CoreWeave (CRWV) Stock: Citizens JMP's Measured Approach

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CoreWeave (CRWV) Stock: Citizens JMP's Measured Approach to a High-Growth Cloud Computing Play

CoreWeave (CRWV), a rapidly expanding player in the cloud computing sector, recently saw its stock receive a measured assessment from Citizens JMP Securities. This cautious optimism reflects the inherent risks and rewards associated with investing in a high-growth, albeit still relatively young, company. Understanding Citizens JMP's perspective is crucial for investors considering adding CRWV to their portfolios.

Citizens JMP's Rating and Price Target:

Citizens JMP initiated coverage of CoreWeave with a "Neutral" rating and a price target of $20 per share. This suggests a degree of hesitancy despite acknowledging the company's strong potential. While the price target implies upside from current market prices (depending on the current share price), the "Neutral" rating underscores the analysts' measured approach. This is a common strategy for analysts when assessing companies with significant growth potential but also substantial risks.

CoreWeave's Strengths: A Powerful Foundation

CoreWeave's success stems from its focus on providing specialized cloud computing services leveraging the power of NVIDIA GPUs. This is particularly attractive to industries like artificial intelligence (AI), machine learning (ML), and high-performance computing (HPC). The company has built a strong reputation for its:

- Scalable Infrastructure: CoreWeave boasts a robust and scalable infrastructure capable of handling demanding workloads.

- GPU Expertise: Their deep understanding of GPU technology allows them to offer optimized solutions for demanding applications.

- Strong Partnerships: Collaborations with key players in the tech industry strengthen their market position.

Risks to Consider: Navigating the Challenges

Despite its strengths, Citizens JMP likely factored several risks into their assessment:

- Competition: The cloud computing market is fiercely competitive, with established giants like AWS, Azure, and Google Cloud constantly innovating.

- Dependence on NVIDIA: CoreWeave's reliance on NVIDIA GPUs creates a degree of vulnerability to changes in NVIDIA's pricing or product strategy.

- Profitability: As a high-growth company, CoreWeave is likely focused on expanding market share, potentially sacrificing short-term profitability.

What Investors Should Consider:

Investors should carefully weigh the potential rewards against the inherent risks. While CoreWeave's technology and market position are promising, the competitive landscape and dependence on external factors demand a cautious approach. The Citizens JMP rating serves as a reminder that even high-growth companies require thorough due diligence before investment.

Beyond the "Neutral" Rating:

It's important to note that a "Neutral" rating doesn't necessarily signal pessimism. It often reflects a wait-and-see approach, allowing analysts to gather more data before issuing a more definitive recommendation. Future performance, particularly in terms of profitability and market share growth, will be key factors influencing subsequent ratings and price targets.

Staying Informed:

Staying updated on CoreWeave's performance through official company announcements, financial news outlets, and analyst reports is crucial for investors. This allows for a more informed decision-making process and potentially minimizes risk. Consider following reputable financial news sources and analyst firms for ongoing coverage of CRWV.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CoreWeave (CRWV) Stock: Citizens JMP's Measured Approach. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

