Don't Miss Out: Claiming Your Federal Clean Energy Tax Credits Before They Expire

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Don't Miss Out: Claiming Your Federal Clean Energy Tax Credits Before They Expire

Are you looking to reduce your carbon footprint and save money? The federal government offers substantial tax credits for clean energy investments, but these valuable incentives won't last forever. Many credits are set to expire or see significant reductions in the near future, making now the crucial time to act. Don't let thousands of dollars in potential savings slip away – learn how to claim your clean energy tax credits before it's too late.

Understanding the Urgency: Expiring Tax Credits and Their Impact

Several crucial clean energy tax credits are facing deadlines or modifications, creating a sense of urgency for homeowners and businesses alike. These credits incentivize the adoption of renewable energy technologies and energy-efficient upgrades, helping to accelerate the transition to a cleaner energy future. Missing out on these credits means missing out on significant financial benefits.

Key Clean Energy Tax Credits to Claim Now:

-

Residential Clean Energy Credit (RCE): This credit offers a significant tax break for homeowners who invest in renewable energy systems like solar panels, wind turbines, and fuel cells. While currently generous, the future of this credit's structure and rate remains uncertain, making immediate action advisable. Learn more about the . (Note: Link to a reputable government source)

-

Energy Efficient Home Improvement Credit: This credit helps cover the cost of making energy-efficient upgrades to your home, including insulation, windows, and doors. The credit offers a percentage of qualified expenses, providing a valuable incentive to improve your home's energy efficiency and reduce utility bills. Consult the for detailed information and eligibility requirements. (Note: Link to a reputable government source)

-

Commercial Clean Energy Tax Credits: Businesses can also benefit from various tax credits for investing in clean energy technologies and improvements. These credits can significantly reduce the cost of upgrading to more sustainable operations. Contact a qualified tax professional to explore the options available to your business.

How to Claim Your Tax Credits: A Step-by-Step Guide

Claiming your clean energy tax credits typically involves these steps:

-

Gather Documentation: Keep thorough records of all expenses related to your clean energy investments, including invoices, receipts, and any other supporting documentation.

-

Choose the Right Form: Depending on the specific credit you're claiming, you'll need to use the appropriate IRS tax form. Consult a tax professional or the IRS website for guidance.

-

File Your Taxes: Include the completed tax form and supporting documentation with your tax return.

-

Seek Professional Advice: Consider consulting a tax professional, especially for complex situations or if you are unsure about your eligibility for specific credits. They can help navigate the process and ensure you maximize your tax savings.

Don't Delay: Act Now to Secure Your Savings!

The window of opportunity to claim these valuable clean energy tax credits is closing. Don't wait until it's too late. Take action today to explore your eligibility and begin the process of claiming your credits. Your wallet and the environment will thank you.

Call to Action: Contact a qualified tax advisor or visit the IRS website for detailed information and to determine your eligibility for clean energy tax credits. Time is of the essence!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Don't Miss Out: Claiming Your Federal Clean Energy Tax Credits Before They Expire. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Intense Nl West Rivalry Dodgers And Padres Tied Atop Mlb Power Rankings

