Dimon's Blunt Assessment: The Impact Of China Tariffs On The US Economy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dimon's Blunt Assessment: The Devastating Impact of China Tariffs on the US Economy

Jamie Dimon, CEO of JPMorgan Chase, rarely minces words. His recent assessment of the lingering effects of US-China tariffs wasn't an exception. Dimon delivered a stark warning, painting a picture of continued economic strain caused by these trade barriers, impacting everything from inflation to consumer spending. This isn't just another Wall Street prediction; it's a powerful statement reflecting the ongoing struggle of the US economy to navigate the complex geopolitical landscape.

The Lingering Shadow of Tariffs:

Dimon’s comments, made during a recent earnings call, weren't focused on the immediate impact, which was significant in itself. Instead, he highlighted the long-term consequences of the tariffs imposed during the Trump administration. These tariffs, intended to pressure China on trade practices, ultimately resulted in increased prices for consumers and businesses, fueling inflation and disrupting supply chains.

The impact isn't simply a matter of higher prices at the checkout. The ripple effect has been substantial, impacting various sectors of the US economy:

- Increased Inflation: Tariffs directly increased the cost of imported goods, contributing to the overall inflation rate. This, in turn, squeezed consumer spending and hampered economic growth. [Link to article on US inflation]

- Supply Chain Disruptions: The tariffs complicated already complex global supply chains, leading to delays, shortages, and increased costs for businesses. This impacted manufacturing, retail, and countless other industries. [Link to article on global supply chain issues]

- Reduced Consumer Spending: Higher prices for everyday goods forced consumers to tighten their belts, impacting overall demand and contributing to slower economic growth. This has implications for businesses relying on consumer spending. [Link to article on consumer spending trends]

- Geopolitical Tensions: The tariffs exacerbated already tense US-China relations, creating uncertainty and hindering potential for future economic cooperation. This uncertainty further discourages investment and growth.

Beyond the Numbers: A Broader Perspective

Dimon’s blunt assessment goes beyond simple economic analysis. It highlights the far-reaching consequences of protectionist trade policies. The belief that tariffs could easily be used as a tool to reshape global trade relations has proven overly simplistic. The resulting economic complexities have been difficult to manage and have impacted various segments of American society.

What Does the Future Hold?

While the immediate future remains uncertain, Dimon's warning serves as a critical reminder of the complexities of international trade and the unintended consequences of protectionist measures. A more nuanced approach to trade relations, focusing on collaboration and addressing underlying issues, might be needed to mitigate the lingering effects of these tariffs and foster sustainable economic growth.

Call to Action: Understanding the impact of trade policies on the US economy is crucial for informed civic engagement. Stay informed about economic developments and advocate for policies that promote sustainable and equitable growth. Learn more about the ongoing discussions surrounding US-China trade relations by exploring resources from reputable economic institutions and news outlets. [Link to relevant government website/economic institution]

Keywords: Jamie Dimon, JPMorgan Chase, China tariffs, US economy, inflation, supply chain, consumer spending, trade war, economic impact, geopolitical tensions, protectionism, trade policy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dimon's Blunt Assessment: The Impact Of China Tariffs On The US Economy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Adulting 101 Miley Cyrus Addresses Billy Rays New Relationship

Jun 02, 2025

Adulting 101 Miley Cyrus Addresses Billy Rays New Relationship

Jun 02, 2025 -

Asian Markets Economic Data Releases For Monday June 2 2025

Jun 02, 2025

Asian Markets Economic Data Releases For Monday June 2 2025

Jun 02, 2025 -

Spanish Grand Prix Verstappens Pursuit Of Piastri And Norris From The Second Row

Jun 02, 2025

Spanish Grand Prix Verstappens Pursuit Of Piastri And Norris From The Second Row

Jun 02, 2025 -

Republican Senator Joni Ernst And The Medicaid Debate Analyzing The Proposed Cuts

Jun 02, 2025

Republican Senator Joni Ernst And The Medicaid Debate Analyzing The Proposed Cuts

Jun 02, 2025 -

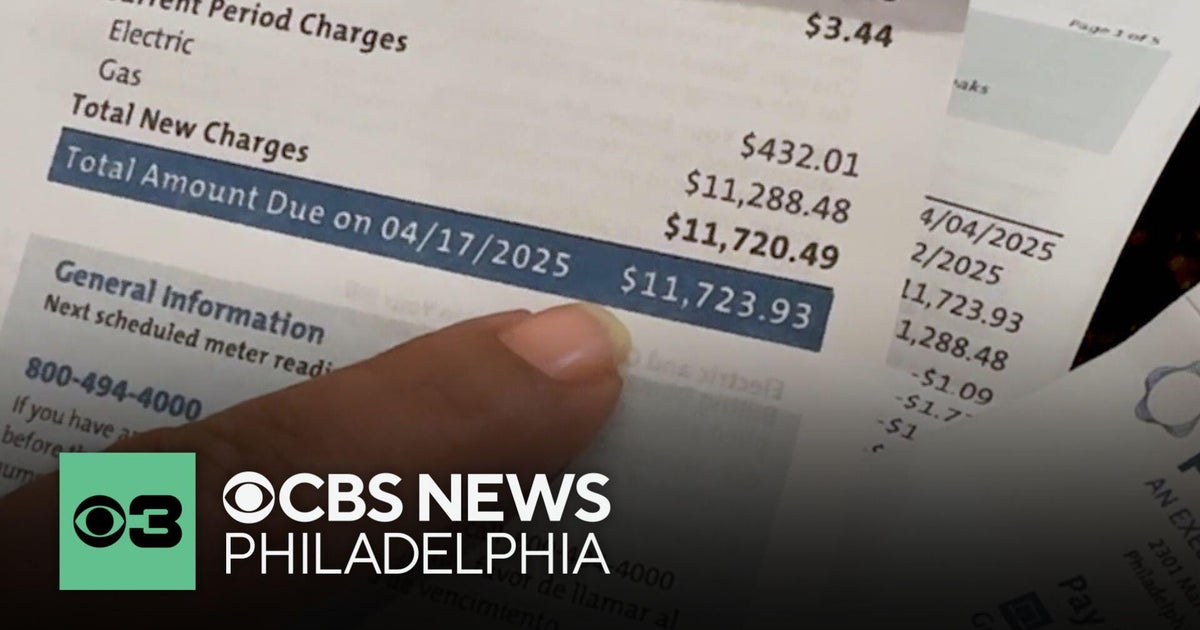

Months Of Missed Bills Lead To 12 000 Peco Bill For Pennsylvania Resident

Jun 02, 2025

Months Of Missed Bills Lead To 12 000 Peco Bill For Pennsylvania Resident

Jun 02, 2025