Currency Exchange And U.S. Tariffs: Challenges And Opportunities For Swiss Pharma

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Currency Exchange and U.S. Tariffs: Navigating the Complex Landscape for Swiss Pharma

The Swiss pharmaceutical industry, a global powerhouse known for innovation and high-quality medications, faces a constantly shifting landscape shaped by international trade policies and fluctuating currency exchange rates. The impact of U.S. tariffs and the ever-changing value of the Swiss Franc (CHF) against the US dollar (USD) present both significant challenges and unexpected opportunities for these companies. Understanding these dynamics is crucial for their continued success.

The Double-Edged Sword of U.S. Tariffs

The imposition of U.S. tariffs on imported goods, while not always directly targeting pharmaceuticals, creates ripple effects throughout the global supply chain. Increased costs for raw materials, packaging, and other inputs sourced from countries subject to tariffs can significantly impact the profitability of Swiss pharmaceutical companies exporting to the U.S. market. This is especially true for companies heavily reliant on global sourcing strategies.

Furthermore, the uncertainty surrounding future tariff policies creates planning difficulties. Companies must carefully consider hedging strategies and diversify their supply chains to mitigate potential risks. This requires significant investment and expertise in international trade law and logistics.

Impact Areas:

- Increased Production Costs: Tariffs on imported components directly increase production costs, squeezing profit margins.

- Price Competitiveness: Higher production costs can make Swiss pharmaceuticals less competitive in the U.S. market.

- Supply Chain Disruptions: Tariffs can lead to delays and disruptions in the supply chain, impacting timely drug delivery.

Currency Fluctuations: A CHF Challenge

The fluctuating exchange rate between the CHF and the USD adds another layer of complexity. A strong CHF makes Swiss pharmaceutical exports more expensive in USD terms, potentially reducing demand in the U.S. market. This can negatively impact revenue and profitability, particularly for companies with a significant portion of their sales in the U.S.

Conversely, a weaker CHF can offer a temporary advantage, increasing price competitiveness. However, relying on currency fluctuations for sustained growth is a risky strategy. Companies need to develop robust financial strategies to manage currency risk and ensure long-term stability.

Opportunities Amidst the Challenges

While the challenges are significant, there are also opportunities for Swiss pharmaceutical companies to thrive in this environment:

- Innovation and Differentiation: Focusing on innovative products and services that offer superior value can help offset price pressures caused by tariffs and currency fluctuations. Investing in R&D to develop unique therapies remains crucial.

- Strategic Partnerships: Collaborating with companies in other regions can diversify supply chains and reduce reliance on potentially tariff-affected sources.

- Supply Chain Optimization: Implementing advanced supply chain management techniques can improve efficiency and reduce costs, mitigating the impact of tariffs.

- Market Diversification: Reducing reliance on the U.S. market by expanding into other high-growth regions can lessen the impact of negative external factors.

Looking Ahead: Navigating Uncertainty

The future for Swiss pharmaceutical companies exporting to the U.S. will depend on their ability to adapt to the dynamic interplay of tariffs and currency exchange rates. Proactive risk management, strategic planning, and a commitment to innovation will be crucial for navigating these complex challenges and capitalizing on emerging opportunities. Staying informed about global trade policy developments and working with experienced financial and legal advisors are essential components of a successful strategy. The ability to adapt quickly and decisively will ultimately determine who thrives in this ever-evolving landscape.

Further Reading:

- [Link to a relevant article on Swiss pharmaceutical industry]

- [Link to a resource on international trade law]

- [Link to a report on currency exchange rates]

Call to Action: Learn more about how your company can navigate these challenges by contacting a specialist in international trade and finance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Currency Exchange And U.S. Tariffs: Challenges And Opportunities For Swiss Pharma. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Top British Players To Watch At Wimbledon This Year

