Economic Calendar Highlights: Asia On Monday, June 2, 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Economic Calendar Highlights: Asia's Key Events on Monday, June 2nd, 2025

Monday, June 2nd, 2025, promises a busy start to the week for Asian markets, with several key economic indicators set to be released. Investors and traders will be keenly watching these data points for clues about the region's economic health and potential shifts in monetary policy. This article highlights the most significant events and their potential market impacts.

Japan: Manufacturing PMI Takes Center Stage

The standout event for Monday will be the release of Japan's Manufacturing Purchasing Managers' Index (PMI) for May 2025. This leading indicator provides insights into the health of the Japanese manufacturing sector, a cornerstone of the country's economy. A strong PMI reading above 50 would signal expansion in the sector, potentially boosting the Yen and Japanese equities. Conversely, a weak reading could trigger concerns about slowing growth and put downward pressure on the currency. Analysts will be closely scrutinizing the details within the report, looking for clues about production levels, new orders, and employment trends. Remember to check reputable financial news sources like the Financial Times or Bloomberg for the official release and subsequent analysis.

China: Caixin Manufacturing PMI – A Private Sector View

While official Chinese PMI data was released earlier in the week, the Caixin Manufacturing PMI, focusing on the private sector, provides a crucial alternative perspective. This index can often differ from the official figures, offering a more nuanced view of the manufacturing landscape. Any significant divergence between the official and Caixin PMIs could spark debate amongst analysts about the true state of the Chinese economy. Keep an eye out for potential volatility in the Chinese markets following this release. Understanding the subtleties of these reports requires staying informed on recent economic developments within China. [Link to an article about recent Chinese economic news - this would be an internal link if part of a larger website].

Australia: Building Approvals – A Housing Market Indicator

Australia's building approvals data for April 2025 will provide valuable insights into the country's housing market. This metric reflects the number of new residential construction projects approved, acting as an indicator of future building activity. Strong building approvals data typically suggests a healthy housing market and can boost investor confidence. Conversely, a decline could signal concerns about the overall economic climate. The Reserve Bank of Australia (RBA) closely monitors this data when making decisions about interest rates. [Link to RBA website - external link].

South Korea: Industrial Production – Gauging Manufacturing Strength

South Korea's industrial production figures for April 2025 will offer further insights into the Asian manufacturing sector's overall performance. As a major exporter, South Korea’s industrial production is closely tied to global demand. This data point will be closely analyzed for any signs of weakening or strengthening in the global economy and its effect on South Korean growth.

Navigating the Market:

Understanding the nuances of these economic releases requires careful consideration of various factors. It's crucial to remember that these indicators provide snapshots in time and should be interpreted within the broader context of global economic trends and geopolitical events.

Disclaimer: This article provides general information and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Keywords: Economic Calendar, Asia, June 2, 2025, Japan, PMI, China, Caixin PMI, Australia, Building Approvals, South Korea, Industrial Production, Manufacturing, Economy, Market Analysis, Investment, Trading, Yen, Currency, Economic Indicators.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Economic Calendar Highlights: Asia On Monday, June 2, 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Arrest Made In North Texas Murder End Of Extensive Manhunt Announced

Jun 03, 2025

Arrest Made In North Texas Murder End Of Extensive Manhunt Announced

Jun 03, 2025 -

Shifting Summertime Bugs Climate Changes Influence

Jun 03, 2025

Shifting Summertime Bugs Climate Changes Influence

Jun 03, 2025 -

Bondis Actions Reduce American Bar Associations Involvement In Trumps Judicial Appointments

Jun 03, 2025

Bondis Actions Reduce American Bar Associations Involvement In Trumps Judicial Appointments

Jun 03, 2025 -

Trump Judicial Nominees Abas Influence Curtailed Under Bondi

Jun 03, 2025

Trump Judicial Nominees Abas Influence Curtailed Under Bondi

Jun 03, 2025 -

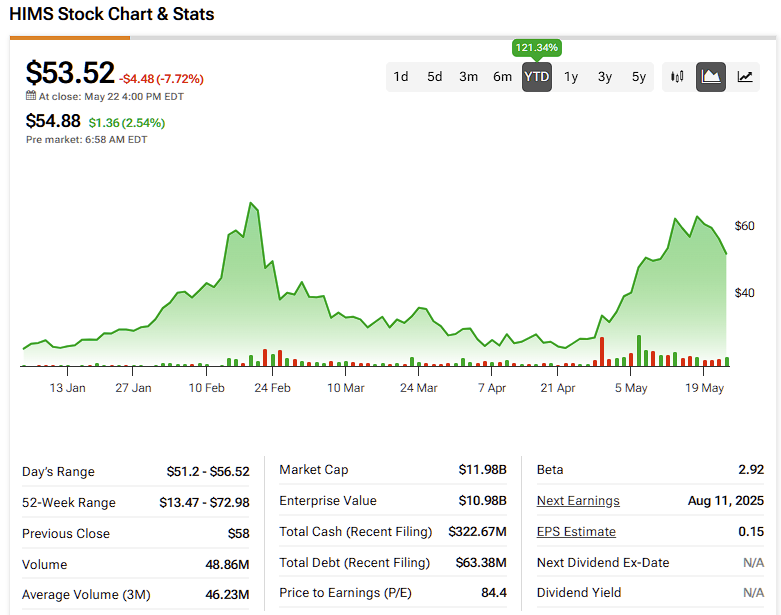

The Volatility Of Hims And Hers Hims Understanding The Stocks Price Fluctuations

Jun 03, 2025

The Volatility Of Hims And Hers Hims Understanding The Stocks Price Fluctuations

Jun 03, 2025