CoreWeave (CRWV) Stock Rating Lowered By Wall Street Zen: A Deeper Dive Into The Implications

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CoreWeave (CRWV) Stock Rating Lowered by Wall Street Zen: A Deeper Dive into the Implications

CoreWeave (CRWV), a prominent player in the burgeoning cloud computing sector specializing in GPU-accelerated computing, recently saw its stock rating downgraded by Wall Street Zen. This move sent ripples through the market, prompting investors to reassess their positions. But what does this downgrade truly signify, and what are the broader implications for CoreWeave and the industry as a whole? This article delves into the details, providing a comprehensive analysis of the situation.

Wall Street Zen's Rationale:

Wall Street Zen, a respected financial analysis firm, cited several factors contributing to their lowered rating of CoreWeave stock. While the specifics of their report may vary, common concerns within the industry regarding companies like CoreWeave often include:

-

Valuation Concerns: The rapid growth of the cloud computing market has led to significant valuations for companies like CoreWeave. Wall Street Zen likely scrutinized CRWV's current valuation against its projected future earnings and revenue streams, potentially identifying a disconnect between the two. High valuations often make a company more vulnerable to market corrections.

-

Competition: The cloud computing landscape is fiercely competitive. Major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) are constantly innovating and expanding their services. CoreWeave faces the challenge of differentiating itself and securing market share against these established giants. The downgrade may reflect concerns about CoreWeave's ability to effectively compete in this crowded market.

-

Market Sentiment: Overall market sentiment plays a crucial role in stock valuations. A downturn in the broader technology sector or a shift in investor confidence towards other sectors could negatively impact CoreWeave's stock price, regardless of the company's intrinsic performance.

-

Financial Projections: Analysts often base their ratings on detailed financial projections. If Wall Street Zen's analysis revealed discrepancies between CoreWeave's stated projections and their own independent assessments, this could explain the lowered rating. This could include concerns about revenue growth, profitability, or operating expenses.

Implications for Investors:

The downgrade from Wall Street Zen doesn't necessarily signal an imminent collapse for CoreWeave. However, it serves as a cautionary flag for investors. Here's what investors should consider:

-

Diversification: Investors heavily invested in CoreWeave might consider diversifying their portfolios to mitigate risk. Spreading investments across various sectors can help cushion against losses in any single stock.

-

Due Diligence: It's crucial for investors to conduct their own thorough due diligence before making any investment decisions. Reviewing CoreWeave's financial statements, understanding their business model, and considering the competitive landscape are all vital steps.

-

Long-Term Outlook: While the short-term outlook might be uncertain, investors should assess CoreWeave's long-term potential within the rapidly expanding GPU-accelerated computing market.

The Future of CoreWeave:

Despite the recent downgrade, CoreWeave's future remains intertwined with the continued growth of the cloud computing market and the increasing demand for high-performance computing. The company's innovative technology and strategic partnerships could still drive significant growth in the long term. However, the competitive pressure and valuation concerns highlighted by Wall Street Zen cannot be ignored.

Conclusion:

The lowered stock rating from Wall Street Zen should be viewed as a signal to proceed with caution, prompting investors to carefully re-evaluate their position in CoreWeave (CRWV). Thorough research and a well-diversified portfolio are essential for navigating the complexities of the stock market. This situation underscores the importance of staying informed and adapting investment strategies based on evolving market conditions and expert analyses. Keep an eye on future announcements from CoreWeave and further analysis from financial institutions to gain a clearer picture of the company's trajectory.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CoreWeave (CRWV) Stock Rating Lowered By Wall Street Zen: A Deeper Dive Into The Implications. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

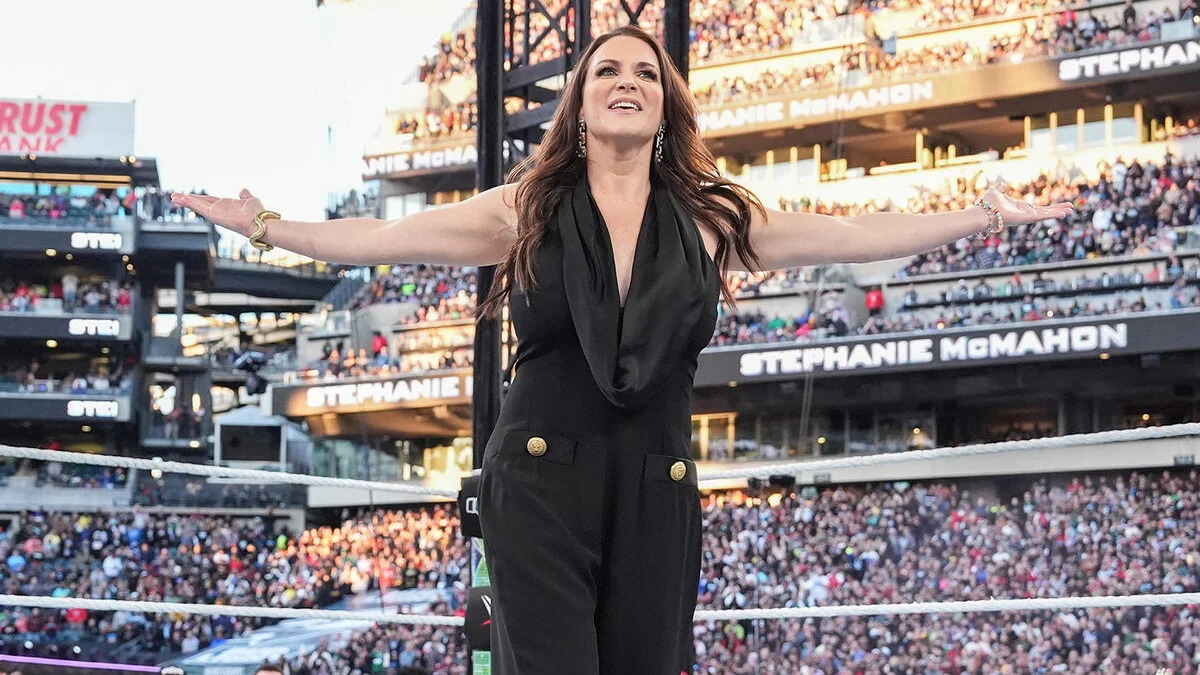

Stephanie Mc Mahons Regretted Tattoo A Wwe Co Ceos Revelation

May 28, 2025

Stephanie Mc Mahons Regretted Tattoo A Wwe Co Ceos Revelation

May 28, 2025 -

Stephanie Mc Mahon Reveals Unsuccessful Wrestling Tattoo Concept

May 28, 2025

Stephanie Mc Mahon Reveals Unsuccessful Wrestling Tattoo Concept

May 28, 2025 -

Analyzing The The Rehearsal Season 2 Finale How Nathan Fielder Achieved His Most Ambitious Project

May 28, 2025

Analyzing The The Rehearsal Season 2 Finale How Nathan Fielder Achieved His Most Ambitious Project

May 28, 2025 -

Overwhelmed Thousands Seek Food Aid In Gaza Amidst Growing Hunger Crisis

May 28, 2025

Overwhelmed Thousands Seek Food Aid In Gaza Amidst Growing Hunger Crisis

May 28, 2025 -

Stephanie Mc Mahon Reveals Near Decision On Family Crest Tattoo

May 28, 2025

Stephanie Mc Mahon Reveals Near Decision On Family Crest Tattoo

May 28, 2025