Does Auto Insurance Cover Legal Costs After An Accident?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Does Auto Insurance Cover Legal Costs After an Accident?

Car accidents are stressful enough without the added worry of hefty legal bills. The question on many minds after a collision is: Will my auto insurance cover my legal costs? The short answer is: it depends. While a comprehensive policy offers significant protection, understanding exactly what's covered is crucial. This article will break down the complexities of legal cost coverage in auto insurance, helping you navigate this critical aspect of post-accident recovery.

Understanding Your Auto Insurance Policy

Your auto insurance policy is a legally binding contract. Before assuming your legal fees are covered, carefully review your policy documents. Look for sections detailing Uninsured/Underinsured Motorist (UM/UIM) coverage and Collision coverage. These are the two areas most likely to impact legal cost reimbursement.

-

Uninsured/Underinsured Motorist (UM/UIM) Coverage: This coverage protects you if you're injured by an uninsured or underinsured driver. If the at-fault driver lacks sufficient liability insurance to cover your medical bills and other damages, including lost wages and pain and suffering, your UM/UIM coverage might step in. Crucially, this often includes coverage for legal fees incurred in pursuing a claim against the at-fault driver.

-

Collision Coverage: This coverage kicks in if you're involved in an accident, regardless of fault. While primarily focused on vehicle repairs, some collision policies might cover legal costs associated with recovering damages from the other driver's insurance company. However, this is less common than UM/UIM coverage for legal fees.

Important Note: Many policies have limits on the amount they'll pay for legal costs. These limits are usually specified within the policy documents. Going over these limits means you'll be responsible for the remaining expenses.

What Legal Costs Might Be Covered?

The specific legal costs covered vary by policy and state. However, common examples include:

- Attorney's fees: This is often the largest expense. Your policy might cover some or all of the fees charged by your attorney for representing you in negotiations or court.

- Court costs: This can include filing fees, service fees, and other expenses associated with the legal process.

- Expert witness fees: If your case requires expert testimony (e.g., accident reconstructionist), your policy might cover the fees of these experts.

When Legal Costs Are Not Covered

It's equally important to understand situations where your insurance likely won't cover legal expenses:

- Accidents caused by your own negligence: If you're found at fault for the accident, your insurance is unlikely to cover legal fees for defending yourself against a lawsuit filed by the other party.

- Minor accidents without significant injuries or damages: In cases of minor fender benders with minimal damage, legal costs are usually not justified, and therefore not covered.

- Failure to comply with policy terms: Failing to notify your insurer promptly or providing false information can void your coverage, including legal cost reimbursement.

Finding the Right Legal Help

Navigating the complexities of insurance claims after an accident can be overwhelming. Consulting with a personal injury attorney experienced in car accident cases is highly recommended. A qualified attorney can assess your case, determine the extent of your potential legal costs, and help you navigate the insurance claim process effectively. They can also help you understand your policy's specific coverage and ensure you receive the compensation you deserve.

Conclusion

Determining whether your auto insurance covers legal costs after an accident requires a thorough review of your policy and the specifics of the accident. Understanding your coverage limitations and seeking professional legal advice are vital steps in protecting your rights and financial well-being following a car accident. Remember to always keep your policy documents readily available and don't hesitate to contact your insurer or an attorney if you have questions. This proactive approach can significantly reduce the stress and uncertainty associated with navigating the legal aftermath of a car accident.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Does Auto Insurance Cover Legal Costs After An Accident?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Multiple Casualties Feared After Ferry Capsizes Off Bali Coast

