Corporate Climate Action: A View From The Business And Finance Sectors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Corporate Climate Action: A Growing Force in Business and Finance

The urgency of climate change is no longer a distant threat; it's a present reality impacting businesses and financial markets globally. From shifting consumer preferences to tightening regulations, companies are increasingly recognizing the need for robust climate action, not just as a matter of corporate social responsibility, but as a crucial factor for long-term profitability and stability. This article explores the evolving landscape of corporate climate action, examining the perspectives of both the business and finance sectors.

The Business Sector's Embrace of Sustainability

Many businesses are actively integrating environmental, social, and governance (ESG) factors into their core strategies. This shift is driven by several key factors:

- Increased Consumer Demand: Consumers, particularly younger generations, are increasingly prioritizing sustainable and ethically sourced products and services. Companies that fail to address this demand risk losing market share.

- Regulatory Pressure: Governments worldwide are implementing stricter environmental regulations, including carbon pricing mechanisms and emission reduction targets. Compliance is no longer optional; it's a necessity.

- Investor Expectations: Institutional investors are increasingly scrutinizing companies' climate-related risks and opportunities. Companies with strong ESG profiles are attracting more investment, while those lagging behind face potential divestment.

- Reputational Risk: Negative publicity surrounding environmental damage can severely impact a company's brand image and customer loyalty. Proactive climate action helps mitigate this risk.

Examples of Corporate Climate Action:

Numerous businesses are showcasing innovative approaches to climate action. This includes:

- Investing in renewable energy: Many companies are switching to renewable energy sources to power their operations, reducing their carbon footprint. Examples include Google's commitment to carbon neutrality and Apple's investment in renewable energy projects.

- Implementing energy efficiency measures: Improving energy efficiency in buildings, manufacturing processes, and supply chains can significantly reduce emissions and save costs.

- Developing sustainable products and services: Companies are increasingly designing and producing products with reduced environmental impact, using recycled materials and minimizing waste.

- Supply chain decarbonization: Addressing emissions throughout the entire supply chain is crucial for achieving meaningful reductions. This requires collaboration with suppliers and implementing sustainable sourcing practices.

The Finance Sector's Role in Driving Change

The finance sector plays a pivotal role in driving corporate climate action. This involves:

- Sustainable finance initiatives: The growth of green bonds, sustainable loans, and other sustainable finance instruments provides businesses with access to capital for climate-related investments. Learn more about the .

- Climate risk assessment and disclosure: Financial institutions are increasingly incorporating climate-related risks into their investment decisions and requiring companies to disclose their climate-related information. The provides a framework for this.

- Divestment from fossil fuels: Some investors are divesting from companies with significant exposure to fossil fuels, sending a clear signal about the need for a transition to a low-carbon economy.

- Supporting climate-related innovation: Investing in climate technology and innovation is essential for developing the solutions needed to mitigate climate change.

Challenges and Opportunities

Despite significant progress, challenges remain. Accurate measurement and reporting of emissions, navigating complex regulatory landscapes, and securing sufficient funding for climate initiatives are ongoing hurdles. However, these challenges also present significant opportunities for businesses and investors who are willing to embrace the transition to a sustainable future. Companies that proactively address climate change are better positioned to attract investment, enhance their reputation, and achieve long-term success.

Conclusion:

Corporate climate action is no longer a niche concern; it's a mainstream business imperative. The combined efforts of the business and finance sectors are crucial for achieving meaningful reductions in greenhouse gas emissions and building a more sustainable future. By embracing innovation, collaboration, and transparency, businesses and investors can both mitigate climate risks and capitalize on the significant opportunities presented by the transition to a low-carbon economy. The future of business depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Corporate Climate Action: A View From The Business And Finance Sectors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Greatest Pain Kelsey Grammer Speaks Out On Past Abortion

