Could Low Volatility Fuel The Next Bitcoin Price Rally?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Could Low Volatility Fuel the Next Bitcoin Price Rally?

Bitcoin's price has been relatively calm recently, a stark contrast to its historically volatile nature. This period of low volatility, while seemingly uneventful, could actually be a precursor to a significant price surge. But is this just wishful thinking, or is there real evidence to support this theory? Let's delve into the potential relationship between low volatility and Bitcoin's future price action.

The Calm Before the Storm? Understanding Bitcoin Volatility

Bitcoin is renowned for its dramatic price swings. Its history is punctuated by periods of explosive growth followed by sharp corrections. This volatility, while exciting for some, can also be a deterrent for potential investors. However, prolonged periods of low volatility, like the one we've seen recently, often suggest a period of consolidation – a time when the market is accumulating strength before a potential breakout. Think of it as the calm before the storm.

Accumulation Phase: A Silent Bull Market?

Many analysts believe that the current low volatility environment indicates a significant accumulation phase. Large institutional investors and savvy traders might be quietly accumulating Bitcoin at these relatively stable price points, anticipating a future price increase. This "silent bull market" could be building momentum beneath the surface, ready to explode once a catalyst emerges. Several factors could trigger this breakout, including:

- Increased Institutional Adoption: Continued adoption by large financial institutions and corporations would inject significant capital into the market, driving demand and pushing prices higher.

- Regulatory Clarity: Clearer and more favorable regulatory frameworks in key jurisdictions could boost investor confidence and attract further investment.

- Technological Advancements: Developments like the Lightning Network's increasing scalability and the emergence of new use cases for Bitcoin could fuel renewed interest.

- Macroeconomic Factors: Global economic instability or inflation could drive investors towards Bitcoin as a safe haven asset.

Analyzing the Current Market Sentiment

While low volatility might suggest future price increases, it's crucial to analyze the broader market sentiment. Currently, the sentiment is mixed. Some analysts remain cautious, citing concerns about regulatory uncertainty and macroeconomic headwinds. Others are more optimistic, pointing to the growing adoption of Bitcoin and the potential for future price appreciation.

What to Watch For:

Several key indicators can help us gauge the potential for a Bitcoin price rally:

- On-chain metrics: Analyzing metrics such as the number of active addresses, transaction volume, and miner behavior can provide valuable insights into market dynamics.

- Social sentiment: Monitoring social media trends and news coverage can help gauge overall market sentiment and identify potential catalysts.

- Technical analysis: Studying price charts and technical indicators can help identify potential support and resistance levels, as well as potential breakout points.

Conclusion: Hopeful Signs, But Proceed with Caution

While low volatility could indeed be a sign of a brewing Bitcoin price rally, it's crucial to remember that the cryptocurrency market remains inherently volatile. No one can predict the future with certainty. Investors should always conduct thorough research, diversify their portfolios, and only invest what they can afford to lose. The potential for a significant price increase is there, but caution and careful analysis are paramount.

Further Reading:

- [Link to a reputable article on Bitcoin on-chain analysis]

- [Link to a reputable article on Bitcoin regulatory developments]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries significant risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Could Low Volatility Fuel The Next Bitcoin Price Rally?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Otsus Stellar Six Pacific League Pitcher Silences Opponents

Sep 23, 2025

Otsus Stellar Six Pacific League Pitcher Silences Opponents

Sep 23, 2025 -

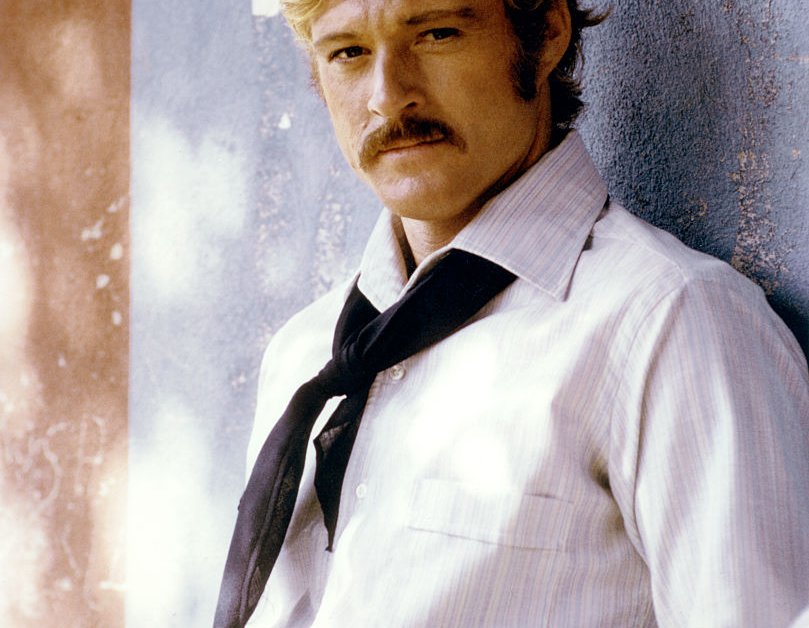

A Portrait Of Integrity Reading The Expressions Of Robert Redford

Sep 23, 2025

A Portrait Of Integrity Reading The Expressions Of Robert Redford

Sep 23, 2025 -

The Kimmel Suspension A Look At The Late Night Communitys Reaction

Sep 23, 2025

The Kimmel Suspension A Look At The Late Night Communitys Reaction

Sep 23, 2025 -

Farm Team Triumphs Naitos Key Hit And Miyagunis Effective Pitching

Sep 23, 2025

Farm Team Triumphs Naitos Key Hit And Miyagunis Effective Pitching

Sep 23, 2025 -

Alaa Abdel Fattah From Egyptian Prison To Freedom

Sep 23, 2025

Alaa Abdel Fattah From Egyptian Prison To Freedom

Sep 23, 2025