Dimon's Blunt Assessment: US Tariffs On China – A Costly Miscalculation?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dimon's Blunt Assessment: US Tariffs on China – A Costly Miscalculation?

Jamie Dimon, the CEO of JPMorgan Chase, rarely minces words. His recent comments on the impact of US tariffs on China have sent ripples through the financial world, prompting a renewed debate about the long-term economic consequences of this trade policy. Dimon's assessment? A costly miscalculation. But is he right?

The ongoing trade war between the US and China, initiated under the Trump administration and somewhat modified under the Biden administration, has been a defining feature of the global economy for several years. While proponents argued the tariffs were necessary to protect American industries and address unfair trade practices, critics – including now Dimon – have consistently pointed to the significant negative consequences.

The Dimon Doctrine: Higher Prices and Reduced Competitiveness

Dimon's argument centers around the simple economics of supply and demand. He contends that the tariffs, designed to protect American businesses, have instead resulted in higher prices for consumers and reduced the competitiveness of American companies in the global marketplace. These increased costs, he argues, are ultimately borne by American businesses and consumers, eroding purchasing power and slowing economic growth.

This isn't just anecdotal evidence. Numerous studies have explored the impact of the tariffs, with many concluding that the costs outweigh the benefits. A report by the Peterson Institute for International Economics, for instance, estimated that the tariffs imposed by the Trump administration cost American consumers billions of dollars annually. [Link to Peterson Institute Report]

Beyond the Balance Sheet: Geopolitical Implications

The consequences extend beyond simple economic calculations. Dimon's concerns also touch on the broader geopolitical landscape. The tariffs have exacerbated tensions between the two largest economies in the world, hindering cooperation on crucial global issues like climate change and pandemics. This fractured relationship, according to Dimon's implied argument, undermines global stability and economic growth.

Furthermore, the tariffs have incentivized companies to diversify their supply chains, moving production away from China and potentially leading to higher manufacturing costs and reduced efficiency in the long run. This shift, while intended to reduce dependence on China, also carries significant risks and economic uncertainties.

The Path Forward: A Need for Strategic Re-evaluation?

Dimon's outspoken critique isn't merely a condemnation of past policies. It serves as a call for a strategic re-evaluation of US-China trade relations. The current climate demands a more nuanced approach that balances the need to protect American industries with the importance of maintaining a stable and cooperative global economic order. Simply put, the blunt assessment highlights the need for a more sustainable and less confrontational trade relationship.

Key takeaways from Dimon's assessment:

- Higher consumer prices: Tariffs have increased the cost of goods for American consumers.

- Reduced competitiveness: American businesses face higher costs, making them less competitive globally.

- Geopolitical instability: Strained US-China relations hinder cooperation on crucial global issues.

- Supply chain disruption: Companies are diversifying supply chains, leading to potential inefficiencies.

The debate around US tariffs on China is far from over. Dimon's forceful intervention, however, underscores the urgent need for a comprehensive reassessment of this controversial policy and its lasting impact on the global economy. What do you think? Share your thoughts in the comments below.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dimon's Blunt Assessment: US Tariffs On China – A Costly Miscalculation?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Al Rokers 20 Year Weight Loss Journey Maintaining A 100 Pound Loss

Jun 03, 2025

Al Rokers 20 Year Weight Loss Journey Maintaining A 100 Pound Loss

Jun 03, 2025 -

The Enigma Of The Pulsating Star Scientists Search For Answers

Jun 03, 2025

The Enigma Of The Pulsating Star Scientists Search For Answers

Jun 03, 2025 -

Crimea Bridge Hit Ukraine Claims Responsibility For Blast With Underwater Drones

Jun 03, 2025

Crimea Bridge Hit Ukraine Claims Responsibility For Blast With Underwater Drones

Jun 03, 2025 -

Is Selling Used Bathwater A Lucrative Business Sydney Sweeney Case Study

Jun 03, 2025

Is Selling Used Bathwater A Lucrative Business Sydney Sweeney Case Study

Jun 03, 2025 -

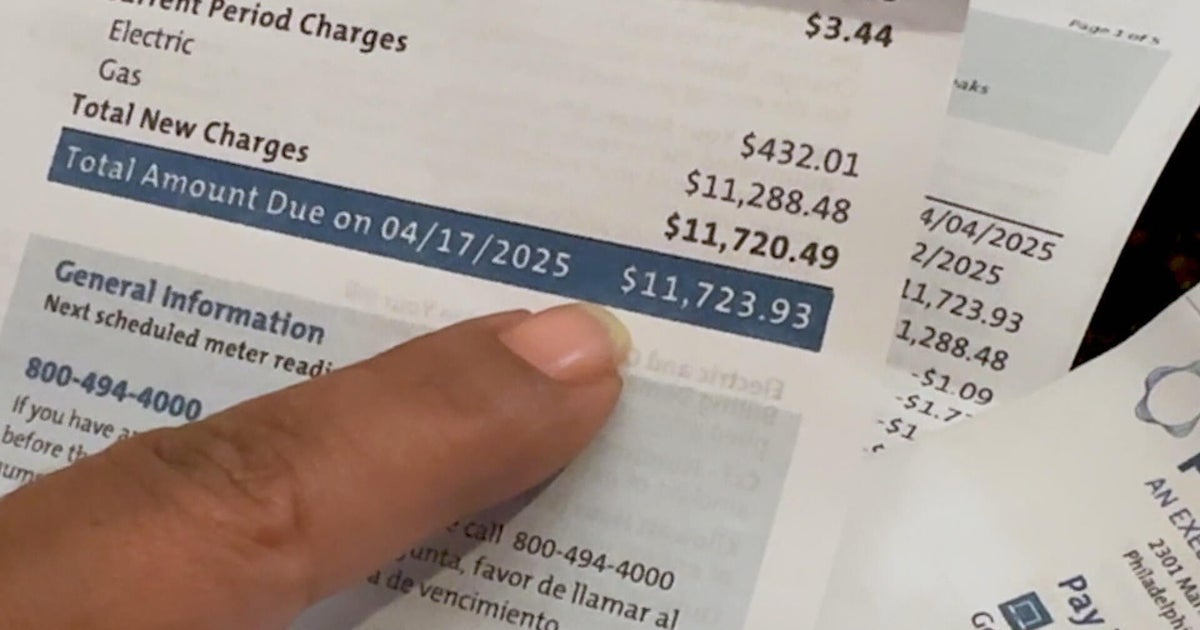

12 000 Peco Energy Bill Stuns Customer Are Others Facing Similar Issues

Jun 03, 2025

12 000 Peco Energy Bill Stuns Customer Are Others Facing Similar Issues

Jun 03, 2025