Economic Uptick Sends Mortgage Rates Climbing

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Uptick Sends Mortgage Rates Climbing: What Homebuyers Need to Know

The U.S. economy is showing signs of strength, but this positive news comes with a potential drawback for prospective homebuyers: rising mortgage rates. Recent economic indicators suggest a strengthening market, leading to increased borrowing costs and impacting affordability in the already competitive housing market. This climb presents a significant challenge for those hoping to enter the real estate market or refinance their existing loans.

Understanding the Connection Between the Economy and Mortgage Rates

The relationship between economic growth and mortgage rates is complex but generally follows a predictable pattern. When the economy performs well, the Federal Reserve often raises interest rates to curb inflation. These increases directly impact the rates lenders offer on mortgages. Higher rates mean higher monthly payments, making homeownership less accessible for many.

Current Mortgage Rate Trends:

As of today, average mortgage rates are [Insert Current Average Rate Here - cite source like Freddie Mac or Bankrate]. This represents a [Percentage Increase/Decrease] compared to [Time Period - e.g., last month, last year]. Several factors contribute to these fluctuations, including:

- Inflation: Persistent inflation pressures the Federal Reserve to act, leading to higher interest rates across the board, including mortgages.

- Economic Growth: Strong economic growth can indicate a healthy economy, but also fuels inflation, again leading to rate hikes.

- Investor Sentiment: Investor confidence and market expectations play a significant role in shaping interest rate movements.

What This Means for Homebuyers:

The rising rates are creating a more challenging environment for homebuyers. Those hoping to purchase a home will need to:

- Budget Carefully: Higher rates translate to significantly higher monthly payments. A thorough budget analysis is crucial before making an offer.

- Consider a Smaller Loan: Reducing the loan amount can mitigate the impact of higher interest rates.

- Shop Around for the Best Rates: Different lenders offer varying rates and terms. Comparing offers from multiple lenders is essential to secure the best possible deal.

- Improve Your Credit Score: A higher credit score typically qualifies you for better interest rates.

Strategies for Navigating the Rising Rate Environment:

For those already in the market, refinancing might be less attractive due to the increased rates. However, if you're locked into a higher rate, consider exploring options, such as:

- Refinancing (only if beneficial): If you can secure a lower rate than your current one, refinancing can save you money over the life of the loan. Carefully weigh the closing costs against potential savings.

- Adjustable-Rate Mortgages (ARMs): ARMs typically offer lower initial rates, but the rate can adjust periodically. Understand the risks and potential long-term costs before opting for an ARM.

Looking Ahead:

Predicting future mortgage rate movements is challenging, but experts [cite source - e.g., economists, financial analysts] suggest that rates may [predict future trend - be cautious and cite source]. Staying informed about economic trends and consulting with a financial advisor can help navigate this dynamic market.

Call to Action: Stay updated on the latest mortgage rate trends by bookmarking reliable financial news sources and consulting with a mortgage professional to discuss your individual needs and explore your options.

Keywords: Mortgage rates, interest rates, home buying, housing market, economy, inflation, Federal Reserve, refinancing, adjustable-rate mortgages, ARM, home affordability, economic growth, financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Uptick Sends Mortgage Rates Climbing. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ncaa Lacrosse Tournament Quarterfinals Where To Watch And Game Times

May 19, 2025

Ncaa Lacrosse Tournament Quarterfinals Where To Watch And Game Times

May 19, 2025 -

What Channel Is Tennessee Softball Playing Ohio State Today Game Time And Tv Schedule

May 19, 2025

What Channel Is Tennessee Softball Playing Ohio State Today Game Time And Tv Schedule

May 19, 2025 -

Man Dies During Brooklyn Half Marathon Race Halted By Medical Emergency

May 19, 2025

Man Dies During Brooklyn Half Marathon Race Halted By Medical Emergency

May 19, 2025 -

World Pride 2025 A Clash Of Cultures In Washington D C

May 19, 2025

World Pride 2025 A Clash Of Cultures In Washington D C

May 19, 2025 -

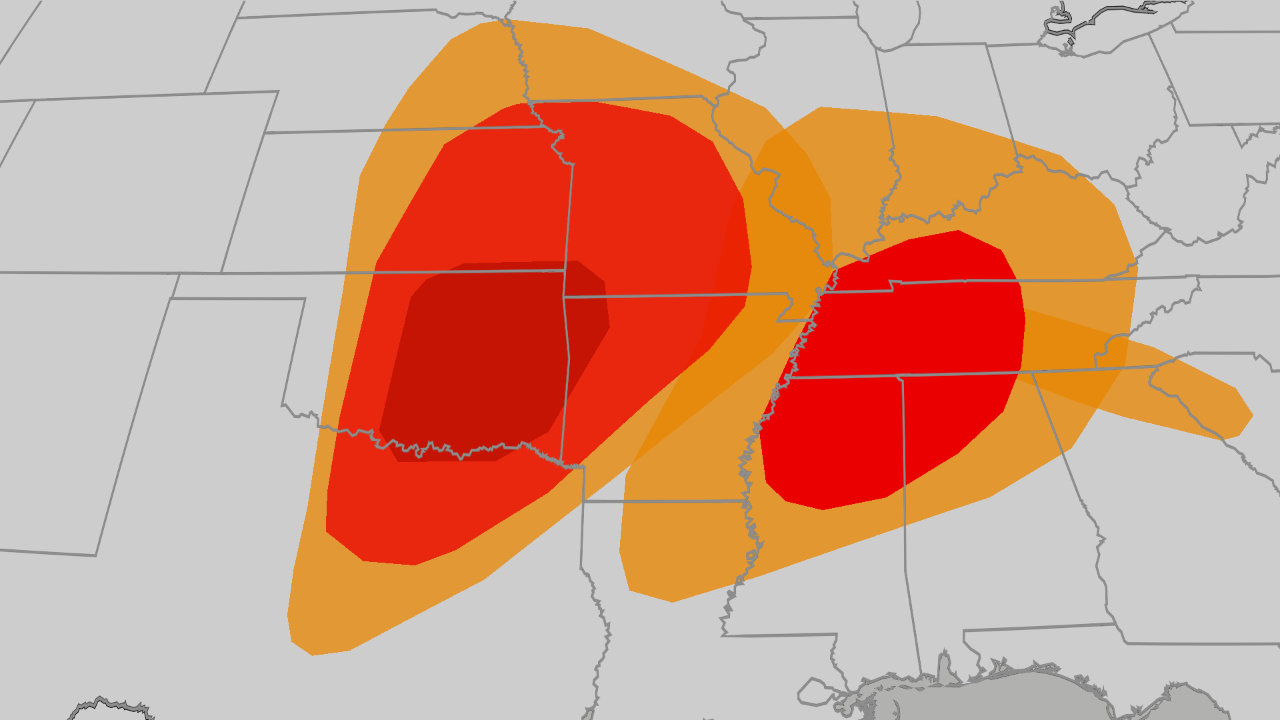

Major Tornado Threat Severe Weather Alert For Plains Midwest And Southern States

May 19, 2025

Major Tornado Threat Severe Weather Alert For Plains Midwest And Southern States

May 19, 2025