Economic Growth Spurs Rise In Mortgage Interest Rates

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Growth Spurs Rise in Mortgage Interest Rates: What Homebuyers Need to Know

The U.S. economy is humming, with strong job growth and rising consumer spending. While this is generally good news, it's also pushing up mortgage interest rates, creating a new challenge for prospective homebuyers. This surge is impacting affordability and making it a more competitive market for those seeking to purchase a home. Understanding this trend is crucial for anyone navigating the current housing market.

The Connection Between Economic Growth and Mortgage Rates:

The relationship between economic growth and interest rates is complex but fundamentally linked. Strong economic indicators often lead the Federal Reserve (the Fed) to raise interest rates to combat inflation. This is because a booming economy can lead to increased demand and potentially higher prices, a phenomenon known as inflation. By raising interest rates, the Fed aims to cool down the economy and keep inflation in check. Mortgage rates, closely tied to the overall economy, follow suit. This means that a period of robust economic growth, like the one we're currently experiencing, tends to translate to higher mortgage rates.

How Rising Rates Impact Homebuyers:

Higher mortgage interest rates directly impact the affordability of homes. A seemingly small increase in the interest rate can significantly increase the monthly mortgage payment and the overall cost of the loan over its lifetime. This means that potential homebuyers may need to:

- Adjust their budget: They may need to lower their price range or consider homes in less expensive areas.

- Increase their down payment: A larger down payment can help lower the overall loan amount and thus the monthly payments.

- Seek creative financing options: Exploring options like adjustable-rate mortgages (ARMs) or FHA loans might be necessary. However, it's crucial to understand the potential risks involved with each option.

What the Future Holds for Mortgage Rates:

Predicting future mortgage rates is always challenging, as they are influenced by various economic factors, including inflation, unemployment, and overall economic growth. However, experts predict that rates are likely to remain elevated in the near term. Keeping a close eye on economic indicators and consulting with a mortgage professional is key to making informed decisions.

Tips for Navigating the Current Market:

- Get pre-approved for a mortgage: Knowing your budget beforehand gives you a significant advantage in a competitive market.

- Work with a real estate agent: A knowledgeable agent can provide valuable insights into market trends and help you find the right property within your budget.

- Improve your credit score: A higher credit score will qualify you for better interest rates.

- Shop around for mortgages: Compare rates and fees from different lenders to secure the best possible deal. Don't hesitate to leverage online mortgage comparison tools to streamline this process.

Conclusion:

The current economic growth, while positive overall, is presenting challenges for prospective homebuyers facing rising mortgage interest rates. By understanding the connection between economic factors and mortgage rates, and by taking proactive steps, potential homebuyers can navigate this challenging market and achieve their homeownership goals. Remember to consult with financial advisors and real estate professionals to make the best decisions for your individual circumstances. Stay informed about economic trends and be prepared to adapt your strategy as needed.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Growth Spurs Rise In Mortgage Interest Rates. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ball With Mud Understanding The Rules For Cleaning

May 19, 2025

Ball With Mud Understanding The Rules For Cleaning

May 19, 2025 -

Leading Golfers Face Adversity Bumpy Start At Pga Tournament

May 19, 2025

Leading Golfers Face Adversity Bumpy Start At Pga Tournament

May 19, 2025 -

Dismal Ratings Four West Ham Players Show They Have No Future Against Forest

May 19, 2025

Dismal Ratings Four West Ham Players Show They Have No Future Against Forest

May 19, 2025 -

West Hams Forest Loss Highlights Four Players Potential Departures Rating Analysis

May 19, 2025

West Hams Forest Loss Highlights Four Players Potential Departures Rating Analysis

May 19, 2025 -

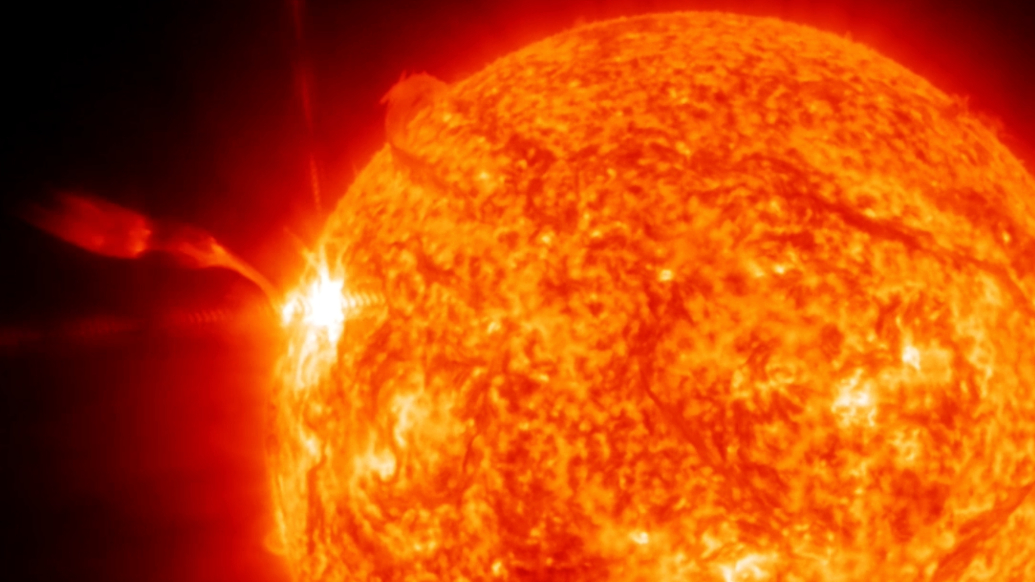

Geomagnetic Storm Major Solar Flare Triggers Radio Blackouts Globally

May 19, 2025

Geomagnetic Storm Major Solar Flare Triggers Radio Blackouts Globally

May 19, 2025