Don't Miss Out: Claim Your Federal Clean Energy Tax Credits Now

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

<h1>Don't Miss Out: Claim Your Federal Clean Energy Tax Credits Now</h1>

Are you ready to save money and help the planet? The federal government offers significant tax credits for clean energy upgrades, but time is running out! Don't miss this opportunity to reduce your tax burden while investing in a sustainable future. This guide breaks down everything you need to know to claim your clean energy tax credits before it's too late.

What Clean Energy Tax Credits Are Available?

Several federal tax credits incentivize homeowners and businesses to adopt clean energy solutions. These credits can significantly reduce the upfront cost of installing:

-

Solar Panels: The Residential Clean Energy Credit offers a tax credit equal to 30% of the cost of new solar electric panel installations. This includes solar water heaters and other solar energy systems. This credit is particularly generous and a major driver for solar adoption across the US.

-

Wind Turbines: Similar to solar, wind turbines qualify for the Residential Clean Energy Credit, providing a substantial incentive for homeowners interested in harnessing wind energy.

-

Energy-Efficient Home Improvements: The Energy Efficient Home Improvement Credit offers tax credits for certain energy-efficient upgrades, including insulation, exterior doors, and windows. This credit can help make your home more comfortable and reduce your energy bills.

-

Fuel Cell Technology: Tax credits are also available for fuel cell property, offering further incentives for exploring alternative energy sources.

It's crucial to check the specific requirements and limitations for each credit, as eligibility criteria can vary. The IRS website ([insert IRS website link here]) provides detailed information on all available clean energy tax credits.

How to Claim Your Tax Credits

The process of claiming these credits involves careful documentation and adherence to IRS guidelines. Here's a step-by-step guide:

-

Keep Detailed Records: Maintain meticulous records of all expenses related to your clean energy investments. This includes invoices, receipts, and any other relevant documentation.

-

File Form 5695: You will need to use IRS Form 5695, Residential Energy Credits, to claim your credits. This form requires detailed information about your eligible expenses.

-

Consult a Tax Professional: Navigating the intricacies of tax credits can be complex. Consulting with a qualified tax professional can ensure you claim all eligible credits accurately and avoid potential errors.

Don't Delay – Act Now!

These tax credits are a limited-time opportunity to significantly reduce the cost of transitioning to clean energy. The availability and specifics of these credits can change, so it's crucial to act quickly. Don't wait until the last minute – contact a qualified installer and start planning your clean energy upgrade today. Your wallet and the environment will thank you!

Call to Action: Research available incentives in your state and begin planning your clean energy upgrade today. Visit [Insert link to a relevant resource, such as EnergySage or the Database of State Incentives for Renewables & Efficiency (DSIRE)] to learn more.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Don't Miss Out: Claim Your Federal Clean Energy Tax Credits Now. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

California High Speed Rail Loses 175 Million In Trump Era Funding Cut

Aug 27, 2025

California High Speed Rail Loses 175 Million In Trump Era Funding Cut

Aug 27, 2025 -

175 Million Funding Cut Trump Administration Targets California High Speed Rail Again

Aug 27, 2025

175 Million Funding Cut Trump Administration Targets California High Speed Rail Again

Aug 27, 2025 -

Dodgers Costly Offseason Signing 6 M Pitcher Ruled Out For October Playoffs

Aug 27, 2025

Dodgers Costly Offseason Signing 6 M Pitcher Ruled Out For October Playoffs

Aug 27, 2025 -

Beyond Texas And California The States Exploring Redistricting Now

Aug 27, 2025

Beyond Texas And California The States Exploring Redistricting Now

Aug 27, 2025 -

Dodgers Sasaki Battles Mental And Physical Hurdles In Postseason Push

Aug 27, 2025

Dodgers Sasaki Battles Mental And Physical Hurdles In Postseason Push

Aug 27, 2025

Latest Posts

-

Examining Uscs 2025 Depth Chart Early Predictions And Potential Surprises

Aug 28, 2025

Examining Uscs 2025 Depth Chart Early Predictions And Potential Surprises

Aug 28, 2025 -

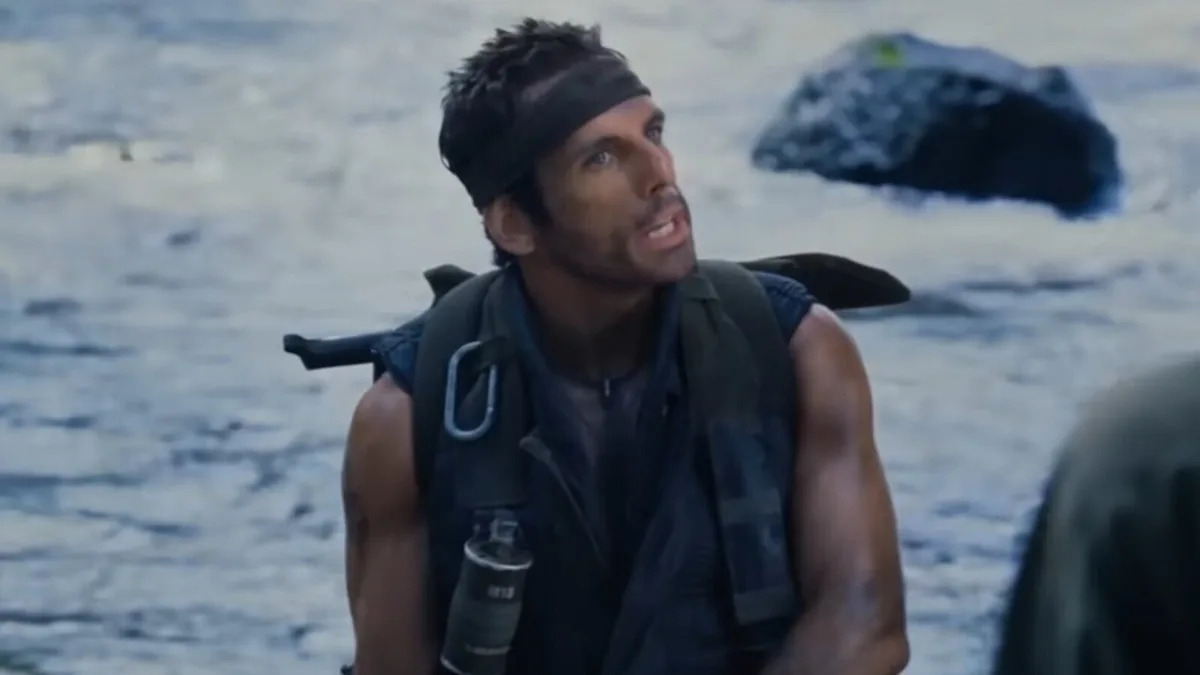

Ben Stiller Explains Tropic Thunder A Commentary On Actor Seriousness In War Films

Aug 28, 2025

Ben Stiller Explains Tropic Thunder A Commentary On Actor Seriousness In War Films

Aug 28, 2025 -

Inter Miami And Seattle Sounders To Battle In Leagues Cup 2025 Final

Aug 28, 2025

Inter Miami And Seattle Sounders To Battle In Leagues Cup 2025 Final

Aug 28, 2025 -

Sons Impact On Family Businesses Success And Challenges

Aug 28, 2025

Sons Impact On Family Businesses Success And Challenges

Aug 28, 2025 -

Ben Stiller On Tropic Thunder Controversy Comedy And The 17 Year Retrospective

Aug 28, 2025

Ben Stiller On Tropic Thunder Controversy Comedy And The 17 Year Retrospective

Aug 28, 2025