Economic Uptick Pushes Mortgage Rates Higher

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Uptick Pushes Mortgage Rates Higher: What Homebuyers Need to Know

The U.S. economy is showing signs of strength, leading to a ripple effect across various sectors, including the housing market. This positive economic momentum, while generally good news, is unfortunately pushing mortgage rates higher, creating challenges for prospective homebuyers. This rise isn't unexpected; it's a direct consequence of the Federal Reserve's actions to combat inflation and the overall improved economic outlook.

Understanding the Connection: Economic Growth and Mortgage Rates

The relationship between economic growth and mortgage rates is fairly straightforward. When the economy strengthens, investors generally become more confident, leading to increased demand for investments. This higher demand drives up interest rates across the board, including those for mortgages. The Federal Reserve's recent interest rate hikes, designed to curb inflation, are further exacerbating this effect. Essentially, a stronger economy often translates to higher borrowing costs.

Current Mortgage Rate Trends and Predictions

Mortgage rates have been steadily climbing in recent months. While the exact numbers fluctuate daily, we're seeing a significant increase compared to the historically low rates of the past few years. Several financial experts predict that rates will continue to climb, although the pace of the increase may slow. Staying informed about these fluctuations is crucial for anyone planning to buy a home. You can track daily mortgage rate updates on reputable financial websites like [link to reputable financial website - e.g., Freddie Mac].

What Does This Mean for Homebuyers?

The rise in mortgage rates has several implications for prospective homebuyers:

- Higher Monthly Payments: A higher interest rate means significantly higher monthly mortgage payments for the same loan amount. This can impact affordability and reduce the purchasing power of many buyers.

- Smaller Loan Amounts: To maintain affordable monthly payments, buyers may need to reduce the amount they borrow, potentially limiting their choice of homes.

- Increased Competition: Even with higher rates, demand for housing remains relatively strong in many areas. This increased competition can lead to bidding wars and potentially higher purchase prices.

Strategies for Navigating the Higher Rate Environment:

Despite the challenges, there are strategies homebuyers can employ:

- Improve Credit Score: A higher credit score can qualify you for better interest rates, potentially saving you thousands of dollars over the life of your loan.

- Increase Down Payment: A larger down payment can reduce the loan amount, leading to lower monthly payments.

- Shop Around for Mortgages: Compare rates and fees from multiple lenders to secure the best possible deal. Consider working with a mortgage broker who can access a wider range of lenders.

- Consider Adjustable-Rate Mortgages (ARMs): While riskier, ARMs might offer lower initial rates, but be aware of potential rate increases down the line.

Looking Ahead:

The future of mortgage rates remains uncertain, dependent on various economic factors. However, understanding the current trends and employing smart strategies can significantly improve a homebuyer's chances of navigating this challenging market. Staying informed and seeking professional advice from financial advisors and mortgage professionals is essential for making informed decisions. The key is to be proactive, plan carefully, and remain flexible in your approach.

Call to Action: Are you planning to buy a home soon? Consult with a financial advisor to discuss your options and create a personalized strategy for navigating the current mortgage rate environment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Uptick Pushes Mortgage Rates Higher. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ufl Week 8 In Depth Analysis And Picks For Defenders Vs Renegades

