Crypto Trading Fuels Robinhood's Record $255 Billion In Assets: 108% Trading Volume Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Trading Fuels Robinhood's Record $255 Billion in Assets: 108% Trading Volume Increase

Robinhood, the popular commission-free trading app, has announced record-breaking assets under custody, reaching a staggering $255 billion. This monumental surge is largely attributed to a phenomenal 108% increase in trading volume, driven significantly by the growing popularity of cryptocurrency trading on its platform. The news sent ripples through the financial markets, highlighting the increasing mainstream adoption of cryptocurrencies and the expanding influence of retail investors.

A Boom in Crypto Trading:

The explosive growth in Robinhood's assets isn't just about stocks and options anymore. The company's strategic expansion into the cryptocurrency market has proven to be a masterstroke. The 108% increase in overall trading volume, reported in their latest financial statement, is directly correlated with a massive influx of users engaging in crypto trading. This signifies a major shift in the retail investment landscape, with more individuals than ever before venturing into the volatile yet potentially lucrative world of digital assets. This surge is not just a fleeting trend; analysts believe it reflects a long-term trend of increased retail investor participation in the crypto market.

What Fueled This Growth?

Several factors contributed to this remarkable growth in crypto trading on Robinhood:

- Increased Accessibility: Robinhood's user-friendly interface and commission-free trading model have significantly lowered the barrier to entry for aspiring crypto investors. This makes cryptocurrency trading accessible to a much broader audience compared to traditional brokerage platforms.

- Growing Crypto Adoption: The mainstream adoption of cryptocurrencies like Bitcoin and Ethereum continues to accelerate, fueled by increased media coverage, institutional investment, and the development of new blockchain technologies. This positive sentiment naturally spills over to trading platforms like Robinhood.

- Regulatory Clarity (to a degree): While regulatory uncertainty still looms large over the cryptocurrency industry, there's been a gradual increase in regulatory clarity in certain jurisdictions. This provides a degree of confidence to retail investors who were previously hesitant.

- Meme Culture and Social Media: The influence of meme stocks and social media trends cannot be ignored. The rapid price swings of certain cryptocurrencies have attracted considerable attention online, leading to increased trading activity.

The Implications for Robinhood and the Broader Market:

This unprecedented growth in assets and trading volume establishes Robinhood as a major player in the cryptocurrency market. However, the company also faces challenges. The volatile nature of cryptocurrencies exposes Robinhood to significant risk, and regulatory changes could significantly impact its operations. Nevertheless, the current success story paints a compelling picture of the future of retail investment and the increasingly prominent role of cryptocurrencies.

Looking Ahead:

Robinhood's success highlights the transformative power of technology in democratizing finance. The accessibility of crypto trading through platforms like Robinhood is likely to drive further growth in the cryptocurrency market, attracting both seasoned investors and newcomers alike. However, it’s crucial for investors to remain cautious and informed, understanding the inherent risks involved before engaging in crypto trading. Further regulatory clarity and investor education will be crucial to ensuring the sustainable growth of this burgeoning sector.

Call to Action: Are you interested in learning more about investing in cryptocurrencies? [Link to a reputable educational resource on crypto investing]. Remember to always do your own thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Trading Fuels Robinhood's Record $255 Billion In Assets: 108% Trading Volume Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

