CoreWeave (CRWV) Class A Common Stock: Rating Decrease Prompts Investor Concern

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

CoreWeave (CRWV) Class A Common Stock: Rating Decrease Prompts Investor Concern

CoreWeave (CRWV), a leading provider of cloud computing infrastructure, saw its Class A common stock take a hit following a recent rating decrease from a major financial institution. This unexpected downgrade has sparked significant concern among investors, prompting a closer look at the company's performance and future prospects. The news sent ripples through the market, highlighting the volatility inherent in the rapidly evolving cloud computing sector.

Rating Downgrade and Market Reaction:

The specific rating agency and the rationale behind the downgrade are crucial pieces of information for investors. (Note: This section requires the specific details of the rating agency and their justification for the downgrade. Please provide this information for a complete and accurate article). However, regardless of the specifics, a downgrade generally signals a negative outlook on the company's financial health, future growth, or ability to meet its obligations. This often leads to a decrease in the stock price, as seen in CRWV's recent performance. The magnitude of the drop reflects the market's sensitivity to such announcements.

Analyzing the Impact on Investors:

For existing investors, the rating decrease raises serious questions. Should they hold, sell, or even buy more? The decision is highly individual and depends on various factors, including the investor's risk tolerance, investment timeline, and overall portfolio diversification. Short-term investors may be particularly impacted, while long-term holders may adopt a "wait and see" approach.

CoreWeave's Business Model and Future Outlook:

CoreWeave operates in a highly competitive market. Understanding its unique selling proposition (USP) and competitive advantages is essential for evaluating the impact of the rating downgrade. Does the company possess a strong technological edge? What is its market share and growth potential? These factors are crucial in determining whether the negative rating is a temporary setback or a sign of deeper underlying problems. Analyzing CRWV's financial statements, including revenue growth, profitability, and debt levels, provides a more comprehensive understanding of the company's financial health. (Further research into CoreWeave's financial performance and market position is needed here).

Understanding the Risks in the Cloud Computing Sector:

The cloud computing sector is characterized by rapid innovation, intense competition, and evolving technological landscapes. Investing in this sector inherently carries higher risk compared to more established industries. Factors like cybersecurity threats, data privacy regulations, and economic downturns can significantly impact cloud computing companies like CoreWeave.

What to Watch For:

Investors should closely monitor CoreWeave's upcoming financial reports, analyst commentary, and any announcements regarding strategic partnerships or new product launches. These factors will help assess the long-term impact of the rating downgrade and inform future investment decisions. Staying informed about the competitive landscape and overall market trends within the cloud computing industry is also crucial.

Conclusion:

The rating decrease for CoreWeave’s Class A common stock has understandably caused concern among investors. However, a well-informed investment decision requires a thorough analysis of the company's fundamentals, market position, and the broader competitive landscape. Investors should conduct independent research and potentially consult with a financial advisor before making any investment decisions concerning CRWV.

Disclaimer: This article provides general information and should not be considered as financial advice. Investing in the stock market carries inherent risks, and individual investors should conduct thorough due diligence before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on CoreWeave (CRWV) Class A Common Stock: Rating Decrease Prompts Investor Concern. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Midweek Storms Possible In Orlando As Heat And Humidity Build

May 27, 2025

Midweek Storms Possible In Orlando As Heat And Humidity Build

May 27, 2025 -

Powerball Lottery Winning Numbers For The May 24 Drawing 167 Million Up For Grabs

May 27, 2025

Powerball Lottery Winning Numbers For The May 24 Drawing 167 Million Up For Grabs

May 27, 2025 -

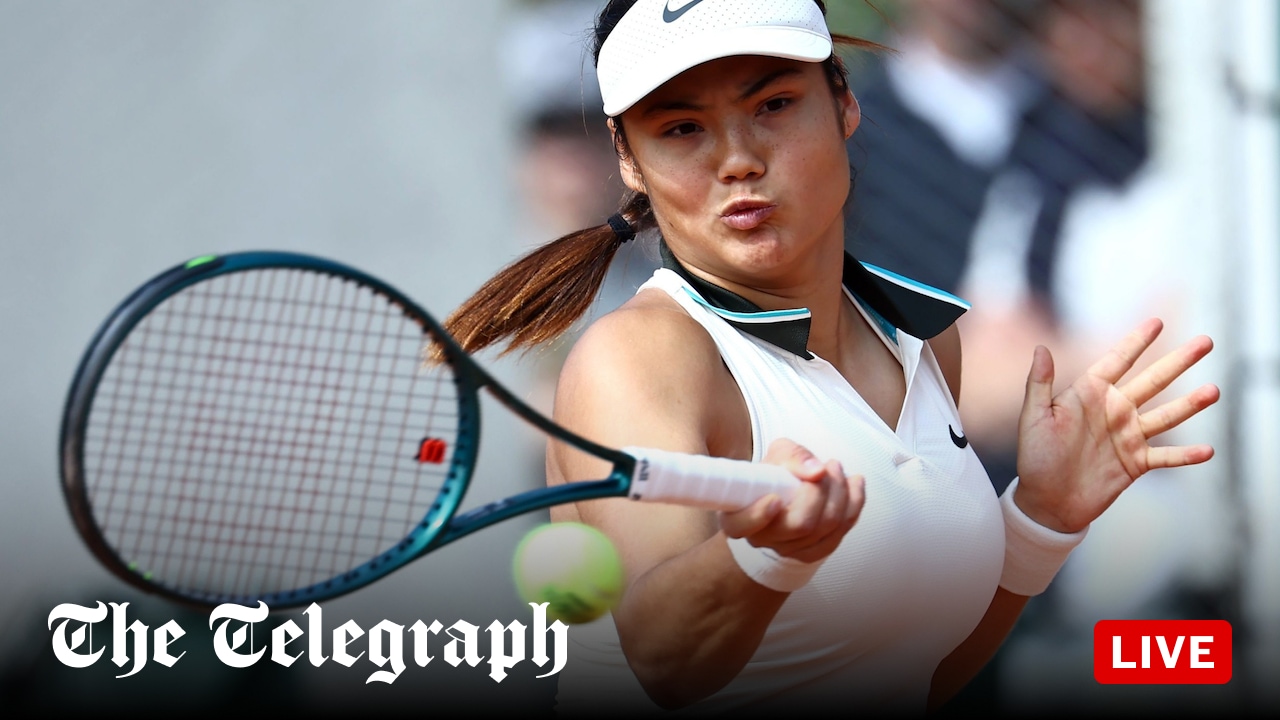

Emma Raducanu Vs Wang Xinyu Live Scores And French Open Match Highlights

May 27, 2025

Emma Raducanu Vs Wang Xinyu Live Scores And French Open Match Highlights

May 27, 2025 -

Sailing With Phoenix Oregon Mans Cross Ocean Journey Concludes

May 27, 2025

Sailing With Phoenix Oregon Mans Cross Ocean Journey Concludes

May 27, 2025 -

Investing In Ai A 150 Return In Two Months Is This The Next Big Thing

May 27, 2025

Investing In Ai A 150 Return In Two Months Is This The Next Big Thing

May 27, 2025