Economic Implications: Trump Administration's Decision To Reduce Tariffs On Chinese Goods

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Implications: Trump Administration's Decision to Reduce Tariffs on Chinese Goods

The Trump administration's decision to significantly reduce tariffs on Chinese goods, while seemingly a boon for consumers, carries complex and far-reaching economic implications. This move, while reversed and modified under subsequent administrations, continues to spark debate amongst economists and policymakers regarding its long-term effects on the US economy and its relationship with China. Understanding these impacts requires a nuanced look beyond the immediate price reductions at the checkout counter.

The Initial Impact: Lower Prices and Increased Consumer Spending?

The most immediate effect of tariff reductions was a decrease in the price of imported Chinese goods. This, in theory, should boost consumer spending and provide some relief to inflation. Many retailers touted lower prices on a range of products, from electronics to clothing. However, the extent to which consumers actually benefited remains a point of contention. Some argue that the savings were minimal, absorbed by retailers or manufacturers rather than passed directly to the end consumer.

Winners and Losers: A Sectoral Analysis

The impact wasn't uniform across sectors. While consumers potentially benefited from cheaper goods, American businesses competing with cheaper Chinese imports faced increased pressure. Industries like manufacturing and agriculture, already grappling with global competition, saw their struggles potentially exacerbated. The reduced tariffs, while benefiting some consumers, could have negatively affected domestic production and employment in certain sectors. This is a key debate point – did the benefits to consumers outweigh the potential harm to domestic industries?

Long-Term Economic Consequences: The Trade Deficit and Beyond

A significant concern surrounding tariff reductions is their potential impact on the US trade deficit with China. Lower tariffs could lead to an increase in imports from China, potentially widening the trade deficit. This could have long-term repercussions for the US dollar's value and overall economic stability. Furthermore, the impact on supply chains remains a complex issue. While reduced tariffs might make some goods cheaper in the short term, relying heavily on a single supplier (China) can create vulnerabilities in the event of future geopolitical tensions or disruptions.

Geopolitical Ramifications: Beyond Economics

The decision to adjust tariffs on Chinese goods was deeply intertwined with broader geopolitical strategies and the ongoing US-China trade war. The economic consequences are inextricably linked to the evolving political relationship between the two superpowers. The decision’s legacy continues to inform current trade negotiations and policies. Understanding the historical context is crucial to fully grasping the implications.

Further Research and Analysis:

The economic consequences of the Trump administration's tariff reductions on Chinese goods are still being debated and analyzed by economists. Further research is needed to fully understand the long-term impact on various sectors of the US economy and its global standing. Accessing reports from organizations like the Congressional Budget Office (CBO) and the Peterson Institute for International Economics can offer valuable insights into this ongoing discussion.

Call to Action: Stay informed about the latest developments in US-China trade relations and the evolving economic landscape. Understanding the intricacies of these policies is vital for making informed decisions about personal finances and supporting policies that benefit the overall economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Implications: Trump Administration's Decision To Reduce Tariffs On Chinese Goods. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trump Stands Firm On Accepting Luxury Jet From Qatar Dismissing Critics

