factor driving the recent investment surge. Before the upgrade, a substantial portion of the ETH supply was locked in staking contracts, limiting its availability in the market.

Unlocking Staked ETH: Increased Liquidity and Market Confidence

The ability to unstake ETH has significantly increased liquidity within the Ethereum ecosystem. This increased liquidity provides investors with more flexibility and reduces the perceived risk associated with staking. The resulting increase in trading volume directly contributed to the price appreciation of ETH and attracted further investment.

Market Sentiment and Price Action

The impact of the Shanghai upgrade is clearly visible in the price of ETH. Following the upgrade, the price experienced a noticeable increase, further encouraging investors to jump on board. While market volatility remains a factor, the overall trend points towards a positive outlook for Ethereum in the near term. This surge is not just about speculation; many analysts see the upgrade as a crucial step in Ethereum's evolution towards becoming a more robust and user-friendly platform.

Beyond the Immediate Gains: Long-Term Implications

The $200 million inflow is more than just a short-term market fluctuation. It reflects a growing belief in Ethereum's long-term potential. The upgrade has addressed key scalability and usability concerns, paving the way for wider adoption and increased development activity within the Ethereum ecosystem. This positive momentum is expected to continue as more decentralized applications (dApps) and projects leverage the enhanced capabilities of the network.

Investing in Ethereum: Considerations for Investors

While the current market sentiment is positive, it's crucial for investors to approach the market with caution. Cryptocurrency investments are inherently volatile, and it's essential to conduct thorough research and understand the associated risks before committing any funds. Diversification within your investment portfolio is always a recommended strategy.

- Do your research: Understand the technology behind Ethereum and the implications of the Shanghai upgrade.

- Manage your risk: Never invest more than you can afford to lose.

- Stay informed: Keep up-to-date with the latest news and developments in the cryptocurrency market.

Conclusion:

The $200 million investment surge in Ethereum following the Shanghai upgrade is a powerful testament to the network's growing strength and appeal. While short-term price fluctuations are expected, the long-term implications of this upgrade suggest a bright future for Ethereum. The increased liquidity and renewed market confidence paint a positive picture for both current and prospective investors. However, remember to always conduct thorough research and manage your risk appropriately when investing in cryptocurrencies. Learn more about .

(Disclaimer: This article is for informational purposes only and does not constitute financial advice.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ethereum Investment Surge: $200 Million Inflows After Shanghai Upgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Impact Of Feds 2025 Rate Cut Prediction On Us Treasury Yields

