Economic Implications Of Clean Energy Tax Proposals In The US

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Implications of Clean Energy Tax Proposals in the US: A Balancing Act

The US is at a crossroads, grappling with the urgent need to transition to cleaner energy sources while simultaneously navigating complex economic considerations. Numerous proposed tax policies aim to accelerate this transition, but their economic implications are far-reaching and require careful analysis. This article delves into the potential economic impacts of these clean energy tax proposals, exploring both the benefits and drawbacks.

The Push for Clean Energy: A Necessary Transition

The urgency to combat climate change is undeniable, with the scientific consensus pointing towards the detrimental effects of greenhouse gas emissions. Clean energy sources, such as solar, wind, and geothermal power, offer a viable path towards reducing our carbon footprint. However, transitioning away from fossil fuels – a cornerstone of the US economy – presents significant economic challenges.

Current Clean Energy Tax Proposals: A Closer Look

Several tax proposals are currently under consideration in the US Congress, designed to incentivize clean energy adoption and discourage reliance on fossil fuels. These often involve:

- Tax Credits for Renewable Energy: These credits provide financial incentives for individuals and businesses to invest in renewable energy technologies like solar panels and wind turbines. The Investment Tax Credit (ITC) is a prime example, offering substantial reductions in tax liability. [Link to IRS information on ITC]

- Tax Deductions for Energy Efficiency Improvements: Tax deductions can encourage homeowners and businesses to upgrade their buildings with energy-efficient appliances, insulation, and other improvements. This reduces energy consumption and lowers utility bills.

- Carbon Pricing Mechanisms: Carbon taxes or cap-and-trade systems aim to internalize the environmental cost of carbon emissions, making polluting activities more expensive and incentivizing cleaner alternatives. This approach has generated considerable debate regarding its potential impact on inflation and competitiveness. [Link to an article discussing carbon pricing]

- Tax Breaks for Electric Vehicles (EVs): Tax credits for purchasing electric vehicles aim to accelerate the adoption of EVs, reducing reliance on gasoline-powered cars and lowering transportation emissions. However, questions remain regarding the equity of these tax breaks and their accessibility to lower-income consumers.

Potential Economic Benefits:

Proponents of these tax policies argue they will stimulate economic growth by:

- Creating Green Jobs: The clean energy sector is a significant job creator, offering employment opportunities in manufacturing, installation, maintenance, and research. [Link to a report on clean energy job growth]

- Boosting Technological Innovation: Tax incentives can encourage investment in research and development of new clean energy technologies, leading to breakthroughs and cost reductions.

- Improving Energy Security: Reducing reliance on imported fossil fuels enhances national energy security and reduces vulnerability to global price fluctuations.

- Attracting Foreign Investment: Countries committed to climate action are more likely to attract investment from businesses seeking to operate in a sustainable environment.

Potential Economic Drawbacks:

Critics raise concerns about potential negative economic consequences:

- Increased Energy Costs: Some argue that carbon pricing mechanisms or increased regulation could lead to higher energy prices for consumers and businesses.

- Job Losses in Fossil Fuel Industries: A rapid transition away from fossil fuels could lead to job losses in coal, oil, and gas industries, requiring retraining and economic diversification efforts.

- Impact on Competitiveness: Higher energy costs could make US businesses less competitive in the global marketplace compared to countries with less stringent environmental regulations.

- Distributional Effects: The benefits and costs of clean energy tax policies may not be evenly distributed across different income groups and geographical regions.

Finding the Right Balance:

The economic implications of clean energy tax proposals are multifaceted and require careful consideration. A successful transition to a clean energy economy necessitates a balanced approach that considers both environmental sustainability and economic viability. This includes:

- Targeted Support for Affected Workers: Retraining programs and economic diversification initiatives are crucial to mitigate job losses in the fossil fuel sector.

- Phased Implementation: A gradual implementation of clean energy policies can minimize economic disruption and allow for adaptation.

- Equitable Distribution of Benefits and Costs: Policies should be designed to ensure a fair distribution of benefits and costs across different income groups and regions.

- Investment in Infrastructure: Significant investment in grid modernization and other crucial infrastructure is essential to support the transition to a clean energy system.

