Economic Instability: Dimon's Focus For Trump's Team

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Instability: Dimon's Focus for Trump's Team

Jamie Dimon, CEO of JPMorgan Chase, is reportedly prioritizing warnings about economic instability to Donald Trump's team, emphasizing the potential for a recession and advocating for proactive measures. The ongoing discussions highlight the growing concerns among top financial leaders about the trajectory of the US economy and the potential consequences of inaction.

Dimon's concerns aren't new. He's been a vocal advocate for fiscal responsibility and has consistently warned about the risks associated with inflation, high interest rates, and geopolitical uncertainty. His direct engagement with Trump's advisors underscores the seriousness of the situation and the urgent need for a coordinated economic strategy.

What are Dimon's Key Concerns?

Dimon's warnings reportedly center on several key areas of economic vulnerability:

-

Inflationary Pressures: Persistently high inflation continues to erode purchasing power and fuel uncertainty in the market. The Federal Reserve's aggressive interest rate hikes, while aimed at curbing inflation, also carry the risk of triggering a recession. [Link to article about current inflation rates]

-

Geopolitical Instability: The ongoing war in Ukraine, tensions with China, and other global conflicts contribute to economic uncertainty and disrupt supply chains, further exacerbating inflationary pressures. [Link to article about geopolitical risks]

-

Debt Ceiling Negotiations: The ongoing debate surrounding the US debt ceiling adds another layer of complexity and uncertainty to the economic outlook. Failure to raise the debt ceiling could trigger a financial crisis with devastating consequences. [Link to article about debt ceiling negotiations]

-

Potential Recession: Many economists predict a recession in the near future, and Dimon's warnings echo these concerns. A recession would likely lead to job losses, decreased consumer spending, and a slowdown in economic growth.

Dimon's Proposed Solutions:

While the specifics of Dimon's recommendations remain largely undisclosed, his past statements and actions suggest a focus on:

-

Fiscal Responsibility: Dimon has consistently advocated for responsible government spending and a reduction in the national debt.

-

Targeted Government Intervention: Instead of broad-based stimulus packages, Dimon likely favors targeted interventions focused on addressing specific economic challenges.

-

Long-Term Economic Planning: He likely stresses the need for a long-term economic strategy that promotes sustainable growth and resilience in the face of unexpected shocks.

The Stakes are High:

The current economic climate is precarious. Dimon's direct engagement with Trump's team highlights the gravity of the situation and the need for decisive action. The potential consequences of inaction – a severe recession, increased unemployment, and social unrest – are significant. The coming months will be crucial in determining how the US government responds to these challenges and whether it can successfully navigate the turbulent economic waters ahead.

What's Next?

The details of the discussions between Dimon and Trump's team remain confidential. However, the fact that such high-level conversations are taking place underscores the urgency of the situation. It remains to be seen what specific policies the Trump team will adopt, but the warnings from Dimon and other leading economists serve as a stark reminder of the challenges facing the US economy. Keeping a close eye on economic indicators and policy developments will be critical in the coming months.

Call to Action: Stay informed about the evolving economic landscape by subscribing to our newsletter for regular updates and insightful analysis. [Link to Newsletter Signup]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Instability: Dimon's Focus For Trump's Team. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Minnesota Governor Walz Democrats Need To Be More Aggressive Condemns Trump

