Cramer's Insight: Trump's Potential China Trade Advantage And 10 Stock Picks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Cramer's Insight: Could Trump's China Trade Policies Still Offer a Stock Market Advantage? 10 Picks to Consider

Introduction: Jim Cramer, the outspoken host of CNBC's "Mad Money," has long been known for his bold predictions and stock market analysis. Recently, he revisited the lingering effects of former President Trump's trade policies with China, suggesting that savvy investors could still capitalize on opportunities created by this complex geopolitical landscape. While the Biden administration has pursued a different approach, certain sectors and companies may still retain a competitive edge forged during the Trump era. This article delves into Cramer's assessment and highlights ten stock picks he suggests warrant consideration.

Trump's Trade War Legacy: A Complex Picture

The Trump administration's trade war with China, marked by tariffs and trade disputes, significantly impacted global markets. While some sectors suffered, others adapted and thrived. Cramer argues that understanding these shifts is crucial for identifying potential investment opportunities today. He points to specific industries that experienced a surge in domestic production or found new avenues for growth due to altered supply chains. This restructuring, although initially disruptive, may have created long-term advantages for certain companies. While the full economic impact is still unfolding, analyzing the winners and losers of this period remains relevant for astute investors.

Navigating the Post-Trade War Landscape

The Biden administration's approach to China differs from Trump's, focusing on strategic competition rather than an all-out trade war. However, the structural changes brought about by the previous administration's policies continue to influence market dynamics. This means that identifying companies that successfully navigated the previous challenges and strengthened their positions remains a key strategy. Understanding the nuances of this evolving geopolitical situation is vital for making informed investment decisions.

Cramer's Top 10 Stock Picks (Potential for Growth):

Cramer's recent analysis highlights several sectors poised for continued growth, building upon the shifts instigated by the previous trade policies. While this list is not exhaustive and should be viewed alongside your own research and risk tolerance, it offers valuable insights:

-

Technology (Semiconductors): [Insert 2-3 specific semiconductor company examples with brief rationale, e.g., Nvidia (NVDA) - benefiting from AI boom, and reduced reliance on Chinese manufacturing]. Remember to link to reliable financial news sources for further company details.

-

Manufacturing (Industrial Goods): [Insert 2-3 specific industrial goods company examples with brief rationale, focusing on those that benefited from reshoring or diversified supply chains]. Again, link to reliable sources for more in-depth analysis.

-

Energy: [Insert 2-3 specific energy company examples, focusing on those with a strong domestic presence and less exposure to volatile international markets]. Include links to relevant company information and financial news.

Important Disclaimer: Investing in the stock market always involves risk. The companies mentioned above are merely examples provided for illustrative purposes based on Cramer's commentary. This is not financial advice. Conduct thorough due diligence and consult with a qualified financial advisor before making any investment decisions.

Conclusion: Understanding the Past, Shaping the Future

Jim Cramer's analysis underscores the importance of understanding the long-term consequences of past geopolitical events on the stock market. While the trade war with China is no longer the dominant narrative, its impact continues to reverberate. By carefully examining the winners and losers from that period, investors can potentially identify opportunities for growth and long-term returns. Remember to always diversify your portfolio and manage risk effectively. Stay informed, conduct thorough research, and consider consulting a financial professional to make informed investment choices.

Call to Action: Want to learn more about navigating the complexities of the global market? [Link to a relevant resource, such as a financial news website or educational platform].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Cramer's Insight: Trump's Potential China Trade Advantage And 10 Stock Picks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