May 19, 2025

Ufl Week 8 In Depth Analysis And Picks For Defenders Vs Renegades

May 19, 2025 -

Pga Championship A Recap Of Moving Days Thrilling Action And Schefflers Lead

May 19, 2025

Pga Championship A Recap Of Moving Days Thrilling Action And Schefflers Lead

May 19, 2025 -

Ncaa Lacrosse Tournament Quarterfinals Where To Watch And Game Day Schedule

May 19, 2025

Ncaa Lacrosse Tournament Quarterfinals Where To Watch And Game Day Schedule

May 19, 2025 -

Injury Update Orioles Tyler O Neill Moved To 10 Day Il

May 19, 2025

Injury Update Orioles Tyler O Neill Moved To 10 Day Il

May 19, 2025 -

Will A Reality Show Decide U S Citizenship Dhs Weighs In

May 19, 2025

Will A Reality Show Decide U S Citizenship Dhs Weighs In

May 19, 2025

Latest Posts

-

Tariffs And Retail Trumps Eat The Tariffs Challenge To Walmart

May 19, 2025

Tariffs And Retail Trumps Eat The Tariffs Challenge To Walmart

May 19, 2025 -

Walmarts Tariff Warning Trumps Reaction And The Impact On Consumers

May 19, 2025

Walmarts Tariff Warning Trumps Reaction And The Impact On Consumers

May 19, 2025 -

Airbnb Faces Major Setback In Spain 65 000 Listings Removed

May 19, 2025

Airbnb Faces Major Setback In Spain 65 000 Listings Removed

May 19, 2025 -

206 Run Challenge For Lsg Marsh And Markram Dominate For Srh

May 19, 2025

206 Run Challenge For Lsg Marsh And Markram Dominate For Srh

May 19, 2025 -

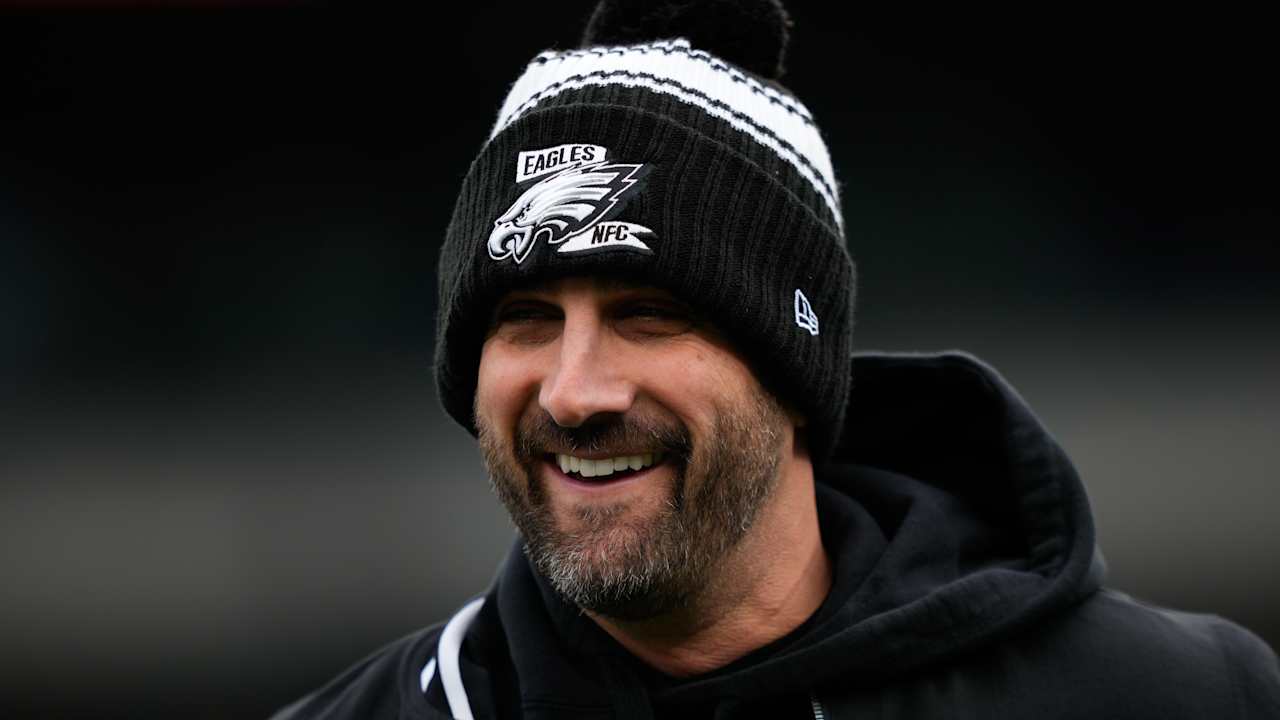

Nick Siriannis Contract Extension Eagles Head Coach Remains In Philadelphia

May 19, 2025

Nick Siriannis Contract Extension Eagles Head Coach Remains In Philadelphia

May 19, 2025