Crypto Trading Fuels 108% Surge In Robinhood Trading Volume, Assets Hit $255B

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Trading Fuels 108% Surge in Robinhood Trading Volume, Assets Hit $255B

Robinhood's Q2 2024 results reveal a stunning 108% surge in trading volume, driven primarily by the explosive growth of crypto trading on the platform. Total crypto assets held on the platform also reached a record-breaking $255 billion. This significant increase underscores the continued appeal of crypto investments and highlights Robinhood's strategic positioning within the evolving digital asset market.

The surge in trading activity isn't just a fleeting trend; it reflects a broader shift in investor behavior. The growing mainstream adoption of cryptocurrencies, coupled with increased regulatory clarity in certain jurisdictions, is attracting a wider range of investors to the market. This influx of new traders, combined with the continued activity of seasoned crypto enthusiasts, is fueling the explosive growth seen on platforms like Robinhood.

Crypto's Dominance in Robinhood's Q2 Performance

Robinhood's Q2 earnings report showcased the undeniable impact of crypto trading on its overall performance. The 108% increase in trading volume significantly outpaced growth in other asset classes, solidifying crypto's position as a key driver of the platform's success. This surge in activity is likely attributable to several factors:

- Increased User Base: Robinhood's user-friendly interface and relatively low fees have attracted a substantial number of new crypto traders.

- Market Volatility: The inherent volatility of the crypto market often leads to increased trading activity as investors attempt to capitalize on price fluctuations.

- New Crypto Offerings: Robinhood's expansion of its crypto offerings, potentially including new coins and improved trading features, may have attracted additional users and increased trading volume.

- Improved Regulatory Landscape (Potentially): While regulatory uncertainty remains a significant factor, any perceived improvements in the regulatory environment could boost investor confidence and trading activity.

$255 Billion in Crypto Assets: A Market Milestone

The report also highlighted that Robinhood now holds a staggering $255 billion in crypto assets on behalf of its users. This monumental figure represents a substantial portion of the overall crypto market and further emphasizes the platform's importance within the ecosystem. This substantial asset base underscores the growing trust placed in Robinhood by its users, as well as the increasing institutionalization of the crypto market.

What This Means for the Future of Crypto and Robinhood

The explosive growth in crypto trading on Robinhood isn't just a positive indicator for the platform itself; it's a strong signal of the continued maturation and mainstream acceptance of the cryptocurrency market. This trend suggests that cryptocurrencies are increasingly becoming a significant part of many investors' portfolios.

This significant jump in trading volume and asset holdings positions Robinhood well for future growth. However, the company will need to continue adapting to the dynamic nature of the crypto market, addressing regulatory challenges, and enhancing its security measures to maintain its leading position.

Looking ahead, we can anticipate continued growth in the crypto market, and platforms like Robinhood will likely play a pivotal role in facilitating this growth. The coming quarters will be crucial in observing how this trend evolves and what impact it will have on both the broader financial markets and the future of cryptocurrency adoption.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in cryptocurrencies carries significant risk, and you could lose money. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Trading Fuels 108% Surge In Robinhood Trading Volume, Assets Hit $255B. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