The debate surrounding clean energy tax proposals in the US is complex and far from settled. However, understanding the potential economic benefits and drawbacks is essential for informed policymaking and ensuring a sustainable and prosperous future. Further research and public discourse are needed to find the optimal balance between environmental protection and economic growth.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Implications Of Clean Energy Tax Proposals In The US. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

How Recent Economic News Is Affecting Mortgage Rates

May 19, 2025

How Recent Economic News Is Affecting Mortgage Rates

May 19, 2025 -

Four West Ham Players Face Uncertain Future After Forest Match Poor Ratings

May 19, 2025

Four West Ham Players Face Uncertain Future After Forest Match Poor Ratings

May 19, 2025 -

What The Rules Say Cleaning Mud From Your Game Ball

May 19, 2025

What The Rules Say Cleaning Mud From Your Game Ball

May 19, 2025 -

Ufl Week 8 Renegades Vs Defenders Full Game Recap And Highlights

May 19, 2025

Ufl Week 8 Renegades Vs Defenders Full Game Recap And Highlights

May 19, 2025 -

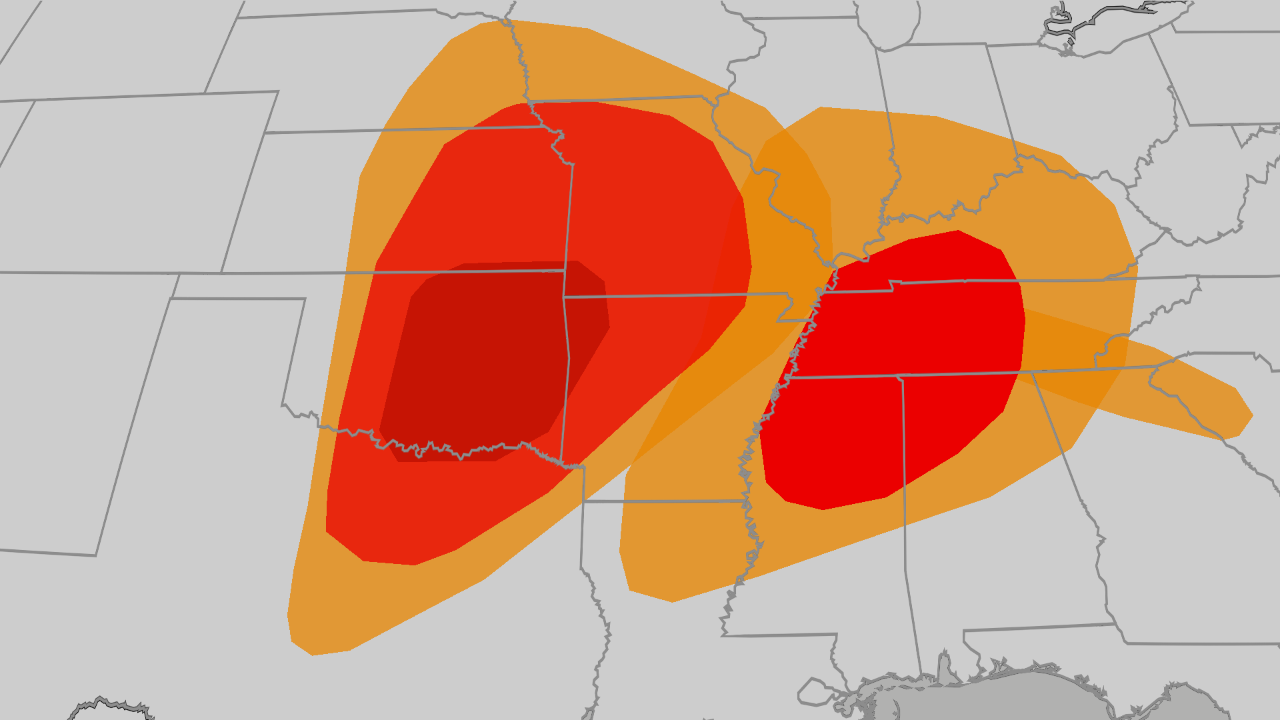

Plains Midwest And South Face Severe Weather High Tornado Risk

May 19, 2025

Plains Midwest And South Face Severe Weather High Tornado Risk

May 19, 2025