Ethereum Investment Surge: $200M Inflow After Shanghai Upgrade

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ethereum Investment Surge: $200M Inflow After Shanghai Upgrade

The Ethereum network has witnessed a significant influx of capital following the highly anticipated Shanghai upgrade, with over $200 million flowing into the ETH market in just the first few days. This substantial investment surge signals a renewed confidence in the second-largest cryptocurrency and its evolving ecosystem. The upgrade, finalized on April 12th, 2023, unlocked staked ETH (stETH), allowing users to finally withdraw their previously locked assets. This long-awaited feature has been a major catalyst for the recent price increase and investment activity.

What Drove the $200 Million Inflow?

The Shanghai upgrade wasn't just a technical update; it was a watershed moment for Ethereum's long-term viability and investor sentiment. Several key factors contributed to the significant investment surge:

- Unstaking of ETH: The ability to unstake ETH eliminated a major uncertainty for many investors. Previously, staked ETH was essentially locked until the upgrade, creating a perceived risk. Now, investors can access their funds, boosting liquidity and confidence.

- Increased Market Liquidity: The unlocking of millions of ETH has significantly increased the overall liquidity in the market. This makes it easier for investors to buy and sell ETH, reducing volatility and attracting more participants.

- Positive Market Sentiment: The successful execution of the Shanghai upgrade demonstrated Ethereum's resilience and capacity for innovation. This positive sentiment has spilled over into broader market confidence, driving further investment.

- Deflationary Pressure: With a portion of staked ETH now available for trading, the circulating supply has increased, but the overall narrative of Ethereum’s eventual deflationary nature remains intact, attracting long-term investors.

Beyond the Numbers: Implications for the Future of Ethereum

This significant inflow of capital is more than just a short-term price fluctuation; it represents a pivotal moment in Ethereum's maturation as a leading blockchain platform. The success of the Shanghai upgrade strengthens its position as a robust and adaptable network.

What This Means for Investors:

The increase in investment is a positive sign for current and prospective Ethereum investors. However, it's crucial to remember that cryptocurrency markets are inherently volatile. While the Shanghai upgrade has significantly boosted confidence, factors like broader macroeconomic conditions and regulatory developments can still influence the price of ETH.

Looking Ahead:

The Ethereum ecosystem continues to evolve rapidly, with ongoing development efforts focused on scalability, security, and usability. Future upgrades and developments are anticipated to further enhance the network's capabilities and attract even more investment. The successful unstaking process has paved the way for further growth and adoption.

Further Reading:

For more in-depth analysis on the Shanghai upgrade and its implications, you can explore resources like [link to reputable crypto news source] and [link to Ethereum Foundation website].

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries inherent risks, and you should conduct your own research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ethereum Investment Surge: $200M Inflow After Shanghai Upgrade. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