Jun 03, 2025

Minnesota Governor Walz Democrats Need To Be More Aggressive Condemns Trump

Jun 03, 2025 -

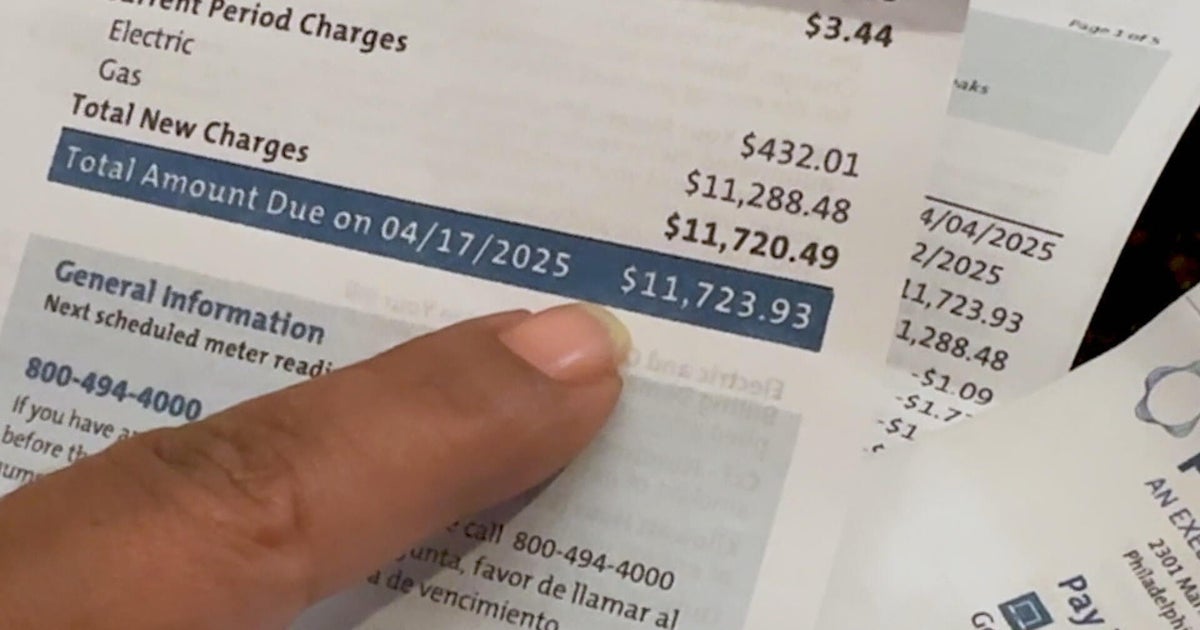

Peco Customers Face Billing Chaos Months Long Delays And Exorbitant Charges

Jun 03, 2025

Peco Customers Face Billing Chaos Months Long Delays And Exorbitant Charges

Jun 03, 2025 -

Taylor Jenkins Reids Path To Success A Study In Publishing

Jun 03, 2025

Taylor Jenkins Reids Path To Success A Study In Publishing

Jun 03, 2025 -

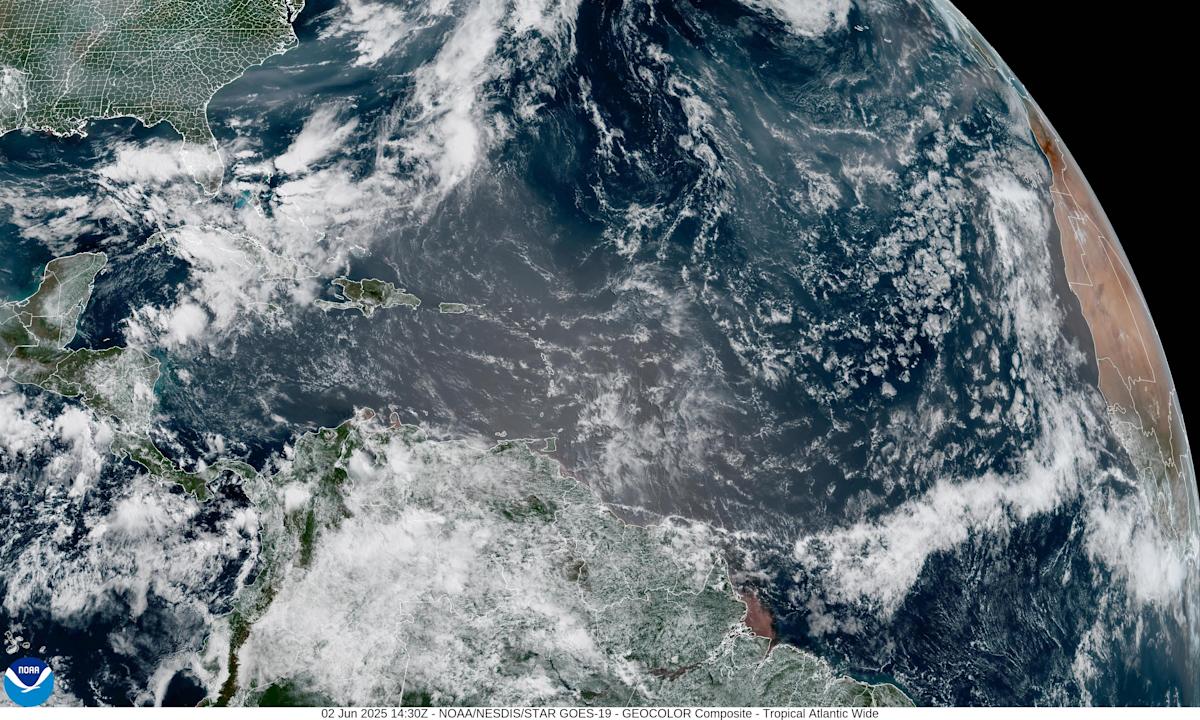

Impacts Of Saharan Dust And Canadian Wildfires On Florida

Jun 03, 2025

Impacts Of Saharan Dust And Canadian Wildfires On Florida

Jun 03, 2025 -

Nio Stock Dips Before Q1 Earnings Release Investment Analysis

Jun 03, 2025

Nio Stock Dips Before Q1 Earnings Release Investment Analysis

Jun 03, 2025