Dimon's Warning: Internal Factors Pose Significant Threat To US Economic Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dimon's Warning: Internal Factors Pose Significant Threat to US Economic Growth

JPMorgan Chase CEO Jamie Dimon's recent comments paint a concerning picture for the US economy, highlighting internal vulnerabilities that overshadow external risks. While inflation shows signs of cooling and the unemployment rate remains low, Dimon's stark warning focuses on internal pressures that could derail sustained economic growth. His concerns, voiced during a recent earnings call, shouldn't be dismissed lightly, especially given his reputation for insightful economic analysis.

Internal Threats Outweigh External Risks

Dimon's message is clear: the biggest threats to the US economy are homegrown. While geopolitical instability, the war in Ukraine, and rising interest rates certainly pose challenges, Dimon believes the internal factors are more significant and immediate. This shift in perspective is crucial, suggesting a need for a reassessment of current economic forecasts.

He specifically highlighted several key internal weaknesses:

-

Government Spending and Debt: The massive increase in government spending in recent years, coupled with a burgeoning national debt, creates long-term fiscal uncertainty. Dimon warned that this unsustainable trajectory could lead to increased interest rates and hamper future economic expansion. [Link to article about US national debt]

-

Political Gridlock: The current political climate, characterized by intense partisan division, hinders the implementation of effective economic policies. This gridlock could further exacerbate existing problems and prevent proactive solutions to emerging challenges. [Link to article about political gridlock in the US]

-

Consumer Spending Slowdown: While consumer spending has been a key driver of economic growth, Dimon indicated a potential slowdown due to factors like inflation and rising interest rates. This cooling effect could significantly impact overall economic performance.

-

Potential for a Recession: Dimon didn't explicitly predict a recession, but his warnings strongly suggest a heightened risk. The confluence of internal challenges increases the likelihood of an economic downturn, particularly if these issues remain unresolved. [Link to article on recession probabilities]

Beyond the Headlines: Understanding Dimon's Concerns

Dimon's concerns aren't merely speculative; they're grounded in the realities of the current economic landscape. His extensive experience at the helm of one of the world's largest banks provides a unique perspective, allowing him to assess risks and predict potential outcomes with a high degree of accuracy. His warnings should serve as a wake-up call for policymakers and investors alike.

What's Next? Navigating the Uncertain Future

The implications of Dimon's warning are far-reaching. Investors should prepare for potential market volatility, while policymakers need to address the underlying internal issues to foster sustainable economic growth. This requires a bipartisan approach focused on fiscal responsibility, infrastructure investment, and policies that promote both short-term stability and long-term economic resilience.

This isn't a call for panic, but rather a call for proactive measures. Addressing these internal threats requires a concerted effort from all stakeholders. Ignoring Dimon's warning could prove costly in the long run. The future of the US economy hinges on effectively navigating these challenges.

Call to Action: Stay informed about the evolving economic landscape and consider diversifying your investments to mitigate potential risks. Regularly consult reputable financial news sources for the latest updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dimon's Warning: Internal Factors Pose Significant Threat To US Economic Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Miley Cyrus On Aging A Shift In Perspective On Her Parents

