ETH Flash Crash Analysis: What Caused The Sudden Price Drop?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

ETH Flash Crash Analysis: What Caused the Sudden Price Drop?

The cryptocurrency market is known for its volatility, but even seasoned traders were caught off guard by the recent flash crash that sent Ethereum (ETH) prices plummeting. This dramatic price drop, which saw ETH lose a significant percentage of its value in a matter of minutes, sparked widespread concern and speculation about the underlying causes. Understanding what triggered this event is crucial for both investors and market analysts. This article delves into the potential factors contributing to the ETH flash crash and explores the broader implications for the cryptocurrency market.

The Event: A Rapid and Unexpected Plunge

On [Date of Flash Crash], the price of Ethereum experienced a sharp and sudden decline, falling from [Price before crash] to [Price after crash] within a short timeframe. This dramatic drop, often referred to as a "flash crash" due to its speed and intensity, sent shockwaves through the crypto community. The swiftness of the price movement left many investors wondering what caused such a significant and unexpected market shift.

Potential Contributing Factors:

Several factors may have contributed to the ETH flash crash. While pinpointing a single definitive cause is challenging, a combination of the following likely played a role:

-

Liquidation Cascades: One of the most likely culprits is a cascade of liquidations. When leveraged positions reach their liquidation thresholds, they are automatically closed by exchanges, leading to a sell-off that can accelerate the downward price pressure. This effect can be amplified in volatile markets, creating a domino effect.

-

Algorithmic Trading: High-frequency trading algorithms, designed to execute trades at lightning speed, may have exacerbated the situation. These algorithms can react to even minor price fluctuations, potentially amplifying sell-off pressure and contributing to the speed and intensity of the crash. [Link to article about algorithmic trading in crypto].

-

Whale Activity: The actions of large institutional investors, often referred to as "whales," can significantly influence market dynamics. A large sell order from a whale could have triggered the initial price drop, setting off the chain reaction described above.

-

Overall Market Sentiment: A negative shift in broader market sentiment, perhaps driven by macroeconomic factors or regulatory uncertainty, could have primed the market for a significant correction. [Link to relevant news article about broader market conditions].

-

Technical Glitches: While less likely to be the primary cause, technical glitches on exchanges or in trading platforms could have momentarily disrupted the market, potentially contributing to the rapid price decline.

Analyzing the Aftermath:

Following the flash crash, several questions remain:

- How quickly did exchanges react? The speed and effectiveness of exchange responses to the volatility were crucial in minimizing further damage.

- What measures are being implemented to prevent future incidents? Exchanges and regulatory bodies will likely review their systems and protocols to identify areas for improvement.

- What are the long-term implications for investor confidence? The impact on investor sentiment and market stability will require close monitoring.

Conclusion: Navigating Volatility in the Crypto Market

The ETH flash crash serves as a stark reminder of the inherent volatility in the cryptocurrency market. While pinpointing a single, definitive cause remains challenging, a confluence of factors likely contributed to this dramatic price drop. Understanding these potential causes is crucial for investors to navigate the complexities of the crypto market and develop more resilient trading strategies. This incident highlights the need for careful risk management, diversification, and a thorough understanding of market dynamics. Staying informed about market trends and developments is vital for anyone involved in the cryptocurrency space.

Call to Action: Stay informed about market updates and follow us for the latest news and analysis on cryptocurrency. [Link to your social media or website]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on ETH Flash Crash Analysis: What Caused The Sudden Price Drop?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Environmental Activists Face Grave Danger In Latin America A New Report

Sep 23, 2025

Environmental Activists Face Grave Danger In Latin America A New Report

Sep 23, 2025 -

Historic Low Bitcoin Volatility Signals Potential Price Surge

Sep 23, 2025

Historic Low Bitcoin Volatility Signals Potential Price Surge

Sep 23, 2025 -

Yvr And Air Canada Expand Service With New Fort Mc Murray Route

Sep 23, 2025

Yvr And Air Canada Expand Service With New Fort Mc Murray Route

Sep 23, 2025 -

Comos Coppa Italia Windfall How The Club Is Giving Back

Sep 23, 2025

Comos Coppa Italia Windfall How The Club Is Giving Back

Sep 23, 2025 -

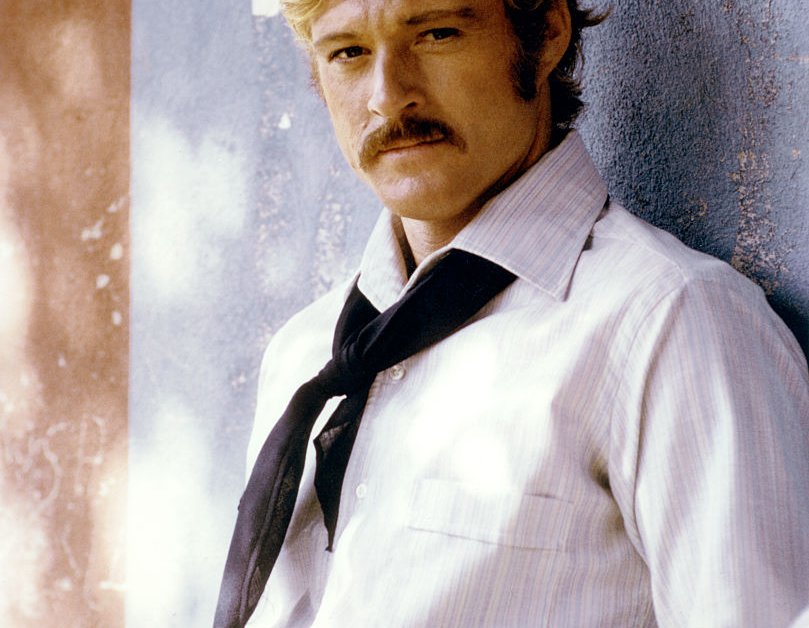

A Portrait Of Integrity Reading The Expressions Of Robert Redford

Sep 23, 2025

A Portrait Of Integrity Reading The Expressions Of Robert Redford

Sep 23, 2025