Cramer Unveils Trump's Potential China Trade Weapon: 10 Stocks To Consider

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Cramer Unveils Trump's Potential China Trade Weapon: 10 Stocks to Consider

Could a renewed focus on domestic manufacturing become the ultimate trump card in US-China trade relations? Jim Cramer, the outspoken CNBC personality, recently suggested a potent strategy for the US to leverage against China – a renewed emphasis on bolstering domestic manufacturing. This approach, he argues, could be a powerful weapon in the ongoing trade war, and he's highlighted ten stocks that could significantly benefit from such a shift.

The escalating tensions between the US and China have kept investors on edge for years. Tariffs, trade disputes, and geopolitical uncertainty have created a volatile market. However, Cramer's analysis offers a potential silver lining, focusing on the opportunity for American companies to thrive through a strategic refocusing on domestic production. This isn't just about protectionism; it's about strengthening the US economy and reducing reliance on foreign supply chains.

Trump's Legacy and the Shift Towards Reshoring

The Trump administration's "America First" policies already initiated a push towards reshoring – the practice of bringing manufacturing jobs back to the United States. While the Biden administration has taken a somewhat different approach, the underlying need to strengthen domestic manufacturing remains. Cramer's analysis suggests that this underlying trend could be reignited, potentially as a response to ongoing geopolitical pressures. This makes understanding the potential beneficiaries crucial for savvy investors.

10 Stocks Poised for Growth: Cramer's Picks

Cramer didn't simply name drop companies; he provided context, highlighting the industries and factors that make these stocks attractive in a reshoring scenario. While specific stock picking is inherently risky and should be approached with thorough due diligence, his selections represent a diverse range of sectors potentially benefiting from increased domestic manufacturing. Remember, this is not financial advice; consult with a financial professional before making investment decisions.

The following stocks are mentioned (Note: This list is for illustrative purposes only and does not constitute a recommendation. Always conduct your own thorough research):

- Manufacturing Giants: Several established manufacturing companies with a significant US presence are likely to see increased demand. This could include companies focused on:

- Industrial Machinery: Companies producing machinery for various manufacturing processes.

- Materials and Components: Suppliers of raw materials and components crucial for US manufacturing.

- Technology and Innovation: Companies involved in automation, robotics, and other technologies boosting domestic manufacturing efficiency are also expected to see growth.

- Defense Contractors: Increased defense spending, often linked to geopolitical tensions, could also benefit specific defense contractors with strong domestic manufacturing capabilities.

- Renewable Energy: The focus on domestic manufacturing extends to renewable energy sectors, potentially benefitting companies involved in solar panel production or wind turbine manufacturing.

(Note: Specific company names have been omitted to avoid the appearance of endorsing particular investments. Readers should conduct independent research to identify the companies Cramer mentioned.)

Navigating the Risks

While the potential for growth in these sectors is significant, investors must be aware of potential risks. These include:

- Inflationary Pressures: Increased domestic production could potentially lead to increased prices for goods.

- Supply Chain Challenges: Even with reshoring, ensuring a smooth and efficient supply chain within the US will present its own set of challenges.

- Geopolitical Uncertainty: The overall geopolitical landscape remains fluid, and unforeseen events could impact market performance.

Conclusion: A Strategic Opportunity?

Cramer's analysis presents a compelling argument for the potential of a renewed focus on domestic manufacturing as a strategic tool in US-China relations. The identified sectors offer intriguing investment opportunities, but thorough due diligence and a long-term perspective are essential for navigating the complexities of this evolving economic landscape. Remember to always consult with a financial advisor before making any investment decisions. What are your thoughts on this potential trade weapon? Share your opinions in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Cramer Unveils Trump's Potential China Trade Weapon: 10 Stocks To Consider. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

