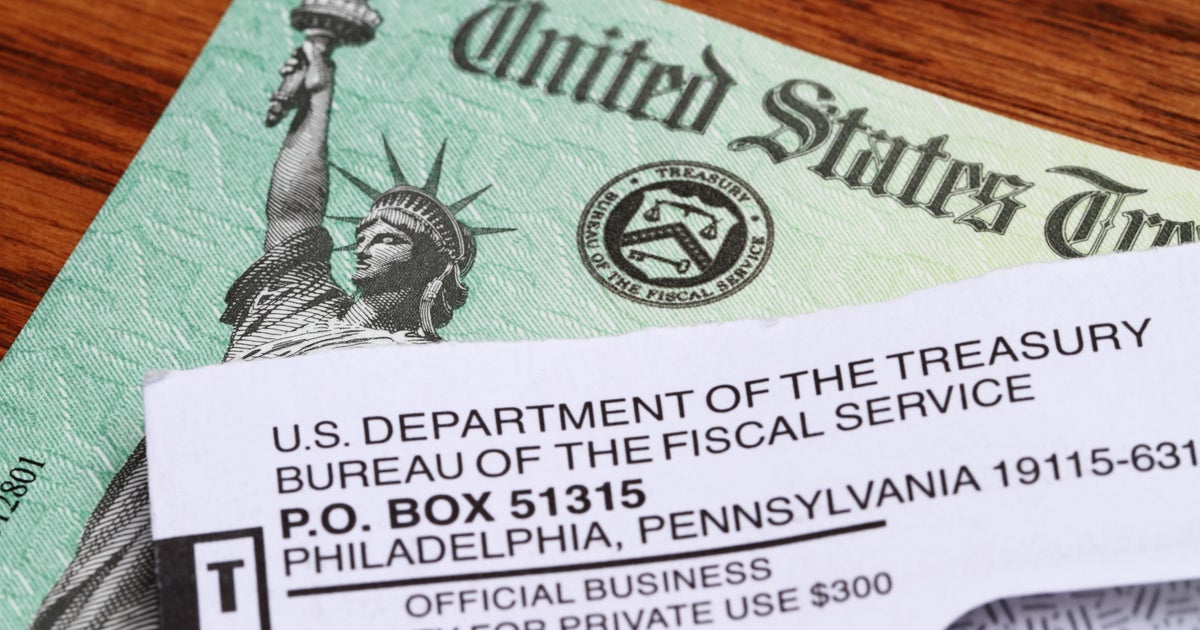

Does The Inflation Reduction Act Eliminate Social Security Taxes?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Does the Inflation Reduction Act Eliminate Social Security Taxes? No, But It Does Impact Some Seniors.

The Inflation Reduction Act (IRA) has sparked considerable debate and discussion since its passage. One common misconception circulating online is that it eliminates Social Security taxes. This is false. The IRA does not eliminate Social Security taxes for anyone. However, it does include provisions that indirectly affect some Social Security recipients, particularly those with higher incomes. Let's break down the facts and clarify any confusion.

What the Inflation Reduction Act Actually Does:

The IRA focuses primarily on climate change initiatives, healthcare reforms, and deficit reduction. While it doesn't touch the Social Security tax itself (the 6.2% tax paid by employees and the matching 6.2% paid by employers), it does impact some aspects of senior healthcare and prescription drug costs. These indirect effects might lead to some individuals feeling a slight financial benefit, but it's not a direct elimination of Social Security taxes.

Understanding Social Security Taxes:

Before delving further, it's crucial to understand what Social Security taxes are. These taxes fund the Social Security retirement, disability, and survivor benefits system. The tax applies to earnings up to a specific annual limit (the Social Security wage base), which is adjusted yearly. The IRA makes no changes to this fundamental aspect of the Social Security system.

How the IRA Indirectly Affects Some Seniors:

The IRA's impact on seniors is primarily felt through its provisions on:

-

Prescription Drug Costs: The IRA caps out-of-pocket prescription drug costs for Medicare beneficiaries at $2,000 per year. This could significantly reduce healthcare expenses for many seniors, indirectly freeing up some money that might otherwise have been spent on medication. This is a considerable benefit, but it's not the same as eliminating Social Security taxes.

-

Medicare Premiums: While not directly impacting Social Security taxes, the IRA's effect on healthcare costs could influence the amount some seniors pay for Medicare premiums. Lower healthcare expenses overall might reduce the strain on individuals' budgets.

Key Takeaway: No Social Security Tax Elimination

It's crucial to reiterate: the Inflation Reduction Act does not eliminate Social Security taxes. Any claims suggesting otherwise are inaccurate. The act focuses on broader healthcare and environmental issues, leading to indirect benefits for some seniors, but it doesn't alter the core mechanics of Social Security taxation.

Further Information and Resources:

For more detailed information on the Inflation Reduction Act, visit the official website of the . You can also find comprehensive information about Social Security taxes and benefits on the official website of the .

Call to Action: Stay informed about important legislative changes that affect your finances. Understanding the nuances of legislation like the IRA is key to making informed financial decisions. Regularly consult reliable sources for updates on Social Security and other relevant government programs.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Does The Inflation Reduction Act Eliminate Social Security Taxes?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

College Football 26 Ultimate Team And Head To Head Mode Updates From Ea

Jul 07, 2025

College Football 26 Ultimate Team And Head To Head Mode Updates From Ea

Jul 07, 2025 -

Polands Majchrzak Creates Wimbledon History Reaches Fourth Round

Jul 07, 2025

Polands Majchrzak Creates Wimbledon History Reaches Fourth Round

Jul 07, 2025 -

Iowa Hawkeyes Top Players In Ea Sports College Football 2026

Jul 07, 2025

Iowa Hawkeyes Top Players In Ea Sports College Football 2026

Jul 07, 2025 -

Why Tom Cruise Rejected Ford V Ferrari According To Brad Pitt

Jul 07, 2025

Why Tom Cruise Rejected Ford V Ferrari According To Brad Pitt

Jul 07, 2025 -

Betting On Wimbledon 2025 Mens Singles Match Previews For July 4th

Jul 07, 2025

Betting On Wimbledon 2025 Mens Singles Match Previews For July 4th

Jul 07, 2025

Latest Posts

-

Trumps Tax Bill Increased Hunger Concerns For Iowa Food Pantries

Jul 07, 2025

Trumps Tax Bill Increased Hunger Concerns For Iowa Food Pantries

Jul 07, 2025 -

Dogecoin Price Holds Steady 0 16 Support Level Key For Bulls

Jul 07, 2025

Dogecoin Price Holds Steady 0 16 Support Level Key For Bulls

Jul 07, 2025 -

Israeli Air Force Targets Yemeni Ports And Galaxy Leader Vessel Idf Statement

Jul 07, 2025

Israeli Air Force Targets Yemeni Ports And Galaxy Leader Vessel Idf Statement

Jul 07, 2025 -

Cancer Free Jim Ross Confirmed For All In Wrestling Event In Texas

Jul 07, 2025

Cancer Free Jim Ross Confirmed For All In Wrestling Event In Texas

Jul 07, 2025 -

Wrestling News Jim Ross All In 2025 Commentary Role Announced

Jul 07, 2025

Wrestling News Jim Ross All In 2025 Commentary Role Announced

Jul 07, 2025