Aug 27, 2025

Intense Nl West Rivalry Dodgers And Padres Tied Atop Mlb Power Rankings

Aug 27, 2025 -

Velocity Drop Sidelines Dodgers Costly Offseason Addition From October Play

Aug 27, 2025

Velocity Drop Sidelines Dodgers Costly Offseason Addition From October Play

Aug 27, 2025 -

Six Month Suspension For Rhode Island Prosecutor After Arrest In Newport

Aug 27, 2025

Six Month Suspension For Rhode Island Prosecutor After Arrest In Newport

Aug 27, 2025 -

Ai And The Future Moving Beyond Zero Sum Games

Aug 27, 2025

Ai And The Future Moving Beyond Zero Sum Games

Aug 27, 2025 -

From Sorry To This Man To Viral Gold Keke Palmers Best Meme Moments

Aug 27, 2025

From Sorry To This Man To Viral Gold Keke Palmers Best Meme Moments

Aug 27, 2025

Latest Posts

-

Watch Son Heung Min Throws Ceremonial First Pitch At Los Angeles Dodgers Game

Aug 28, 2025

Watch Son Heung Min Throws Ceremonial First Pitch At Los Angeles Dodgers Game

Aug 28, 2025 -

Low Rise Trend Returns Zoe Kravitz Rocks The Ultra Low Skirt

Aug 28, 2025

Low Rise Trend Returns Zoe Kravitz Rocks The Ultra Low Skirt

Aug 28, 2025 -

Experience Report Cathay Pacifics Aria Suite

Aug 28, 2025

Experience Report Cathay Pacifics Aria Suite

Aug 28, 2025 -

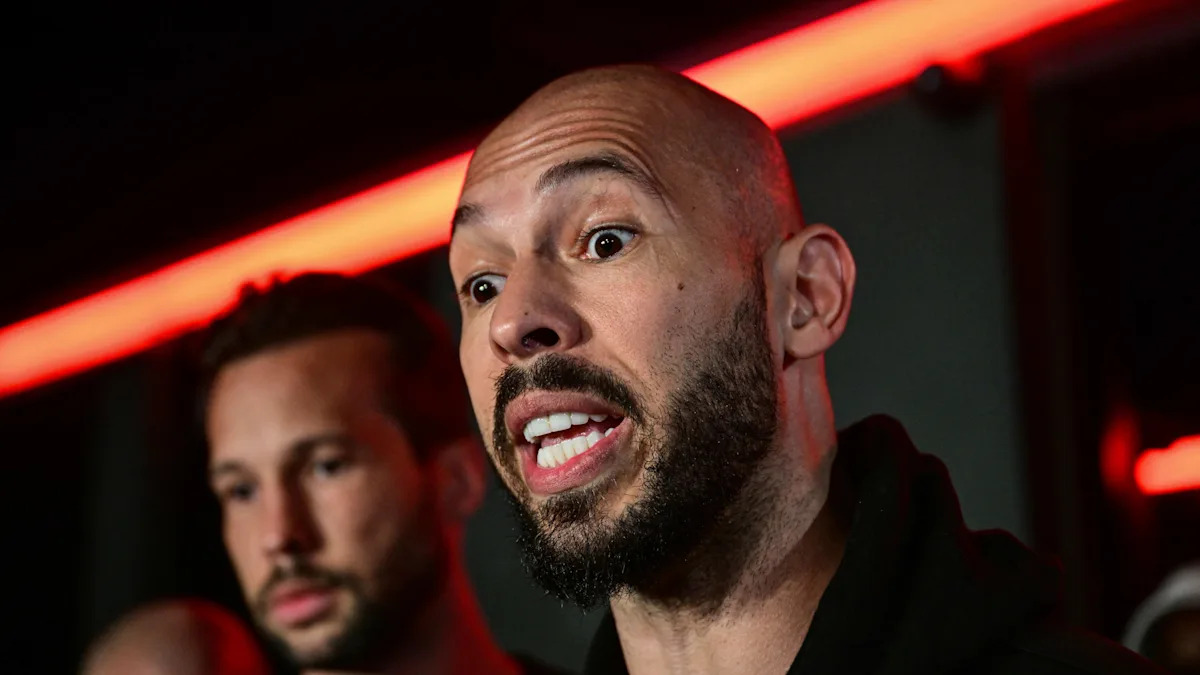

Andrew Tate In Advanced Negotiations For Misfits Boxing Match Amidst Charges

Aug 28, 2025

Andrew Tate In Advanced Negotiations For Misfits Boxing Match Amidst Charges

Aug 28, 2025 -

Violent Chaotic Enjoyable A Review Of Darren Aronofskys Caught Stealing

Aug 28, 2025

Violent Chaotic Enjoyable A Review Of Darren Aronofskys Caught Stealing

Aug 28, 2025