Dimon Sounds Alarm: Internal Risks Pose Significant Threat To US Economic Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Dimon Sounds Alarm: Internal Risks Pose Significant Threat to US Economic Growth

JPMorgan Chase CEO Jamie Dimon's stark warning about internal US economic risks has sent shockwaves through Wall Street and beyond. His recent comments, delivered during a conference call, highlight a growing concern among economic experts: the threat of internal fragility outweighs external factors like the war in Ukraine or global inflation. This isn't just about market volatility; it's a deep-seated concern about the underlying health of the American economy.

Dimon's alarm centers on several key internal pressures, each capable of independently triggering significant economic slowdown, and collectively, posing a systemic risk. Understanding these risks is crucial for investors, businesses, and everyday Americans alike.

H2: The Looming Threats to US Economic Growth: A Dimon Perspective

Dimon didn't mince words, highlighting several key areas of concern:

-

High Debt Levels: The staggering levels of both government and consumer debt remain a significant vulnerability. The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, are increasing borrowing costs, making it harder for individuals and businesses to manage existing debt. This could trigger a wave of defaults, impacting financial institutions and slowing economic activity. [Link to article on US national debt]

-

Government Spending and Political Gridlock: Political gridlock in Washington is hampering the ability to address crucial long-term economic challenges. This includes infrastructure investment, which could boost productivity and growth, but is currently stalled due to partisan divides. Furthermore, the ongoing debate about the federal budget further adds to economic uncertainty. [Link to article on US political gridlock]

-

Geopolitical Uncertainty (Internal): While Dimon mentioned external geopolitical factors, his primary concern lies with internal political and social divisions that are eroding confidence and slowing progress on crucial economic initiatives. This internal fragmentation acts as a drag on investment and overall economic growth.

-

The Unexpected Impact of Inflation: The persistent high inflation isn’t just about price increases; it’s also impacting consumer behavior and business investment decisions. Uncertainty about future price levels is hindering long-term planning and investment, leading to slower economic expansion. [Link to article on US inflation]

H2: What Does This Mean for the Average American?

Dimon's warning isn't just for Wall Street. These internal risks translate to real consequences for everyday Americans:

- Potential Job Losses: An economic slowdown could lead to job losses and increased unemployment, impacting household incomes and consumer spending.

- Increased Interest Rates: Higher interest rates make borrowing more expensive, impacting everything from mortgages and auto loans to business investments.

- Reduced Consumer Confidence: Uncertainty about the future can reduce consumer confidence, leading to decreased spending and further economic slowdown.

H2: Navigating the Uncertain Future

While Dimon's warnings are serious, they aren't necessarily a prediction of imminent collapse. However, they serve as a crucial wake-up call highlighting the need for proactive measures. Addressing the issues of high debt, political gridlock, and fostering a more unified national approach to economic challenges is paramount to ensuring sustained economic growth and stability. The future of the US economy depends on it.

H3: Call to Action: Stay informed about economic developments and engage in responsible financial planning. Understanding these risks allows individuals and businesses to better prepare for potential challenges and adapt their strategies accordingly. Monitor reputable economic news sources and consult with financial advisors for personalized guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Dimon Sounds Alarm: Internal Risks Pose Significant Threat To US Economic Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

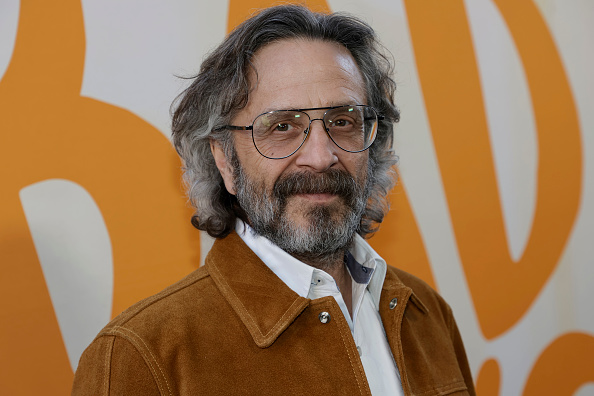

After 15 Years Wtf With Marc Maron Podcast Announces Final Episodes

Jun 02, 2025

After 15 Years Wtf With Marc Maron Podcast Announces Final Episodes

Jun 02, 2025 -

Mpsc Town Hall Looms Detroit Lawmaker Highlights Dte Energys Rate And Reliability Issues

Jun 02, 2025

Mpsc Town Hall Looms Detroit Lawmaker Highlights Dte Energys Rate And Reliability Issues

Jun 02, 2025 -

Manhunt Over Arrest Made In North Texas Capital Murder Case

Jun 02, 2025

Manhunt Over Arrest Made In North Texas Capital Murder Case

Jun 02, 2025 -

Stone Mountain Park Crime Police Probe Discovery Of Burned Body

Jun 02, 2025

Stone Mountain Park Crime Police Probe Discovery Of Burned Body

Jun 02, 2025 -

Marc Marons Iconic Wtf Podcast A Farewell After 16 Seasons

Jun 02, 2025

Marc Marons Iconic Wtf Podcast A Farewell After 16 Seasons

Jun 02, 2025