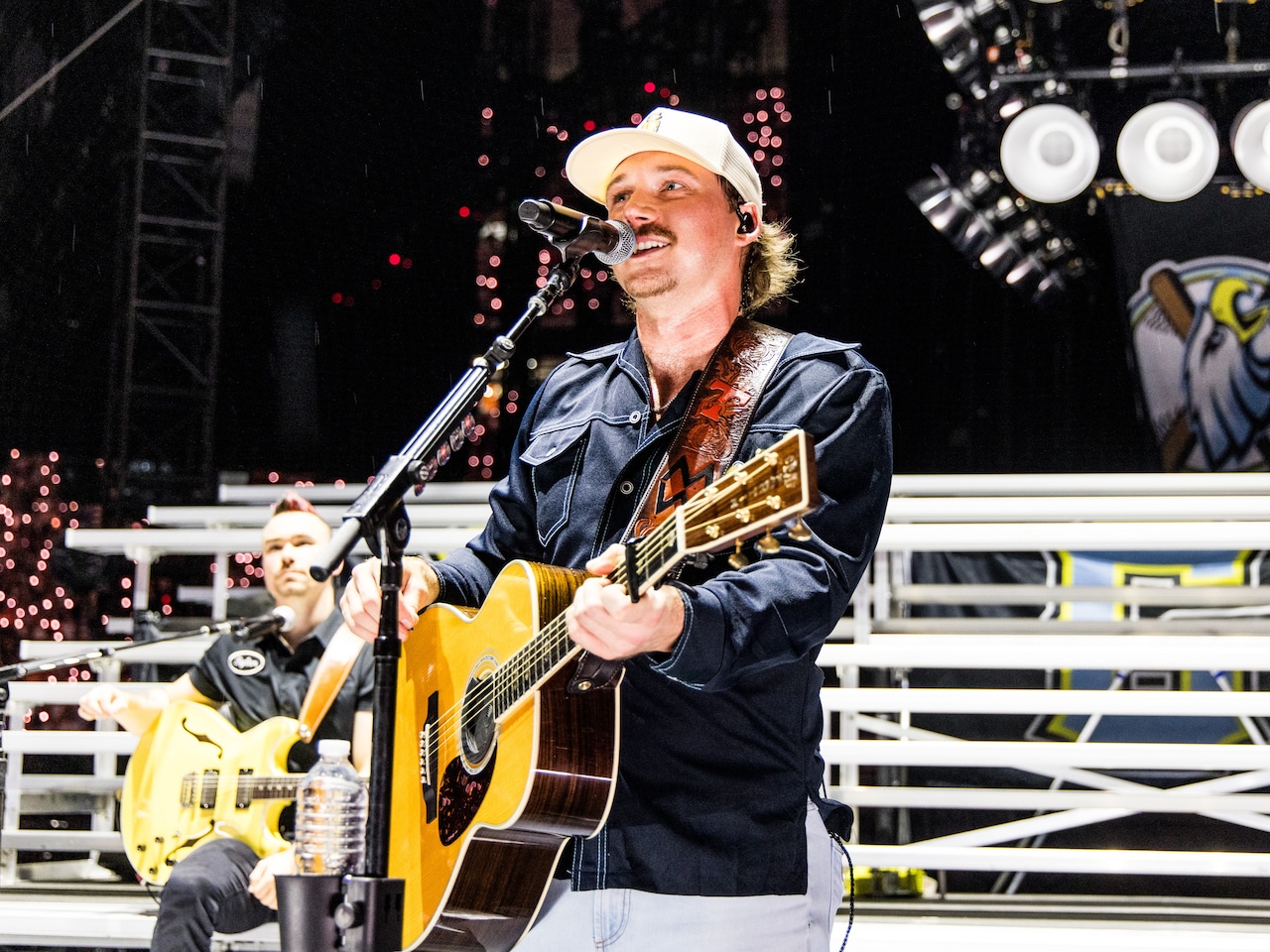

Score Affordable Morgan Wallen Tickets Houston I M The Problem Tour June 20 21

Jun 14, 2025

Score Affordable Morgan Wallen Tickets Houston I M The Problem Tour June 20 21

Jun 14, 2025 -

Korn Ferry Tour Press Conference Full Coverage And Key Announcements

Jun 14, 2025

Korn Ferry Tour Press Conference Full Coverage And Key Announcements

Jun 14, 2025 -

Complete Transcript And Analysis Korn Ferry Tour News Conference

Jun 14, 2025

Complete Transcript And Analysis Korn Ferry Tour News Conference

Jun 14, 2025 -

Top Golfer Robert Mac Intyre Mastering Irons At A Notorious Scottish Course

Jun 14, 2025

Top Golfer Robert Mac Intyre Mastering Irons At A Notorious Scottish Course

Jun 14, 2025 -

Nijjar And Pama Management Face Lawsuit For Alleged California Housing Law Violations

Jun 14, 2025

Nijjar And Pama Management Face Lawsuit For Alleged California Housing Law Violations

Jun 14, 2025