Jun 02, 2025

Miley Cyrus On Aging A Shift In Perspective On Her Parents

Jun 02, 2025 -

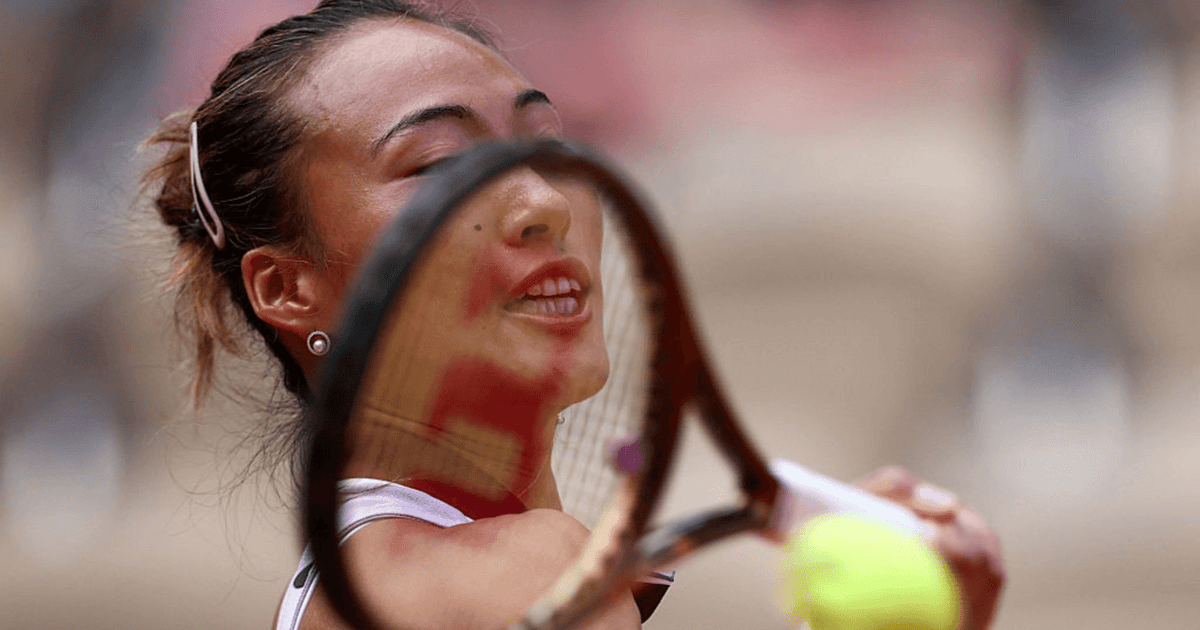

Roland Garros 2025 Day 8 Live Scores Results And Updates Key Matches Today

Jun 02, 2025

Roland Garros 2025 Day 8 Live Scores Results And Updates Key Matches Today

Jun 02, 2025 -

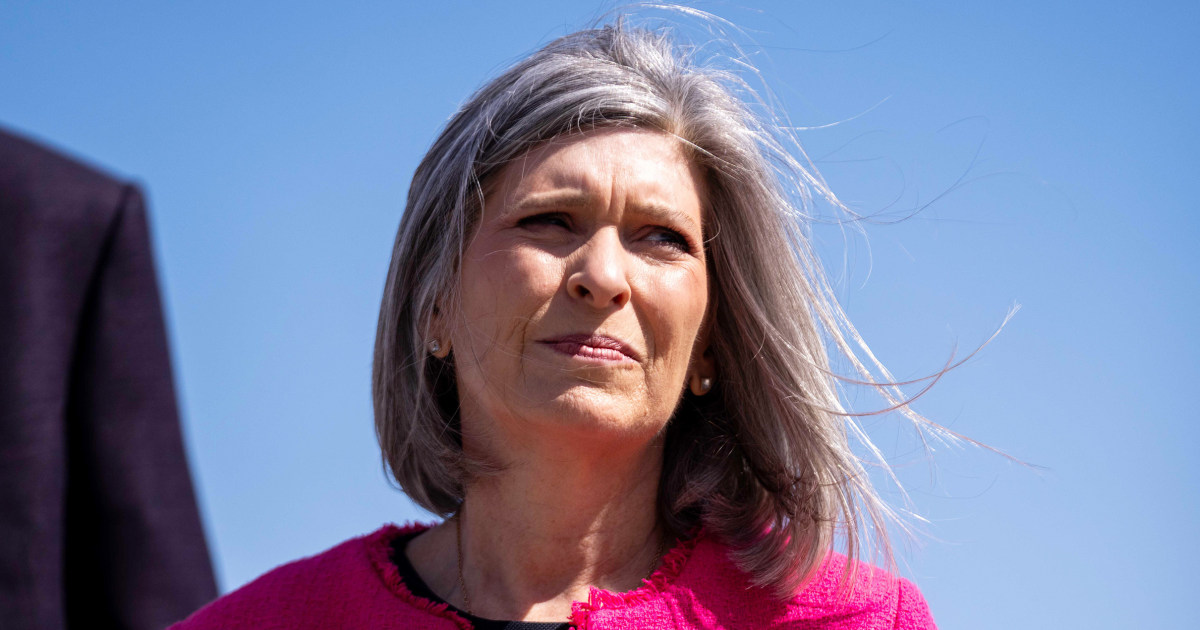

Medicaid Cuts Senator Ernst Faces Backlash Over We All Die Remark

Jun 02, 2025

Medicaid Cuts Senator Ernst Faces Backlash Over We All Die Remark

Jun 02, 2025 -

Pam Bondi Restricts American Bar Associations Judicial Vetting Process

Jun 02, 2025

Pam Bondi Restricts American Bar Associations Judicial Vetting Process

Jun 02, 2025 -

Strong Stand Urged At Harvard Graduates Back Commencement Speakers Call

Jun 02, 2025

Strong Stand Urged At Harvard Graduates Back Commencement Speakers Call

Jun 02, 2025