CoreWeave, Inc. (CRWV): Stock Rating Cut By Wall Street Zen – Analysis And Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CoreWeave, Inc. (CRWV): Stock Rating Downgraded by Wall Street Zen – What It Means for Investors

CoreWeave, Inc. (CRWV), a prominent player in the rapidly expanding cloud computing market specializing in high-performance computing (HPC) solutions, recently faced a setback with Wall Street Zen downgrading its stock rating. This move sent ripples through the market, prompting investors to reassess their positions. This article delves into the details of the downgrade, analyzes its implications, and explores the future outlook for CRWV.

Wall Street Zen's Downgrade: A Deeper Dive

Wall Street Zen, a respected financial analysis platform, recently lowered its rating for CoreWeave stock. While the exact reasoning behind the downgrade may vary slightly depending on the specific report, common factors influencing such decisions often include concerns about:

- Valuation: The current market capitalization of CRWV might be considered overvalued compared to its projected growth and earnings potential by some analysts. Rapid growth in the tech sector often leads to inflated valuations, making future returns less certain.

- Competition: The HPC cloud computing market is fiercely competitive. Established giants like AWS, Google Cloud, and Microsoft Azure, along with other emerging players, pose significant challenges to CoreWeave's market share growth.

- Financial Performance: While CoreWeave has shown impressive growth, scrutiny on its financial performance, including profitability and cash flow, may have contributed to the downgrade. Investors often look for sustainable profitability beyond just rapid revenue growth.

- Market Sentiment: Overall market sentiment towards the technology sector and particularly high-growth stocks can significantly impact individual company valuations. A bearish market outlook can lead to downgrades even for fundamentally strong companies.

Implications for CRWV Investors

The Wall Street Zen downgrade serves as a cautionary signal for investors. It's crucial to understand that this is just one opinion, and other analysts may hold different perspectives. However, the downgrade highlights potential risks associated with investing in CRWV:

- Increased Volatility: Expect increased price volatility in the short term following a rating downgrade. Investor confidence can be shaken, leading to price fluctuations.

- Potential for Further Price Drops: While not guaranteed, there's a possibility of further price declines in the short term as investors react to the negative news.

- Need for Re-evaluation: Existing investors should critically re-evaluate their investment thesis in light of the downgrade and consider their risk tolerance.

Analyzing the Future of CoreWeave

Despite the recent setback, CoreWeave operates in a high-growth sector with immense long-term potential. The company's focus on HPC solutions positions it to benefit from increasing demand in fields like AI, machine learning, and scientific research. However, success will depend on:

- Maintaining Competitive Advantage: CoreWeave needs to differentiate its services and maintain a competitive edge against larger players. Innovation and strategic partnerships will be crucial.

- Demonstrating Profitability: Sustained profitability will be key to attracting and retaining investor confidence. A clear path to profitability will be essential for future growth.

- Navigating Market Fluctuations: The company needs to effectively navigate market fluctuations and maintain a strong financial position.

Conclusion: A Cautious Approach

The Wall Street Zen downgrade of CoreWeave's stock rating necessitates a cautious approach for investors. While the long-term prospects for the company remain promising, the current market conditions and competitive landscape present significant challenges. Investors should conduct thorough due diligence, considering all available information before making any investment decisions. Staying informed about CRWV’s financial performance and industry developments is crucial for managing risk effectively. Consider seeking advice from a qualified financial advisor before making any investment choices.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CoreWeave, Inc. (CRWV): Stock Rating Cut By Wall Street Zen – Analysis And Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fourth Annual Juneteenth Celebration Summits 2024 Event

May 27, 2025

Fourth Annual Juneteenth Celebration Summits 2024 Event

May 27, 2025 -

25 I Phone Tariffs How Trumps Apple Threat Impacts Us Buyers

May 27, 2025

25 I Phone Tariffs How Trumps Apple Threat Impacts Us Buyers

May 27, 2025 -

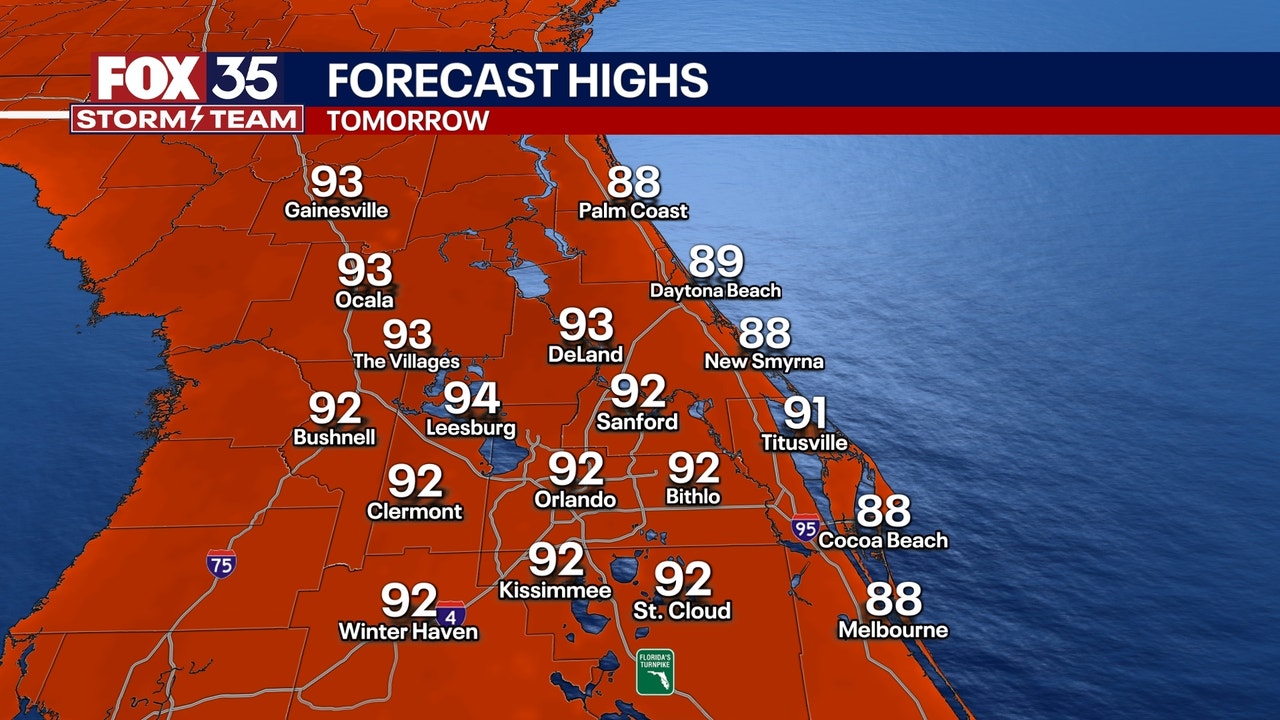

Severe Weather Alert Orlando Faces Heatwave And Increased Rain Chances

May 27, 2025

Severe Weather Alert Orlando Faces Heatwave And Increased Rain Chances

May 27, 2025 -

Roland Garros Schedule 2024 Men S Womens And Doubles Matches

May 27, 2025

Roland Garros Schedule 2024 Men S Womens And Doubles Matches

May 27, 2025 -

French Open 2025 Day 2 Follow The Action With Live Updates From Roland Garros

May 27, 2025

French Open 2025 Day 2 Follow The Action With Live Updates From Roland Garros

May 27, 2025