All Night Egg Pets New Feature In Grow A Gardens Lunar Update

May 11, 2025

All Night Egg Pets New Feature In Grow A Gardens Lunar Update

May 11, 2025 -

Journalist Austin Tice Years Long Kidnapping Case Ends With Body Discovery

May 11, 2025

Journalist Austin Tice Years Long Kidnapping Case Ends With Body Discovery

May 11, 2025 -

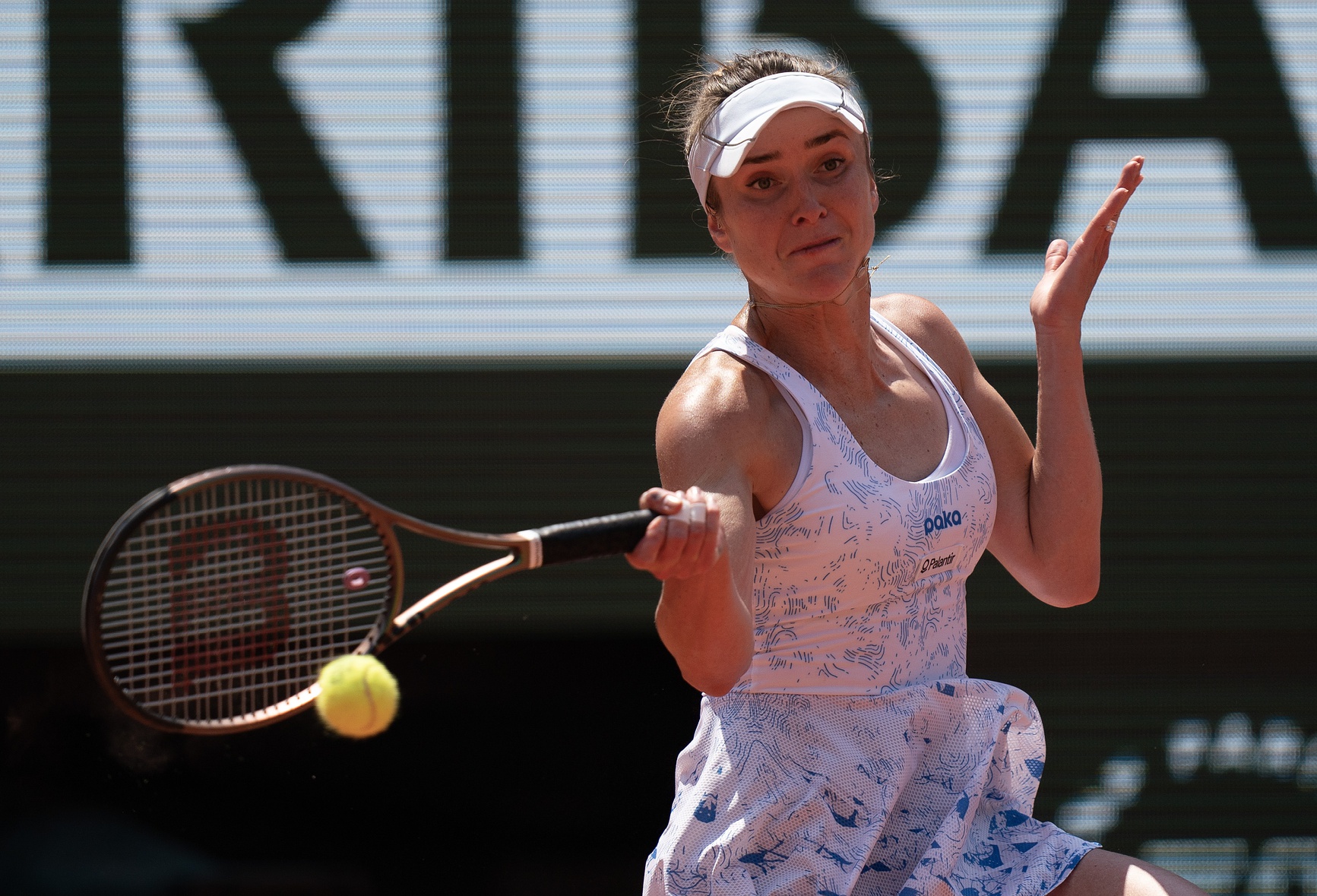

Wta Italian Open 2025 Round 3 In Depth Look At Svitolina Vs Baptiste

May 11, 2025

Wta Italian Open 2025 Round 3 In Depth Look At Svitolina Vs Baptiste

May 11, 2025 -

China Trade Talks Jim Cramer Reveals Trumps Potential Asset And Top 10 Stock Picks

May 11, 2025

China Trade Talks Jim Cramer Reveals Trumps Potential Asset And Top 10 Stock Picks

May 11, 2025 -

Confirmed Jude Bellingham Needs Surgery Englands Euro 2024 Participation Affected

May 11, 2025

Confirmed Jude Bellingham Needs Surgery Englands Euro 2024 Participation Affected

May 11, 2025