May 16, 2025

Greatest Pain Kelsey Grammer Speaks Out On Past Abortion

May 16, 2025 -

Sony Xm 6 Headphones Performance Review And Comparison To Top Rivals

May 16, 2025

Sony Xm 6 Headphones Performance Review And Comparison To Top Rivals

May 16, 2025 -

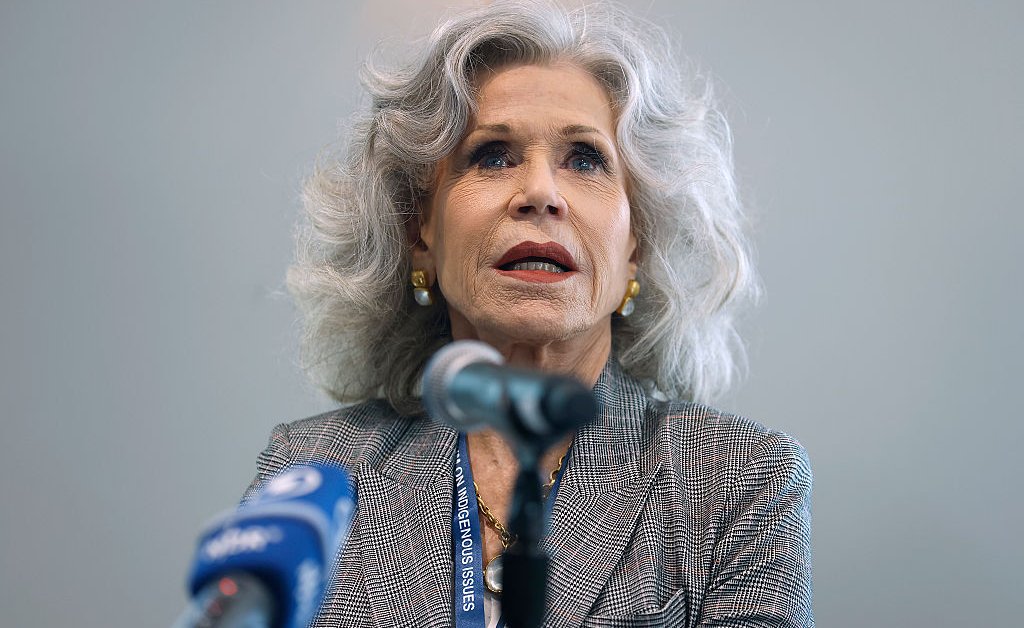

Jane Fondas Mission Protecting Ecuadors Vital Rainforest

May 16, 2025

Jane Fondas Mission Protecting Ecuadors Vital Rainforest

May 16, 2025 -

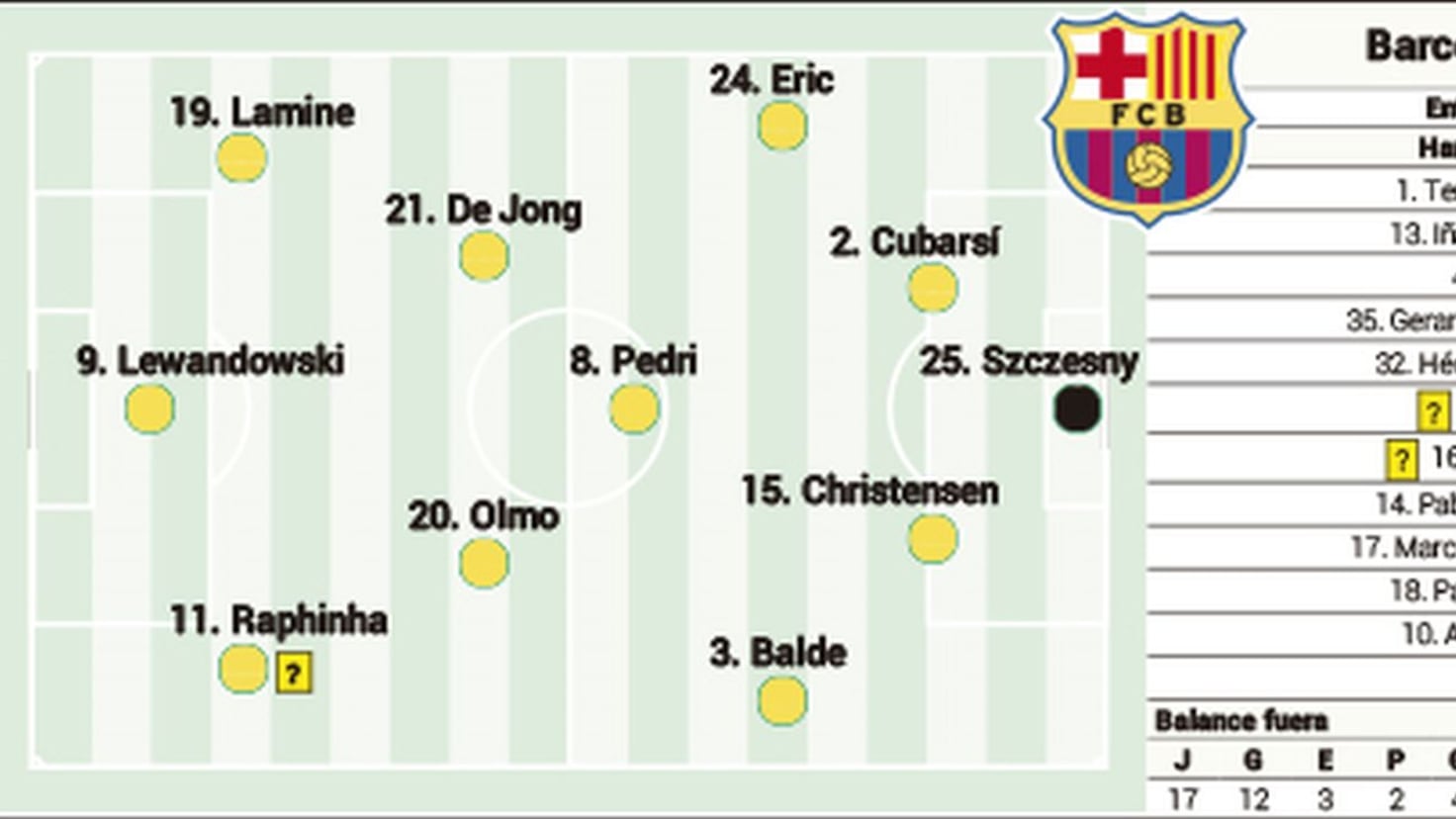

Posible Alineacion Del Barcelona Para El Derbi Que Sorpresas Nos Depara Xavi

May 16, 2025

Posible Alineacion Del Barcelona Para El Derbi Que Sorpresas Nos Depara Xavi

May 16, 2025 -

En Vivo Rayo Vallecano Real Betis

May 16, 2025

En Vivo Rayo Vallecano Real Betis

May 16, 2025