May 20, 2025

Impact Of Feds 2025 Rate Cut Prediction On Us Treasury Yields

May 20, 2025 -

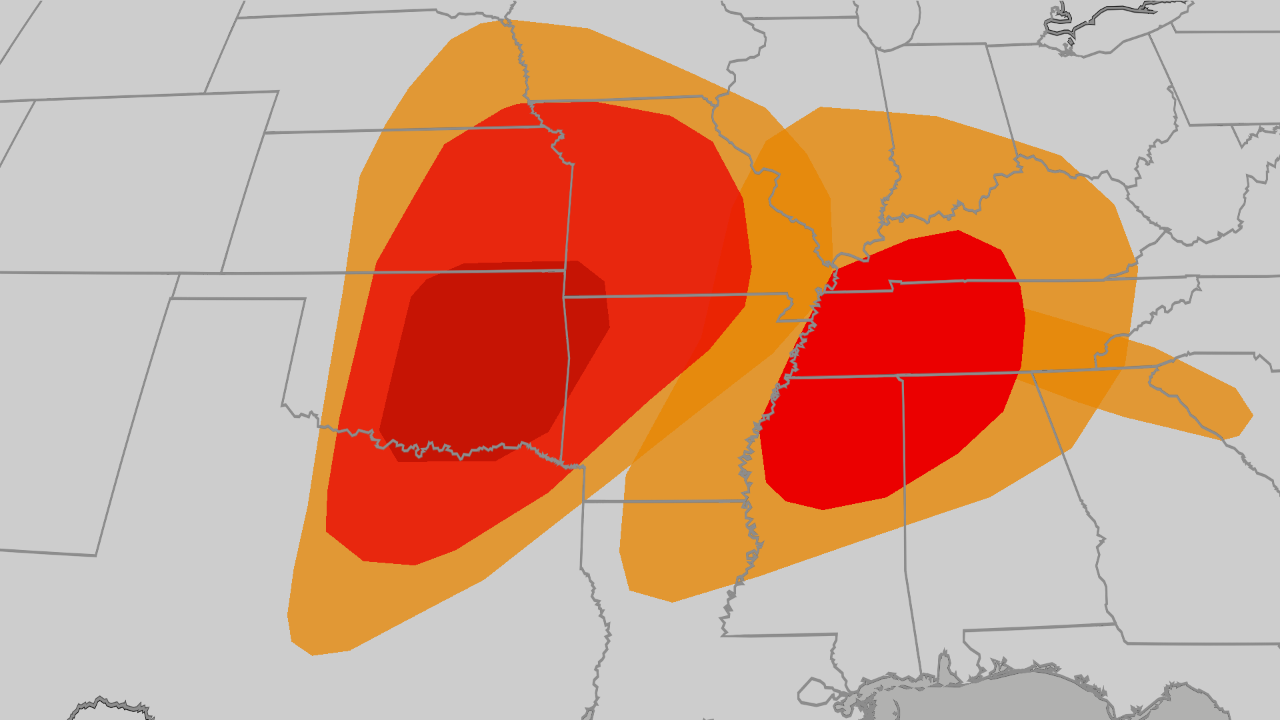

Tornado Threat Intensifies Severe Weather Impacts Plains Midwest And South

May 20, 2025

Tornado Threat Intensifies Severe Weather Impacts Plains Midwest And South

May 20, 2025 -

World Prides Washington D C Event A Show Of Strength Amid Political Tensions

May 20, 2025

World Prides Washington D C Event A Show Of Strength Amid Political Tensions

May 20, 2025 -

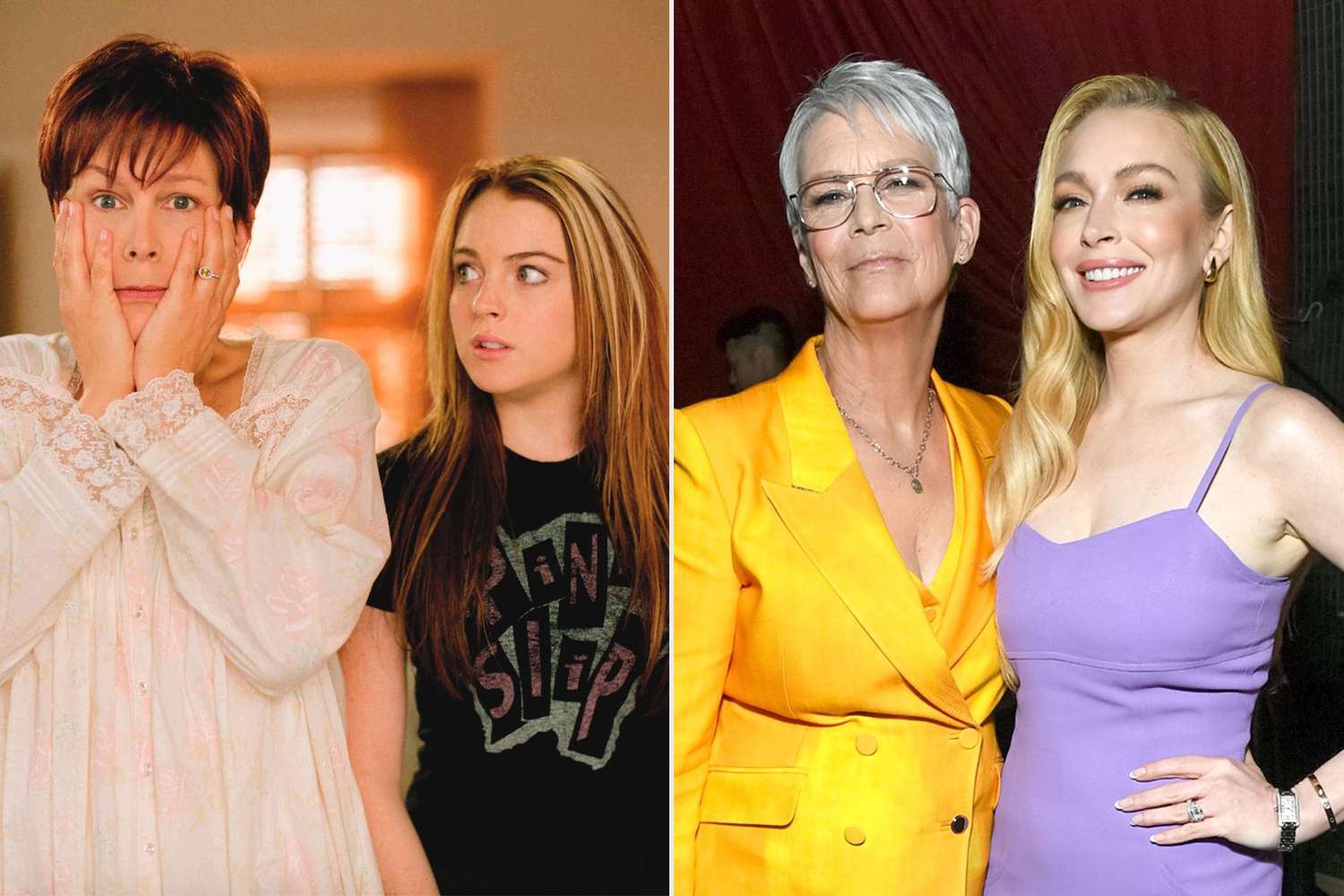

Freaky Friday Reunion Jamie Lee Curtis Discusses Her Relationship With Lindsay Lohan Exclusive

May 20, 2025

Freaky Friday Reunion Jamie Lee Curtis Discusses Her Relationship With Lindsay Lohan Exclusive

May 20, 2025 -

Nasa Warning Massive Solar Flares Threaten Global Blackouts

May 20, 2025

Nasa Warning Massive Solar Flares Threaten Global Blackouts

May 20, 2025