Jul 07, 2025

Top British Players To Watch At Wimbledon This Year

Jul 07, 2025 -

Twitch Streamers Skincare Brand Tone Now Available At Target

Jul 07, 2025

Twitch Streamers Skincare Brand Tone Now Available At Target

Jul 07, 2025 -

Red Dead Online Strange Tales Update Brings Zombies Robots And More

Jul 07, 2025

Red Dead Online Strange Tales Update Brings Zombies Robots And More

Jul 07, 2025 -

Did Jaws Harm Or Help Marine Conservation Assessing The Films Impact

Jul 07, 2025

Did Jaws Harm Or Help Marine Conservation Assessing The Films Impact

Jul 07, 2025 -

The Jaws Effect Analyzing The Films Influence On Marine Life Protection

Jul 07, 2025

The Jaws Effect Analyzing The Films Influence On Marine Life Protection

Jul 07, 2025

Latest Posts

-

Trumps Tax Bill Increased Hunger Concerns For Iowa Food Pantries

Jul 07, 2025

Trumps Tax Bill Increased Hunger Concerns For Iowa Food Pantries

Jul 07, 2025 -

Dogecoin Price Holds Steady 0 16 Support Level Key For Bulls

Jul 07, 2025

Dogecoin Price Holds Steady 0 16 Support Level Key For Bulls

Jul 07, 2025 -

Israeli Air Force Targets Yemeni Ports And Galaxy Leader Vessel Idf Statement

Jul 07, 2025

Israeli Air Force Targets Yemeni Ports And Galaxy Leader Vessel Idf Statement

Jul 07, 2025 -

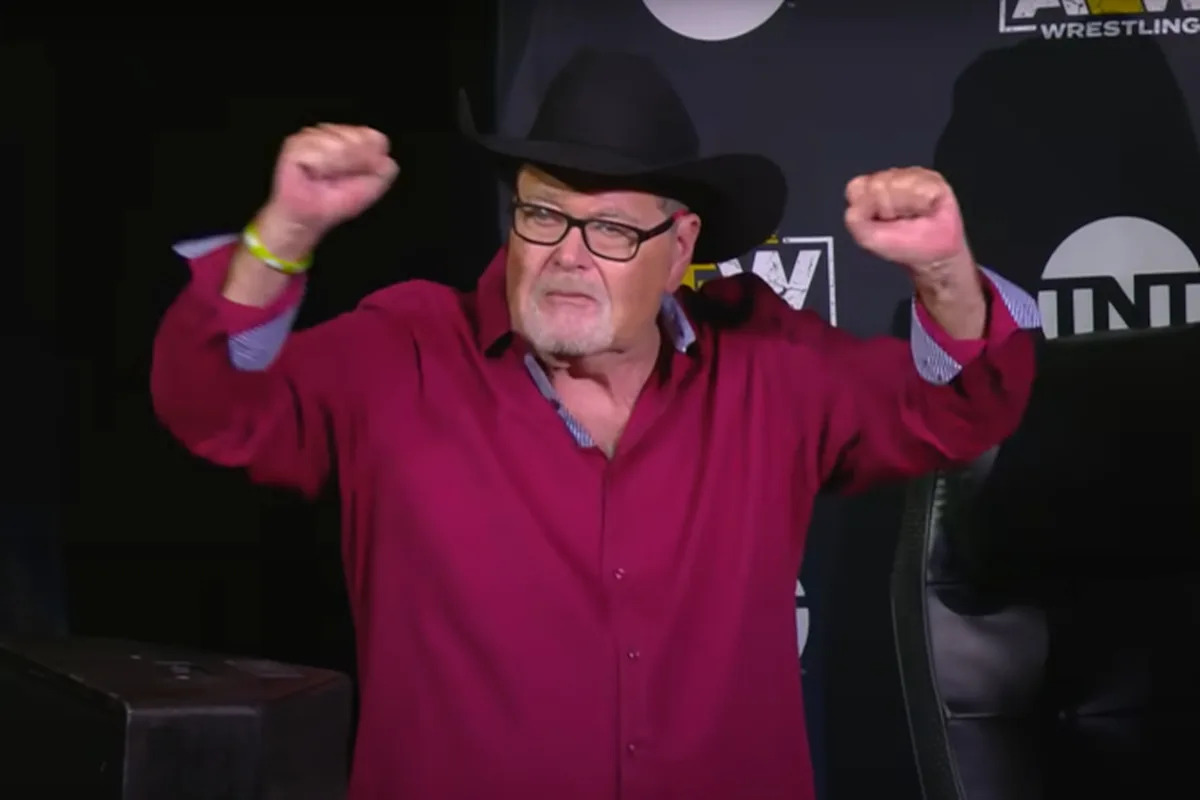

Cancer Free Jim Ross Confirmed For All In Wrestling Event In Texas

Jul 07, 2025

Cancer Free Jim Ross Confirmed For All In Wrestling Event In Texas

Jul 07, 2025 -

Wrestling News Jim Ross All In 2025 Commentary Role Announced

Jul 07, 2025

Wrestling News Jim Ross All In 2025 Commentary Role Announced

Jul 07, 2025