Could This Undervalued Warren Buffett Stock Make You Richer?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Could This Undervalued Warren Buffett Stock Make You Richer?

The Oracle of Omaha's investments often spark interest, and one particular holding is raising eyebrows. Is this undervalued gem the next big winner in your portfolio? Let's dive into the details.

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has a long track record of shrewd investments that have generated substantial wealth. His choices, therefore, often become the subject of intense scrutiny by individual investors and financial analysts alike. One company currently held by Berkshire Hathaway is generating considerable buzz: [Insert Company Name Here]. Is it truly undervalued, and could investing in it make you richer?

Understanding the Potential of [Company Name]

[Company Name] operates in the [Industry Sector] industry, specializing in [Specific Company Activities]. The company's recent performance has been [Describe Recent Performance – positive, negative, mixed]. However, many analysts believe that the current market valuation doesn't fully reflect the company's long-term potential.

Key factors contributing to the "undervalued" argument include:

- Strong fundamentals: [Company Name] boasts [mention key strengths, e.g., strong brand recognition, consistent profitability, expanding market share, innovative product pipeline]. These fundamentals suggest a robust foundation for future growth.

- Competitive advantage: The company benefits from [mention competitive advantages, e.g., unique technology, strong distribution network, established brand loyalty]. This creates a barrier to entry for competitors.

- Growth potential: Analysts foresee significant growth opportunities for [Company Name] in [mention specific growth areas, e.g., expanding into new markets, launching new products]. This growth potential could significantly boost the company's valuation in the coming years.

- Warren Buffett's backing: The fact that Berkshire Hathaway, led by the renowned Warren Buffett, holds a significant stake in [Company Name] lends considerable credibility to the investment. Buffett's reputation for long-term value investing suggests he sees considerable potential in the company.

The Risks Involved

It's crucial to remember that no investment is without risk. While [Company Name] presents an attractive opportunity, several factors could impact its future performance:

- Market volatility: The overall stock market can experience periods of significant volatility, affecting even the strongest companies.

- Industry competition: Increased competition could erode [Company Name]'s market share and profitability.

- Economic downturn: A broader economic slowdown could negatively impact consumer spending and affect the company's performance.

- Unforeseen circumstances: Unexpected events, such as natural disasters or geopolitical instability, can also impact the company's prospects.

Should You Invest?

Whether or not investing in [Company Name] is right for you depends on your individual risk tolerance, investment goals, and financial situation. It's always advisable to conduct thorough due diligence before making any investment decisions. Consider consulting with a qualified financial advisor to discuss your options and determine if this stock aligns with your portfolio strategy.

Before investing, consider:

- Your risk tolerance: Are you comfortable with the potential for both significant gains and losses?

- Your investment timeline: How long are you willing to hold the investment? Buffett’s approach is often long-term.

- Diversification: Does this investment fit within a well-diversified portfolio?

This analysis is for informational purposes only and should not be considered financial advice. Always conduct your own research and seek professional guidance before making investment decisions.

Learn more about Warren Buffett's investment strategies: [Link to a reputable source about Warren Buffett's investing]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Could This Undervalued Warren Buffett Stock Make You Richer?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Charli Xcx Responds To Backlash Over Controversial Festival Set

Jul 01, 2025

Charli Xcx Responds To Backlash Over Controversial Festival Set

Jul 01, 2025 -

Kojima Productions Why Japanese Actors Are Scarce In Kojimas Games

Jul 01, 2025

Kojima Productions Why Japanese Actors Are Scarce In Kojimas Games

Jul 01, 2025 -

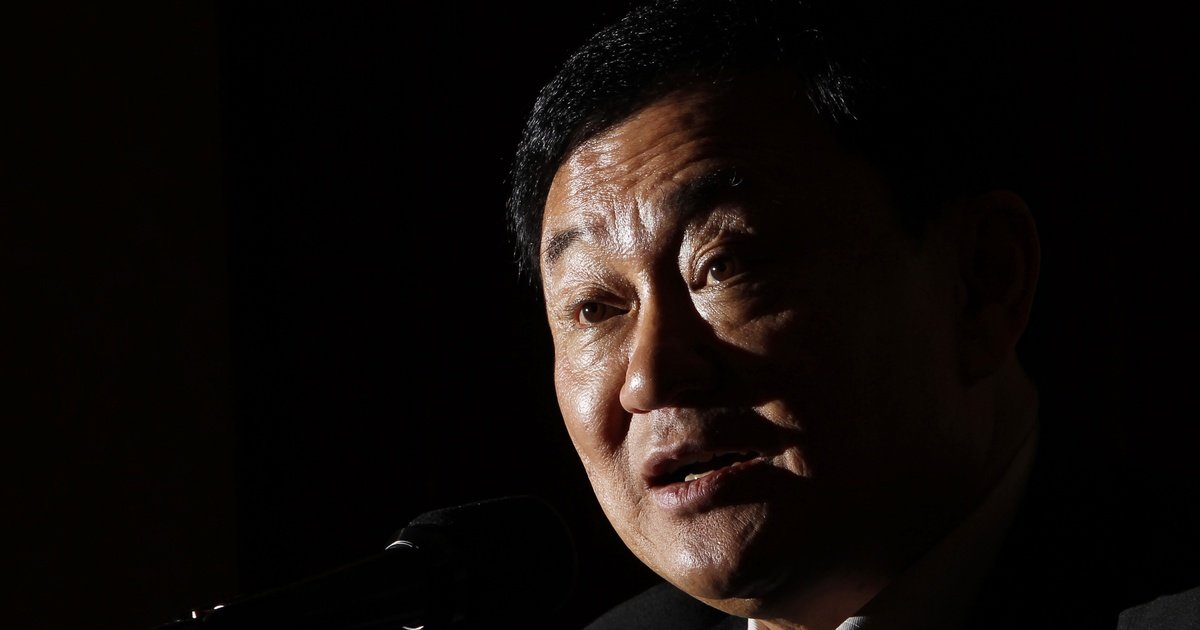

Thailands Shinawatra Era End Of An Influence

Jul 01, 2025

Thailands Shinawatra Era End Of An Influence

Jul 01, 2025 -

Ufc Champ Dvalishvilis Self Deprecating Pound For Pound Placement

Jul 01, 2025

Ufc Champ Dvalishvilis Self Deprecating Pound For Pound Placement

Jul 01, 2025 -

The Decline Of Thailands Shinawatra Political Dynasty

Jul 01, 2025

The Decline Of Thailands Shinawatra Political Dynasty

Jul 01, 2025

Taylor Jenkins Reid The Business Of Authorship And Her Path To Success

Taylor Jenkins Reid The Business Of Authorship And Her Path To Success