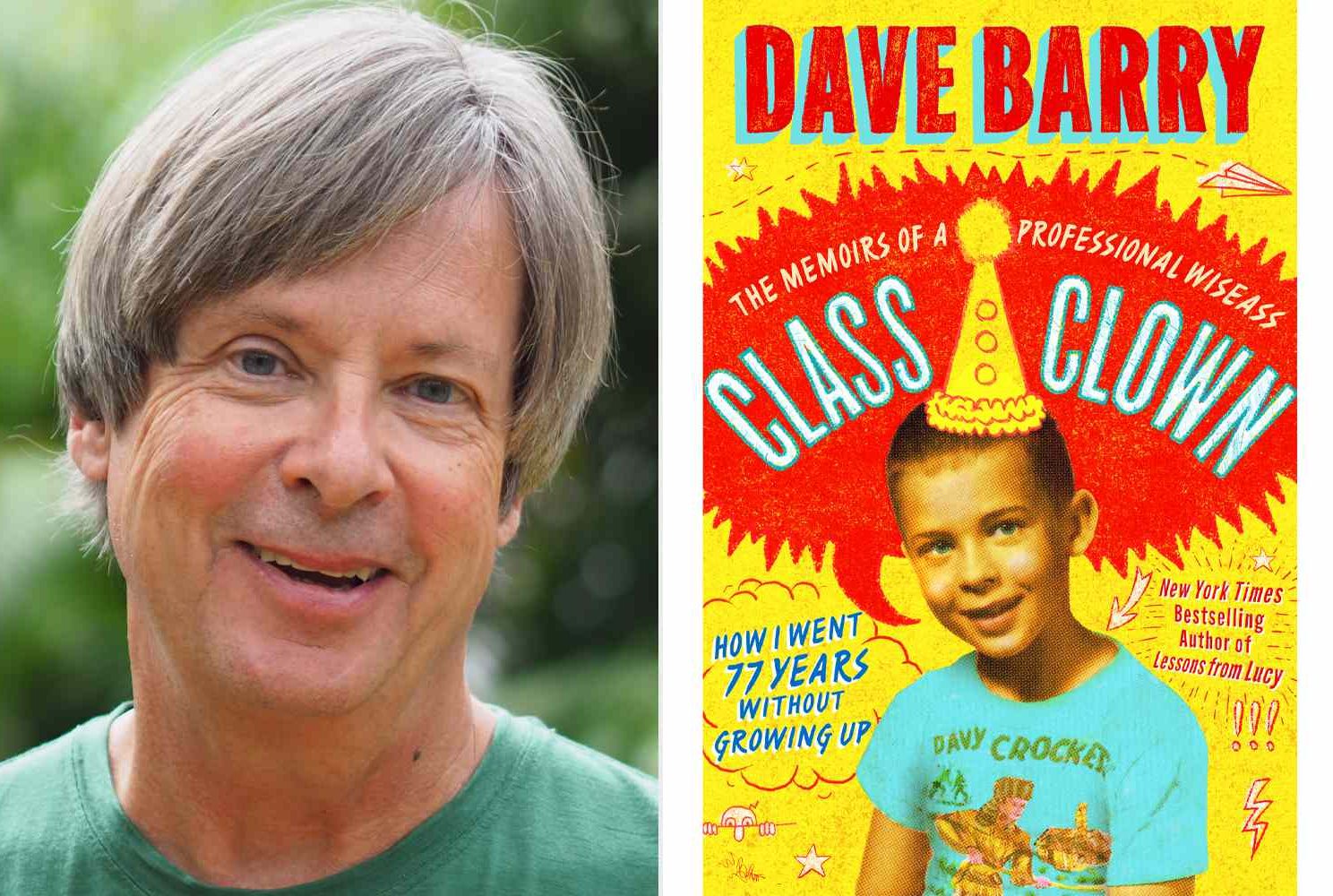

Keplers Upcoming Event Dave Barry And Angie Corio May 12th

May 11, 2025

Keplers Upcoming Event Dave Barry And Angie Corio May 12th

May 11, 2025 -

Trumps China Trade Card Jim Cramer Reveals Strategy And 10 Stock Recommendations

May 11, 2025

Trumps China Trade Card Jim Cramer Reveals Strategy And 10 Stock Recommendations

May 11, 2025 -

Hitowy Mecz Sklad Barcelony Na Real Madryt Udzial Lewandowskiego I Szczesnego Potwierdzony

May 11, 2025

Hitowy Mecz Sklad Barcelony Na Real Madryt Udzial Lewandowskiego I Szczesnego Potwierdzony

May 11, 2025 -

Lamine Yamal The Next Messi Comparing Barcelonas Rising Star To Its Legend

May 11, 2025

Lamine Yamal The Next Messi Comparing Barcelonas Rising Star To Its Legend

May 11, 2025 -

Hilaria Baldwin And Amy Schumer Clash Over Controversial Comedy Routine

May 11, 2025

Hilaria Baldwin And Amy Schumer Clash Over Controversial Comedy Routine

May 11, 2025