Economic Calendar: Tracking Key Asian Economic Indicators (June 2, 2025)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Calendar: Tracking Key Asian Economic Indicators (June 2, 2025)

Asia's economic pulse is strong, but monitoring key indicators is crucial for investors and businesses alike. June 2nd, 2025, marks a pivotal point for understanding the Asian economic landscape. Several key indicators will be released, offering valuable insights into the region's growth trajectory and potential challenges. This article provides a comprehensive overview of these crucial data points and their significance.

The Asian economic sphere, encompassing powerhouses like China, Japan, South Korea, and India, significantly impacts global markets. Understanding the trends within this region is vital for informed decision-making. This economic calendar highlights the major releases expected on June 2nd, 2025, and their potential impact.

Key Asian Economic Indicators for June 2nd, 2025 (Illustrative Examples):

While the precise release schedule varies yearly, we can anticipate data releases similar to those outlined below. Remember to always consult reputable financial news sources for the most up-to-date information.

-

China's Manufacturing PMI (Purchasing Managers' Index): This indicator provides a snapshot of the health of China's manufacturing sector. A reading above 50 signals expansion, while a reading below 50 suggests contraction. Any significant deviation from expectations will likely send ripples through global markets. Historically, a weakening PMI in China has led to concerns about global supply chain disruptions and decreased demand for commodities.

-

Japan's Unemployment Rate: Japan's unemployment figures offer insights into the strength of its labor market. A consistently low unemployment rate typically suggests a healthy economy. However, persistent low unemployment could also indicate potential inflationary pressures.

-

India's GDP Growth Rate (Preliminary Estimate): India's economic growth is a significant driver of global economic activity. The preliminary estimate for the GDP growth rate will be closely watched, offering a glimpse into the performance of this rapidly expanding economy. Strong GDP growth in India is generally positive news for global markets.

-

South Korea's Export Figures: South Korea's export figures are a key barometer for global trade. Strong export numbers indicate robust global demand, while weak figures suggest potential slowdown. These figures are particularly sensitive to global technological trends and geopolitical factors.

Understanding the Significance of These Indicators:

These economic indicators are not isolated events; they interact and influence each other. For instance, a slowdown in Chinese manufacturing could impact South Korean exports, leading to wider economic consequences. Analyzing these indicators in conjunction provides a more holistic view of the Asian economic landscape.

Where to Find Reliable Data:

Reliable sources for tracking these key Asian economic indicators include:

- Trading Economics: [Link to Trading Economics]

- Bloomberg: [Link to Bloomberg]

- Reuters: [Link to Reuters]

- National Statistical Offices: Each country maintains its own national statistical office which provides official data.

Conclusion:

The Asian economic calendar for June 2nd, 2025, (and indeed, throughout the year) provides valuable insights for investors, businesses, and policymakers. By carefully monitoring these key indicators, stakeholders can better understand the economic trends shaping this crucial region and make informed decisions. Stay informed, stay ahead. Remember to always consult multiple sources to gain a well-rounded perspective.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Calendar: Tracking Key Asian Economic Indicators (June 2, 2025). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

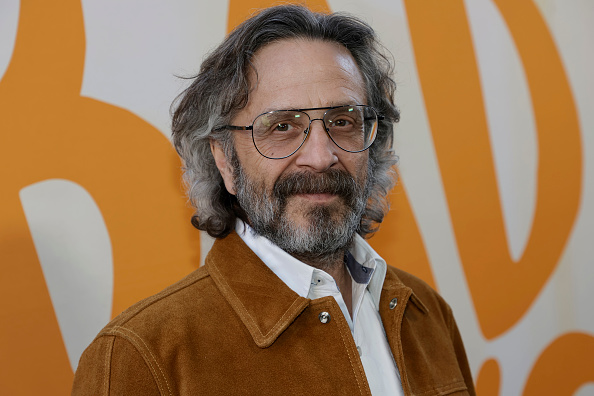

16 Years Of Wtf Marc Marons Podcast Coming To An End

Jun 03, 2025

16 Years Of Wtf Marc Marons Podcast Coming To An End

Jun 03, 2025 -

South Loop Development Chicago Fire Eye 650 Million Soccer Stadium At The 78

Jun 03, 2025

South Loop Development Chicago Fire Eye 650 Million Soccer Stadium At The 78

Jun 03, 2025 -

The Impact Of Climate Change On Summertime Insect Life Cycles

Jun 03, 2025

The Impact Of Climate Change On Summertime Insect Life Cycles

Jun 03, 2025 -

Chinese Ev Maker Nio Previews Q1 Results Delivery Growth In Focus

Jun 03, 2025

Chinese Ev Maker Nio Previews Q1 Results Delivery Growth In Focus

Jun 03, 2025 -

North Texas Murder Case Solved Suspect Arrested Following Extensive Search

Jun 03, 2025

North Texas Murder Case Solved Suspect Arrested Following Extensive Search

Jun 03, 2025