CoreWeave (CRWV) Stock Downgrade: Understanding Wall Street Zen's Assessment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CoreWeave (CRWV) Stock Downgrade: Wall Street Zen's Cautious Outlook

CoreWeave (CRWV), a prominent player in the rapidly expanding cloud computing sector specializing in high-performance computing (HPC) solutions, recently faced a downgrade from Wall Street Zen, prompting significant discussion among investors. This assessment, while negative, provides valuable insight into the potential challenges and opportunities surrounding CRWV stock. Understanding Wall Street Zen's rationale is crucial for investors navigating the complexities of this dynamic market.

Wall Street Zen's Concerns and the CRWV Downgrade:

Wall Street Zen, known for its in-depth financial analysis, expressed concerns about CoreWeave's valuation, citing several key factors. These included:

-

High Valuation: The firm highlighted CRWV's relatively high price-to-sales (P/S) ratio compared to its competitors, suggesting a potential overvaluation in the current market conditions. This is a common concern with many high-growth tech stocks, especially during periods of economic uncertainty. A high P/S ratio implies investors are betting heavily on future growth.

-

Competition: The HPC cloud computing market is becoming increasingly competitive. Giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) are all heavily invested in this space, posing significant challenges to smaller players like CoreWeave. Wall Street Zen likely factored this intense competition into their assessment.

-

Profitability Concerns: While CoreWeave boasts impressive growth, consistent profitability remains a key hurdle. The firm's focus on expansion and market share capture may necessitate continued investment, potentially delaying substantial profits in the near term. This is a common trade-off for high-growth companies.

-

Market Sentiment: The overall tech sector sentiment plays a significant role. Recent market downturns and increased regulatory scrutiny can impact investor confidence and influence stock valuations, even for fundamentally strong companies like CoreWeave.

Understanding the Implications for Investors:

Wall Street Zen's downgrade doesn't necessarily signal an imminent collapse for CRWV. However, it does serve as a cautionary note. Investors should carefully consider the following:

-

Risk Tolerance: Investing in CRWV involves inherent risk. The high valuation and competitive landscape demand a higher risk tolerance. Only invest what you can afford to lose.

-

Long-Term Perspective: CoreWeave operates in a rapidly evolving market with significant long-term growth potential. Investors with a long-term horizon may find CRWV attractive despite the current challenges.

-

Diversification: Diversifying your portfolio is crucial to mitigating risk. Don't over-allocate your investment in any single stock, especially in a volatile sector like technology.

Beyond Wall Street Zen's Assessment:

It's crucial to remember that Wall Street Zen's assessment is just one perspective. Investors should conduct thorough due diligence, considering various financial reports, industry analyses, and competitor performance before making investment decisions. Consulting with a qualified financial advisor is always recommended.

The Future of CoreWeave (CRWV):

Despite the downgrade, CoreWeave's innovative technology and strategic positioning in the HPC cloud computing market suggest significant potential for future growth. The company's success will hinge on its ability to navigate the competitive landscape, achieve profitability, and manage its growth effectively. Continued monitoring of financial performance and market trends is crucial for investors.

Call to Action: Stay informed about CoreWeave's progress by regularly reviewing their financial reports and following industry news. This will allow you to make more informed decisions about your investment strategy. Remember, investing in the stock market always involves risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CoreWeave (CRWV) Stock Downgrade: Understanding Wall Street Zen's Assessment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Gauff Alcaraz And The Rest A Deep Dive Into The 2025 French Opens Leading Players

May 27, 2025

Gauff Alcaraz And The Rest A Deep Dive Into The 2025 French Opens Leading Players

May 27, 2025 -

Community Celebrates Juneteenth At Summit Name S Annual Event

May 27, 2025

Community Celebrates Juneteenth At Summit Name S Annual Event

May 27, 2025 -

Nathan Fielders The Rehearsal Finale A Deep Dive Into The Seasons Most Complex Stunt

May 27, 2025

Nathan Fielders The Rehearsal Finale A Deep Dive Into The Seasons Most Complex Stunt

May 27, 2025 -

Joe Burrow Baltimore And Primetime Mike Norths Take On The Controversy

May 27, 2025

Joe Burrow Baltimore And Primetime Mike Norths Take On The Controversy

May 27, 2025 -

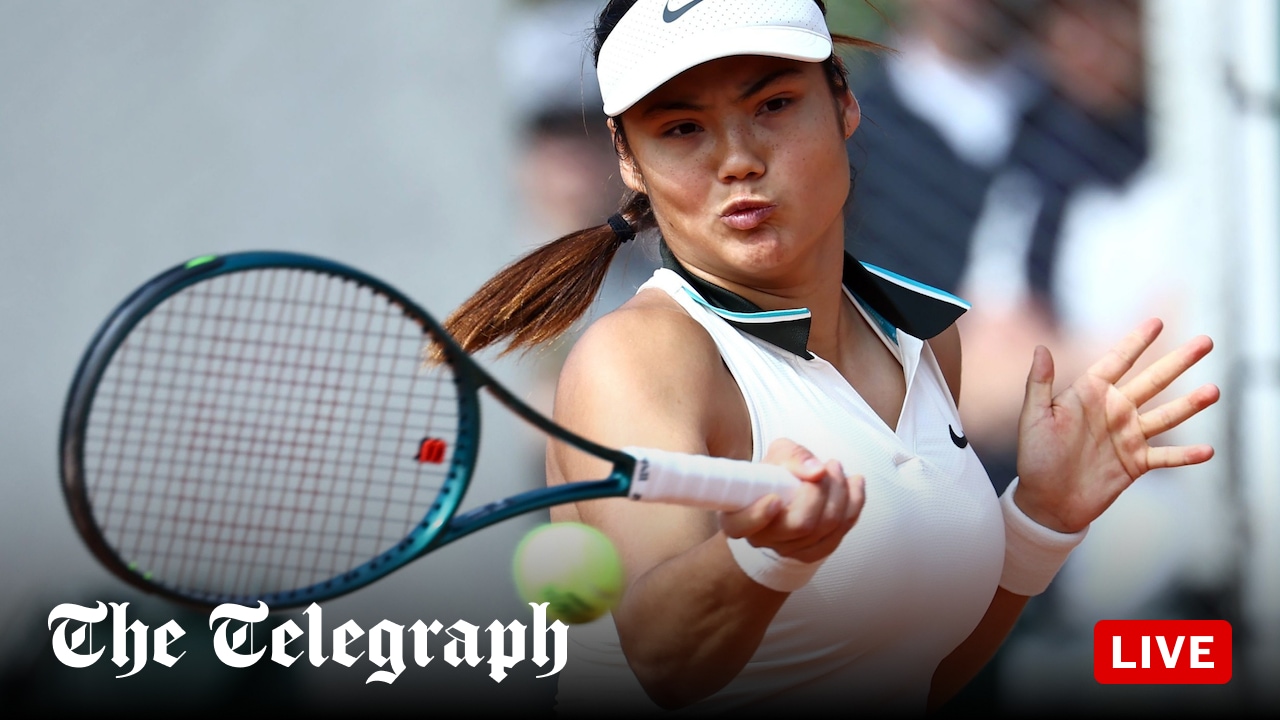

Raducanu Wang Xinyu Showdown French Open Live Scores And Commentary

May 27, 2025

Raducanu Wang Xinyu Showdown French Open Live Scores And Commentary

May 27, 2025