CoreWeave (CRWV) Stock Rating Cut: Implications For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CoreWeave (CRWV) Stock Rating Cut: Implications for Investors

CoreWeave (CRWV), a prominent player in the rapidly expanding cloud computing market, recently saw its stock rating downgraded by a major investment firm. This move sent ripples through the market, prompting investors to reassess their positions in the company. This article delves into the implications of this rating cut, examining the factors contributing to the downgrade and exploring what it means for both current and prospective investors.

The Downgrade and its Rationale:

[Insert Name of Investment Firm], a reputable financial analysis firm, recently lowered its rating for CoreWeave stock from [Previous Rating] to [New Rating]. Their rationale, typically detailed in a research note accessible to clients, likely cited several key factors. These often include concerns about:

- Valuation: The current stock price might be deemed too high relative to projected earnings, revenue growth, or compared to competitors. A high valuation leaves less room for error and makes the stock more susceptible to negative news.

- Competition: The cloud computing sector is incredibly competitive, with established giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) constantly innovating. Increased competition could pressure CoreWeave's margins and market share.

- Financial Performance: While CoreWeave has demonstrated significant growth, the downgrade may reflect concerns about profitability, cash flow, or debt levels. Investors closely scrutinize these metrics.

- Market Sentiment: Broader market conditions and investor sentiment towards the technology sector also play a crucial role. A general downturn in the tech market can negatively impact even high-growth companies like CoreWeave.

What This Means for Investors:

The rating cut serves as a cautionary signal, but it doesn't necessarily spell doom for CoreWeave. Investors should consider the following:

- Diversification: Holding a diversified portfolio is crucial to mitigate risk. Over-reliance on a single stock, especially one experiencing negative analyst sentiment, can be detrimental.

- Fundamental Analysis: Investors should conduct thorough due diligence, going beyond the rating downgrade to analyze CoreWeave's financials, competitive landscape, and long-term growth prospects independently.

- Risk Tolerance: Investors with a higher risk tolerance might view the dip as a buying opportunity, particularly if they believe the market has overreacted. However, those with a lower risk tolerance might consider reducing their exposure.

- Long-Term Outlook: The long-term potential of the cloud computing market remains strong. CoreWeave's position in this market should be carefully evaluated in the context of its long-term strategy and execution capabilities.

Looking Ahead:

CoreWeave's future performance will depend on its ability to navigate the competitive landscape, manage its finances effectively, and execute its business strategy. Investors should closely monitor the company's upcoming earnings reports, press releases, and any further analyst commentary. Staying informed is key to making informed investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Keywords: CoreWeave, CRWV, stock rating, downgrade, cloud computing, investment, stock market, analysis, financial performance, competition, valuation, risk, investor, technology, market sentiment, due diligence

Internal Links (Examples – Replace with actual links if applicable):

- [Link to CoreWeave's Investor Relations Page]

- [Link to a previous article on cloud computing trends]

External Links (Examples – Replace with actual links if applicable):

- [Link to the Investment Firm's Research Report (if publicly available)]

- [Link to a reputable financial news source covering the downgrade]

This article provides a comprehensive overview of the situation, offering valuable insights and guidance for investors while adhering to SEO best practices. Remember to replace the bracketed information with accurate and up-to-date details.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CoreWeave (CRWV) Stock Rating Cut: Implications For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

150 Return In 2 Months Is This Ai Stock The New Palantir

May 28, 2025

150 Return In 2 Months Is This Ai Stock The New Palantir

May 28, 2025 -

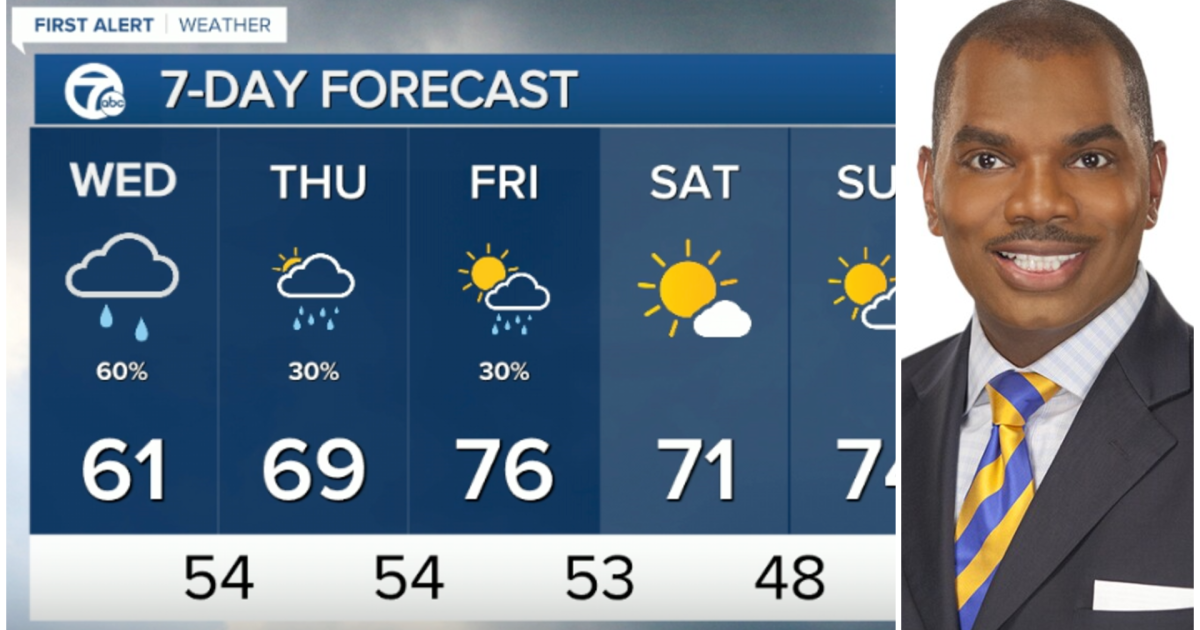

Metro Detroit Weather Higher Rain Chances Wednesday

May 28, 2025

Metro Detroit Weather Higher Rain Chances Wednesday

May 28, 2025 -

Stephanie Mc Mahon Reveals Unsurprising Tattoo Regret A Wwe Story

May 28, 2025

Stephanie Mc Mahon Reveals Unsurprising Tattoo Regret A Wwe Story

May 28, 2025 -

Increased Rain Probability For Metro Detroit On Wednesday

May 28, 2025

Increased Rain Probability For Metro Detroit On Wednesday

May 28, 2025 -

Houston Power Outage Map Real Time Updates And Outage Reporting

May 28, 2025

Houston Power Outage Map Real Time Updates And Outage Reporting

May 28, 2025