May 15, 2025

Trump Stands Firm On Accepting Luxury Jet From Qatar Dismissing Critics

May 15, 2025 -

Manchester City Alvarez Recupera La Titularidad Y Brilla En El Sadar

May 15, 2025

Manchester City Alvarez Recupera La Titularidad Y Brilla En El Sadar

May 15, 2025 -

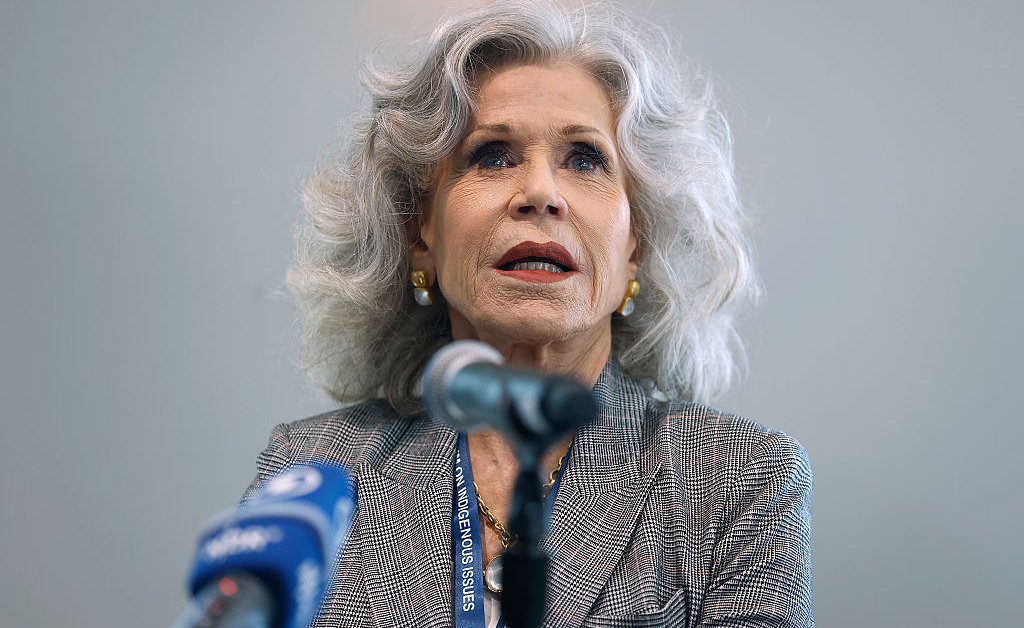

Jane Fondas Ecuador Rainforest Conservation Efforts

May 15, 2025

Jane Fondas Ecuador Rainforest Conservation Efforts

May 15, 2025 -

Marcelinos Selection Headache Four Injuries Complicate Leganes Match

May 15, 2025

Marcelinos Selection Headache Four Injuries Complicate Leganes Match

May 15, 2025 -

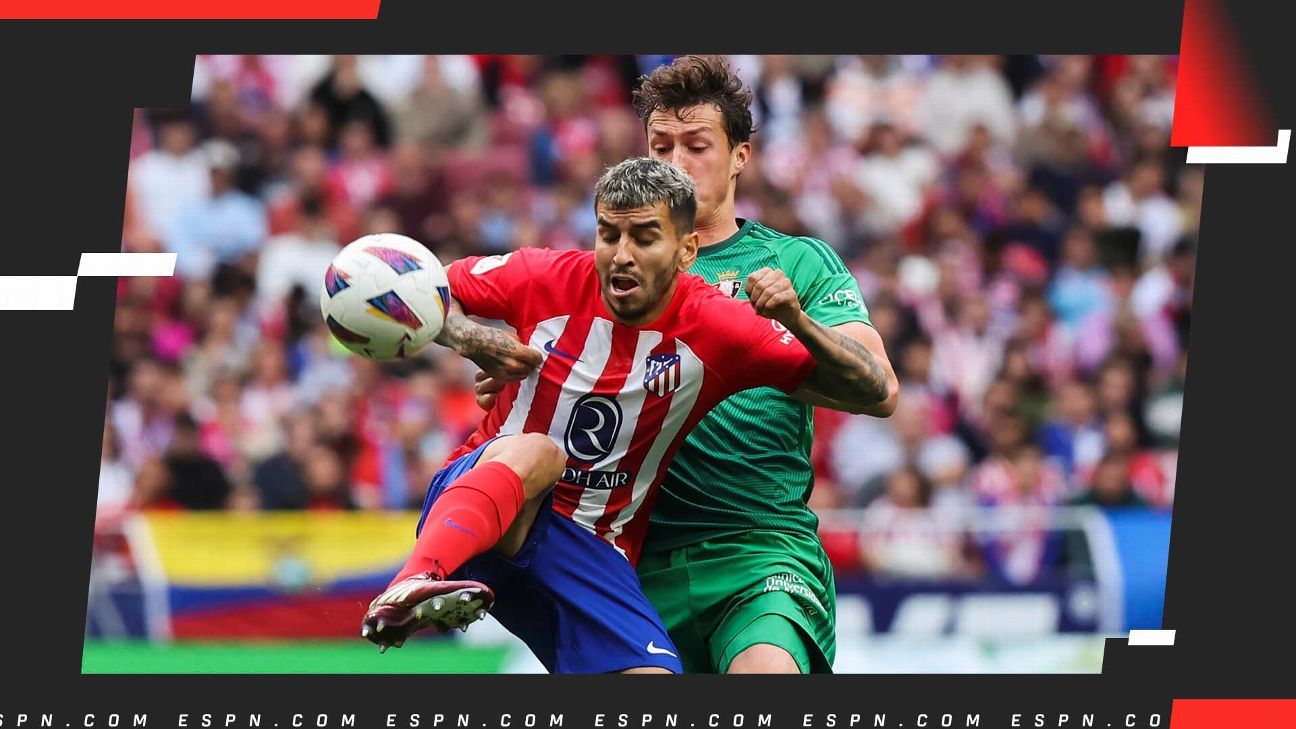

Atletico Madrid Busca La Victoria Ante Osasuna En La Liga Santander

May 15, 2025

Atletico Madrid Busca La Victoria Ante Osasuna En La Liga Santander

May 15, 2025