Crypto Fuels Robinhood Growth: $255B In Assets, 65% Crypto Trading Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Crypto Fuels Robinhood's Growth: $255 Billion in Assets, 65% Crypto Trading Surge

Robinhood, the popular commission-free trading app, is experiencing explosive growth, largely fueled by the surging popularity of cryptocurrency trading. Recent financial reports reveal a staggering $255 billion in assets under custody, with cryptocurrency trading volume surging by a remarkable 65% year-over-year. This significant increase underscores the growing role of digital assets in the mainstream financial landscape and highlights Robinhood's strategic positioning within this rapidly evolving market.

The Crypto Boom Drives Robinhood's Success

The numbers speak for themselves. Robinhood's Q2 2024 earnings report showcased a dramatic increase in cryptocurrency trading activity, significantly outpacing growth in other asset classes. This isn't just a fleeting trend; the consistent rise in crypto trading on the platform suggests a long-term shift in investor behavior. More and more retail investors are turning to platforms like Robinhood to access the volatile yet potentially lucrative world of cryptocurrencies like Bitcoin, Ethereum, and Dogecoin.

This surge can be attributed to several factors:

- Increased Crypto Adoption: The increasing mainstream acceptance of cryptocurrencies, driven by technological advancements and regulatory clarity (in certain regions), has opened the door for a wider range of investors.

- Ease of Access: Robinhood's user-friendly interface and commission-free trading model have made cryptocurrency investing accessible to beginners who might otherwise be intimidated by traditional exchanges.

- Growing Market Capitalization: The overall growth in the cryptocurrency market capitalization has attracted significant capital inflows, further fueling the demand for trading platforms like Robinhood.

$255 Billion in Assets Under Custody: A Milestone for Robinhood

The reported $255 billion in assets under custody represents a monumental achievement for Robinhood. This figure underscores the platform's growing influence in the financial technology (FinTech) sector and its ability to attract and retain a substantial user base. While this figure includes assets beyond cryptocurrencies, the substantial contribution from crypto trading is undeniable.

Challenges and Future Outlook

Despite the impressive growth, Robinhood faces ongoing challenges. The volatile nature of the cryptocurrency market presents inherent risks, and regulatory uncertainty remains a significant concern. The company must continue to adapt to evolving regulatory landscapes and enhance its security measures to maintain user trust and protect against potential threats like hacking and fraud.

However, the long-term outlook remains positive. As cryptocurrency adoption continues to grow globally, platforms like Robinhood are well-positioned to benefit from the increasing demand for accessible and user-friendly trading solutions. The company's focus on innovation and its ability to cater to the evolving needs of its user base will be crucial in navigating the competitive landscape and maintaining its leading position.

What This Means for Investors:

The explosive growth of crypto trading on Robinhood reflects a broader trend in the financial world. For investors, this means increased accessibility to digital assets, but it also highlights the importance of careful research, risk management, and diversification. Before investing in any cryptocurrency, it's essential to understand the risks involved and to only invest what you can afford to lose.

Learn More:

For more information on investing in cryptocurrencies, consider exploring resources like [link to reputable financial news source] and [link to educational resource on crypto investing]. Remember, investing always carries risk, and it's crucial to conduct thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Crypto Fuels Robinhood Growth: $255B In Assets, 65% Crypto Trading Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

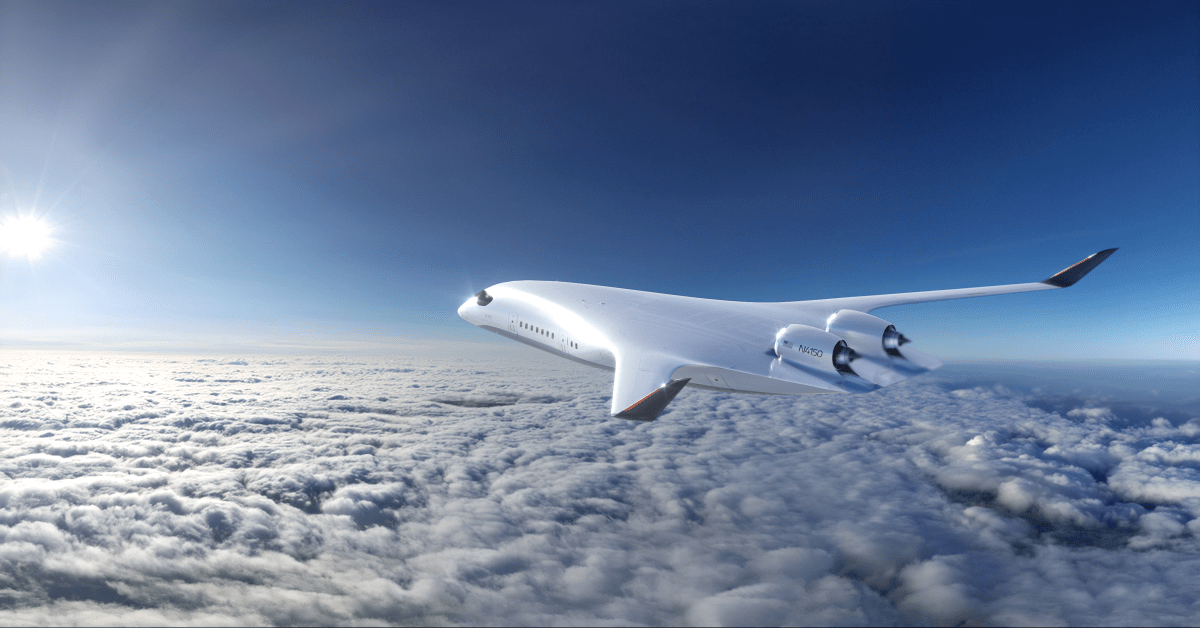

Could This Company Solve The Problem Of Carbon Emissions In Air Travel

Jun 14, 2025

Could This Company Solve The Problem Of Carbon Emissions In Air Travel

Jun 14, 2025 -

Casualties Confirmed Iranian Generals And Scientists Among Those Killed In Israeli Strikes

Jun 14, 2025

Casualties Confirmed Iranian Generals And Scientists Among Those Killed In Israeli Strikes

Jun 14, 2025 -

Tenant Exploitation Lawsuit Filed Against Prominent Southern California Developer

Jun 14, 2025

Tenant Exploitation Lawsuit Filed Against Prominent Southern California Developer

Jun 14, 2025 -

Stunning 65 Sam Burns Final Putt Highlights U S Open Round

Jun 14, 2025

Stunning 65 Sam Burns Final Putt Highlights U S Open Round

Jun 14, 2025 -

Kittles Support For Deebo Samuel After Controversial Video Surfaces

Jun 14, 2025

Kittles Support For Deebo Samuel After Controversial Video Surfaces

Jun 14, 2025