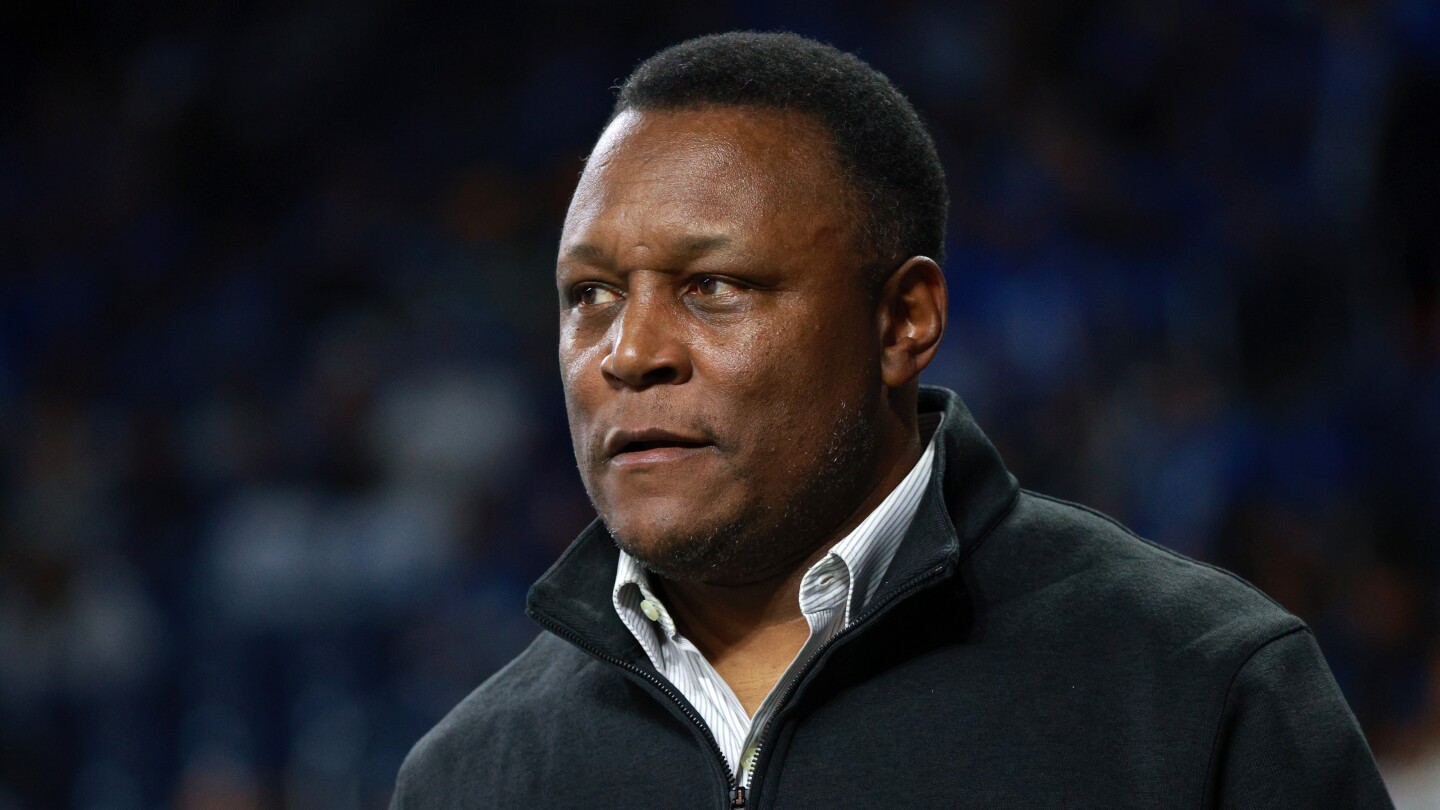

Barry Sanders A Year After His Heart Attack Hes Fighting For Change

Jun 14, 2025

Barry Sanders A Year After His Heart Attack Hes Fighting For Change

Jun 14, 2025 -

Burns Stellar Round 65 At U S Open Clinched By Final Putt

Jun 14, 2025

Burns Stellar Round 65 At U S Open Clinched By Final Putt

Jun 14, 2025 -

Air India Flight Crash Full Story And Casualty Details Emerging

Jun 14, 2025

Air India Flight Crash Full Story And Casualty Details Emerging

Jun 14, 2025 -

Tacoma Amber Alert Police Search For Missing 2 Year Old Girl

Jun 14, 2025

Tacoma Amber Alert Police Search For Missing 2 Year Old Girl

Jun 14, 2025 -

New Movie Starring Paula Patton Plot Cast And Release Details

Jun 14, 2025

New Movie Starring Paula Patton Plot Cast And Release Details

Jun 14, 2025