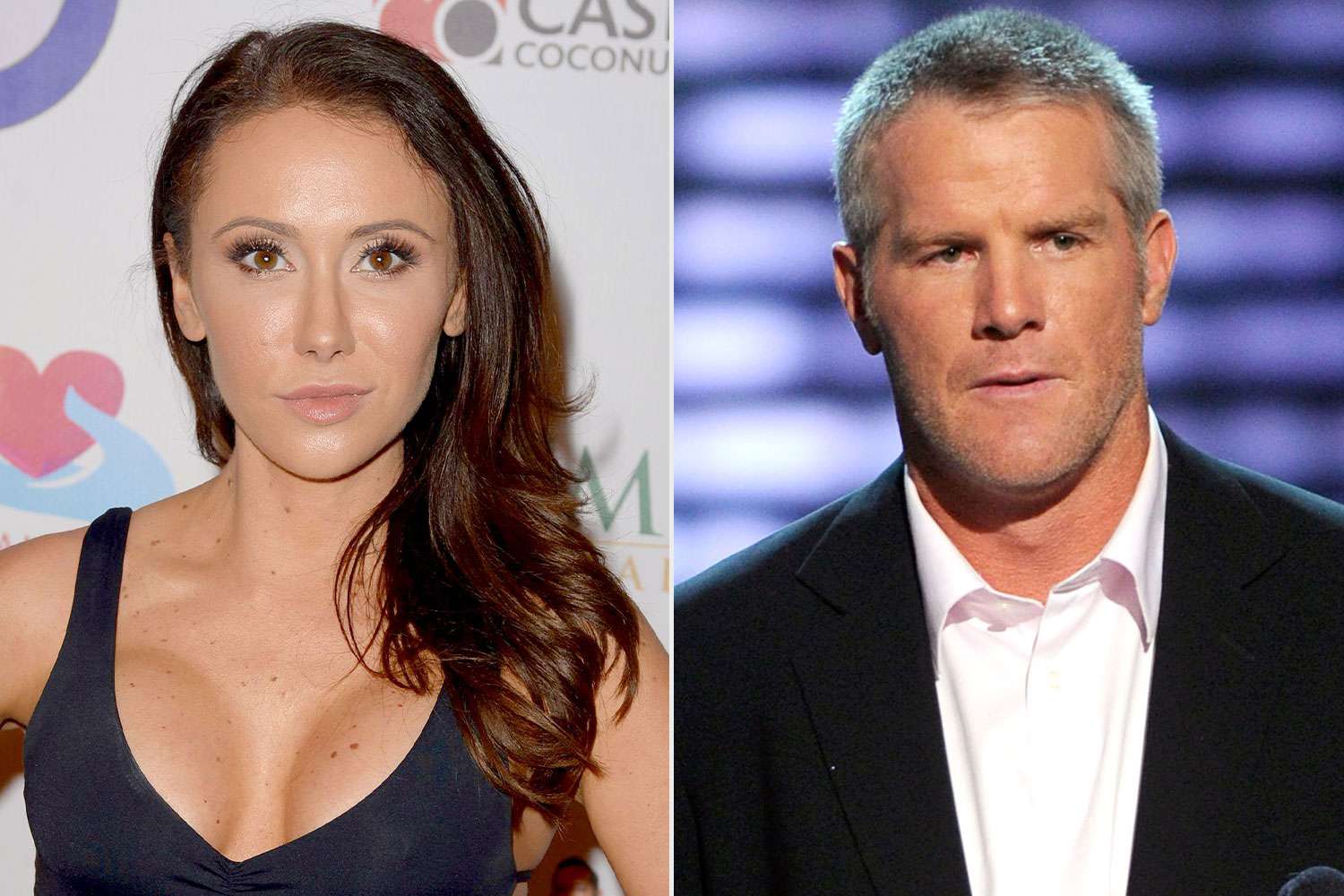

The Lasting Impact Jenn Sterger Reflects On The Brett Favre Controversy

May 20, 2025

The Lasting Impact Jenn Sterger Reflects On The Brett Favre Controversy

May 20, 2025 -

Beyond The Game Analyzing The Changes To Joel And Ellies Relationship In The Last Of Us Season 2

May 20, 2025

Beyond The Game Analyzing The Changes To Joel And Ellies Relationship In The Last Of Us Season 2

May 20, 2025 -

Putins Snub Demonstrates Trumps Diminished Global Influence

May 20, 2025

Putins Snub Demonstrates Trumps Diminished Global Influence

May 20, 2025 -

Taylor Jenkins Reids Success A Blueprint For Authors

May 20, 2025

Taylor Jenkins Reids Success A Blueprint For Authors

May 20, 2025 -

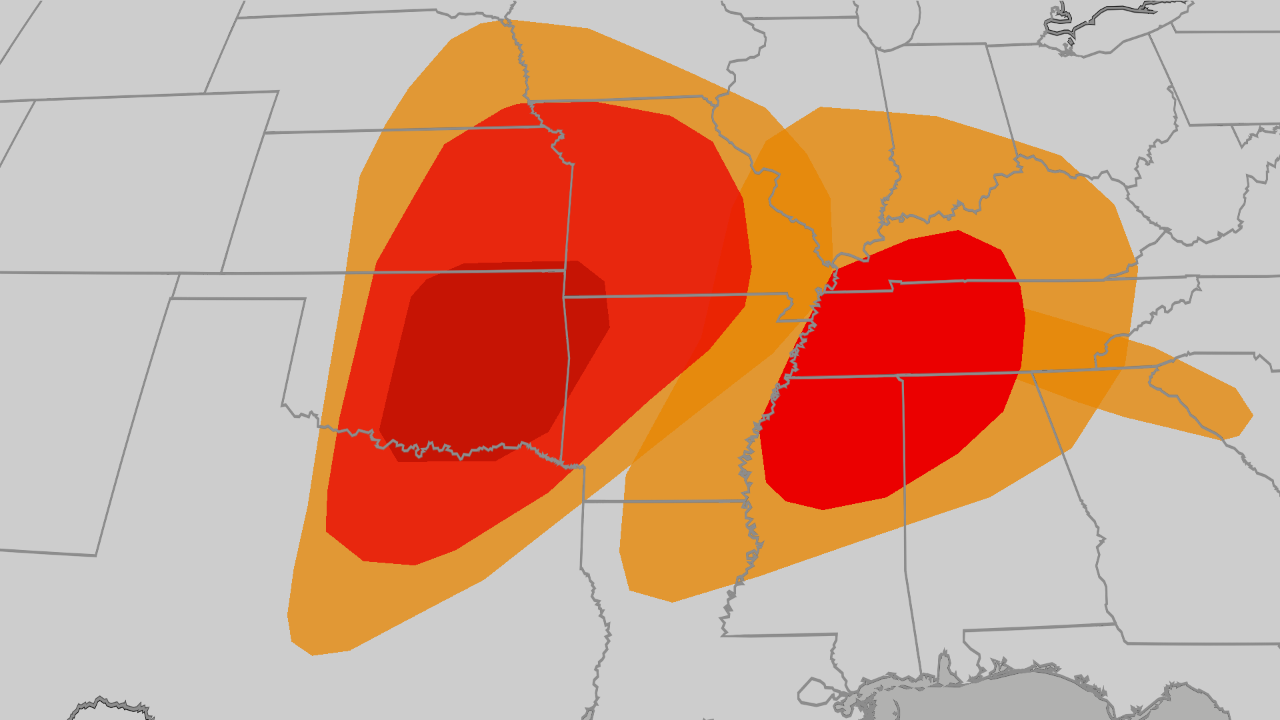

Powerful Storms And Tornado Threat Plains Midwest And South Brace For Severe Weather

May 20, 2025

Powerful Storms And Tornado Threat Plains Midwest And South Brace For Severe Weather

May 20, 2025