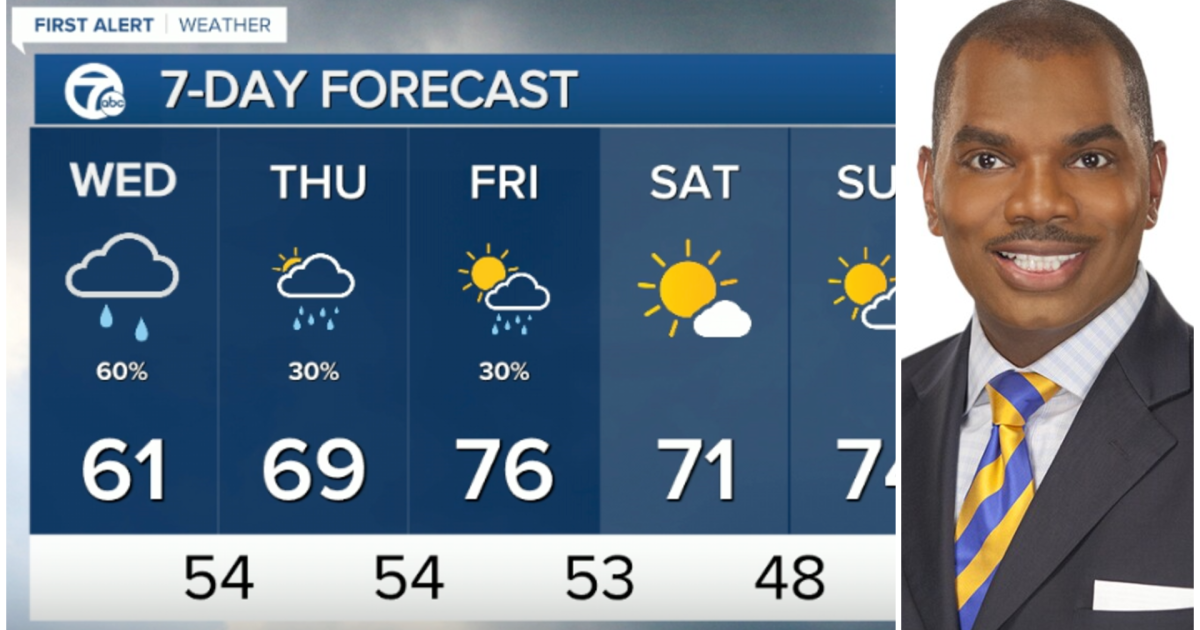

Metro Detroit Weather Update Expect More Rain Wednesday

May 28, 2025

Metro Detroit Weather Update Expect More Rain Wednesday

May 28, 2025 -

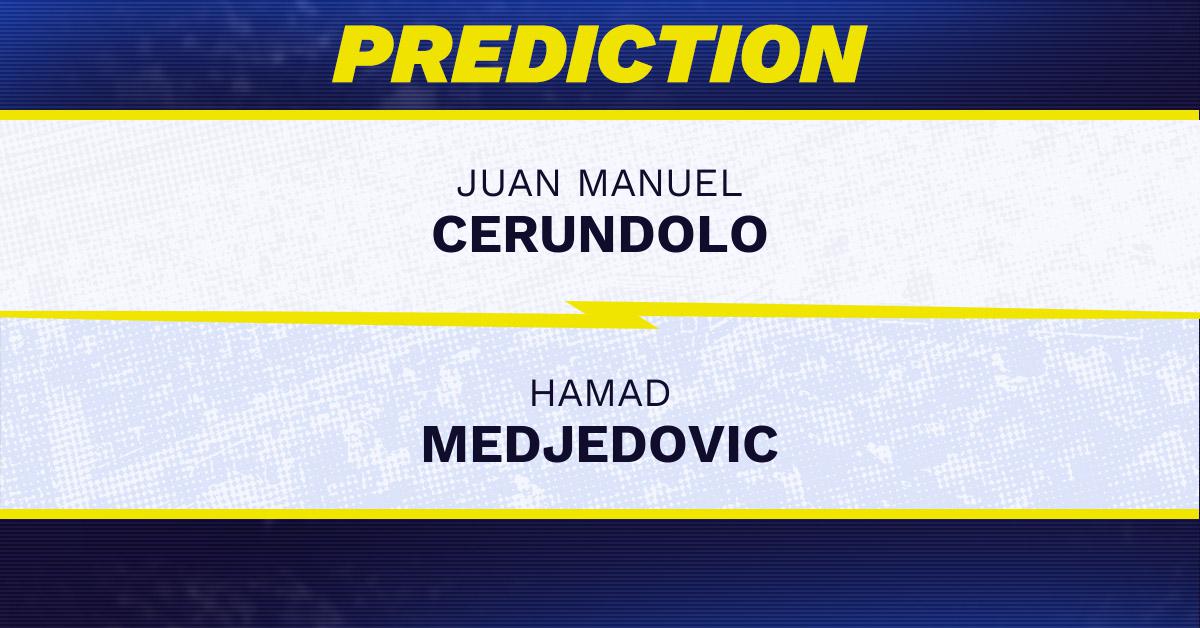

Betting Analysis Juan Manuel Cerundolo Vs Hamad Medjedovic French Open 2025

May 28, 2025

Betting Analysis Juan Manuel Cerundolo Vs Hamad Medjedovic French Open 2025

May 28, 2025 -

Cooler Temperatures On The Way After A Mild Day In Metro Detroit

May 28, 2025

Cooler Temperatures On The Way After A Mild Day In Metro Detroit

May 28, 2025 -

Stephanie Mc Mahons Unseen Side The Almost Mc Mahon Crest Tattoo

May 28, 2025

Stephanie Mc Mahons Unseen Side The Almost Mc Mahon Crest Tattoo

May 28, 2025 -

Joe Burrows Baltimore Primetime Concerns Mike Norths Fair Assessment

May 28, 2025

Joe Burrows Baltimore Primetime Concerns Mike Norths Fair Assessment

May 28, 2025