Jul 04, 2025

Multiple Casualties Feared After Ferry Capsizes Off Bali Coast

Jul 04, 2025 -

Investigating The Effects Of Cough Syrup On Cognitive Performance

Jul 04, 2025

Investigating The Effects Of Cough Syrup On Cognitive Performance

Jul 04, 2025 -

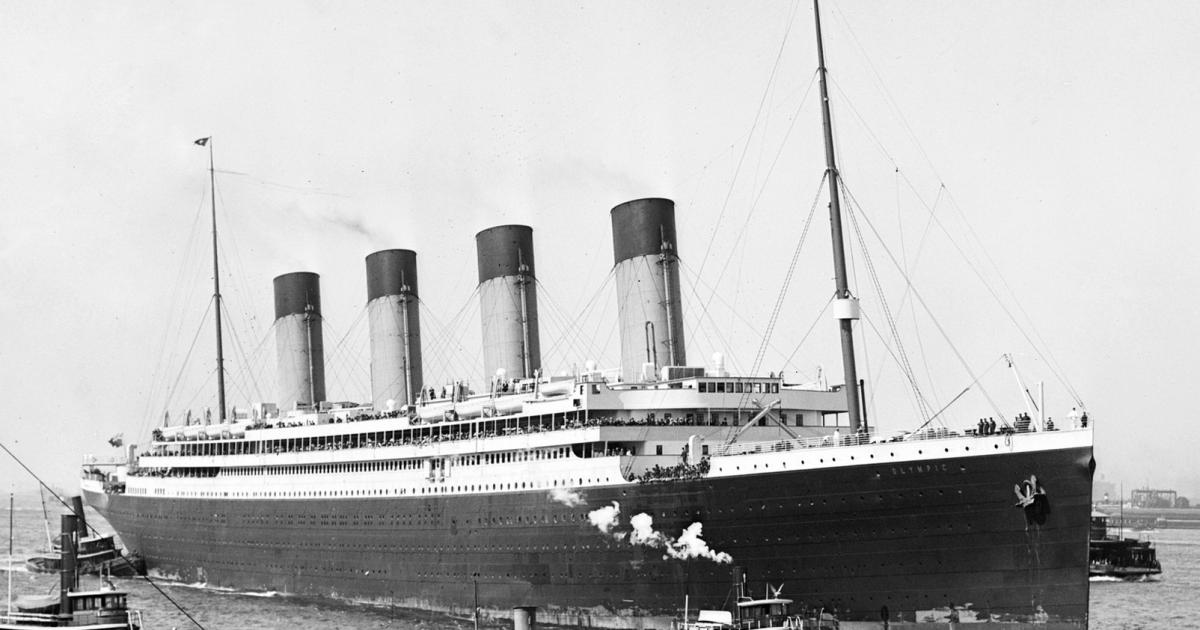

Exploring The Bournemouth Titanic Story Untold Tales

Jul 04, 2025

Exploring The Bournemouth Titanic Story Untold Tales

Jul 04, 2025 -

Cough Syrup And Cognition Separating Fact From Fiction

Jul 04, 2025

Cough Syrup And Cognition Separating Fact From Fiction

Jul 04, 2025 -

Indonesian Ferry Disaster Six Dead Dozens Missing Fears Of Rising Casualties

Jul 04, 2025

Indonesian Ferry Disaster Six Dead Dozens Missing Fears Of Rising Casualties

Jul 04, 2025

Latest Posts

-

Live Stream Details France Vs Iceland World Cup Qualifier Match Today

Sep 10, 2025

Live Stream Details France Vs Iceland World Cup Qualifier Match Today

Sep 10, 2025 -

France Vs Iceland 2026 World Cup Qualifying Live Stream And Tv Guide

Sep 10, 2025

France Vs Iceland 2026 World Cup Qualifying Live Stream And Tv Guide

Sep 10, 2025 -

Portugals World Cup Dream Can They Win It All

Sep 10, 2025

Portugals World Cup Dream Can They Win It All

Sep 10, 2025 -

Mundial 2026 Francia Vs Islandia Horario Y Canales De Tv

Sep 10, 2025

Mundial 2026 Francia Vs Islandia Horario Y Canales De Tv

Sep 10, 2025 -

Preventing Racist Abuse Englands Plan To Protect Kane And Other Players

Sep 10, 2025

Preventing Racist Abuse Englands Plan To Protect Kane And Other Players

Sep 10, 2025